- Rappid Valves India IPO is a book-built issue of Rs 30.41 crores.

- This upcoming IPO bidding opens on Sep 23 and closes on Sep 25, 2024.

- Rappid Valves India SME IPO price is set at Rs 210 to Rs 222 per share.

- The minimum investment required is Rs 1,30,200.

Rappid Valves India IPO: Synopsis

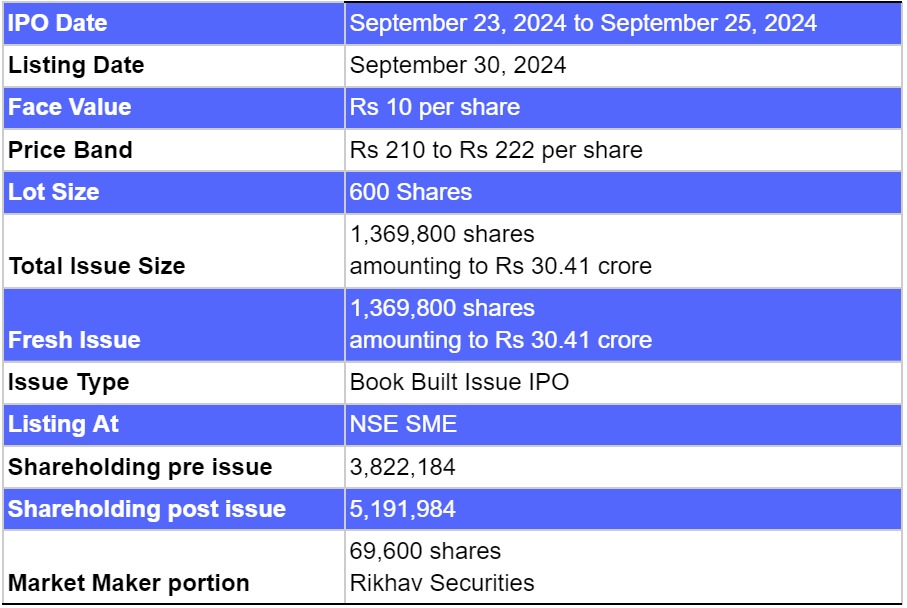

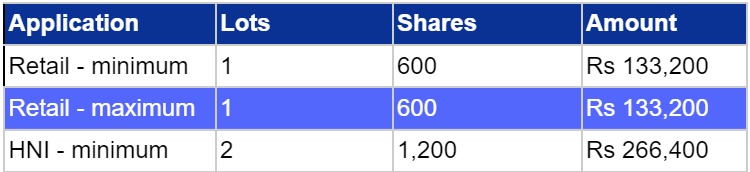

Rappid Valves India IPO is open for subscription starting Monday, September 23, 2024, and closing on Wednesday, September 25, 2024. This upcoming IPO price is Rs 210 to Rs 222 per share. The minimum lot size set for the retail category is 600 shares. Meanwhile, the minimum lot size for the HNI category is 2 lots consisting of 1200 shares.

The minimum investment required for retail category investors is Rs 1,29,600 (222 x 600 shares). However, for the HNI category, the minimum investment amount required is Rs 2,59,200 (222 x 1200 shares). Rappid Valves India IPO is a book-built issue of Rs 30.41 crores. This upcoming IPO is an entirely fresh issue of 13.7 lakh equity shares.

The allotment for this new IPO is expected to be finalised on Thursday, September 26, 2024. Rappid Valves India IPO will be listed on NSE SME on Monday, September 30, 2024. Shreni Shares Limited is the book-running lead manager, Link Intime India Private Limited is the registrar, and Rikhav Securities is the market maker for this IPO.

Also Read | SD Retail IPO: Important Details of IPO

Rappid Valves India IPO: About the Company

Rappid Valves India Limited was incorporated in 2002, engaged in the business of manufacturing valve solutions. The company offers various valves, including ball, gate, globe, butterfly, check, double block, filter, and marine valves. These valves are made using ferrous and non-ferrous materials and come in sizes ranging from 15 mm to 600mm to meet diverse requirements. Rappid Valves manufacturing unit is equipped with a comprehensive range of standard machinery, including conventional and automated CNC machines, VMCs, test benches, EOT cranes, lathes, milling machines, drilling machines, grinders, saws, testers, lapping machines, welders, compressors, buffing machines, and testing equipment, supporting a seamless manufacturing process.

Rappid Valves India IPO: Objectives

The net proceeds from this issue will be allocated to funding capital expenditures toward the purchase of new plant, machinery, and software by the company. The money will also be used to renovate the registered office and existing manufacturing unit. The remaining funds will be used for repaying loans, acquisitions, and fulfilling general corporate purposes.

Rappid Valves India IPO: Other Important Details

Time-Table of Rappid Valves India IPO

Rappid Valves India IPO: Financial Metrics (Amt in Rs Lakhs)

Rappid Valves India posted revenue of Rs 3,660.06 lakhs and net profit of Rs 413.27 lakhs for the period ending on 31 Mar 2024. The company’s revenue increased by 123% and net profit increased by 807% between the FY ending on 31 Mar 2024 and 31 Mar 2023.

Minimum Investment: Lot Size Details

Promoters of Rappid Valves India Limited and Their Holdings

The promoter of Rappid Valves India is Gaurav Vijay Dalal. The promoter shareholdings before the IPO were 69.46%; however, after the IPO, shareholdings will decline to 51.13%.

Rappid Valves India : Strength of Company

- Rappid Valves India has experienced and dedicated key management personnel.

- The company focuses on Innovative and new products.

- The solid knowledge base of Marine Industries.

- Upgradation and expansion of manufacturing capabilities.

FAQs

1. What are the details of the Rappid Valves India IPO?

Rappid Valves India IPO is a book-built issue of Rs 30.41 crores. This upcoming IPO is an entirely fresh issue of 13.7 lakh equity shares. The allotment for this new IPO is expected to be finalised on Thursday, September 26, 2024.

2. Who are the lead managers for the Rappid Valves India IPO?

Shreni Shares Limited is appointed as the book-running lead manager for the IPO.

3. What is the role of Link Intime India in this IPO?

Link Intime India Private Limited is the registrar for Rappid Valves India Limited, handling the IPO's administrative aspects.

4. How can I apply for the Rappid Valves India IPO?

The public subscription of this new IPO will open on September 23, 2024. Click here to initiate the application process.

5. How will the net proceeds from the IPO be utilised?

The net proceeds from this issue will be allocated to funding capital expenditures toward the purchase of new plant, machinery, and software by the company. The money will also be used to renovate the registered office and existing manufacturing unit. The remaining funds will be used for repaying loans, acquisitions, and fulfilling general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied can check the allotment status of the Rappid Valves India Limited IPO by visiting here. For further updates follow Bigul.

Also Read | Paramount Speciality Forgings IPO: Important Details of IPO

.jpg)

.jpg)

.jpg)