- SD Retail IPO is a book-built issue worth up to Rs 64.98 crore.

- Bidding opens on September 20 and closes on September 24, 2024.

- SD Retail SME IPO price band is set at Rs 124 – Rs 131 per share.

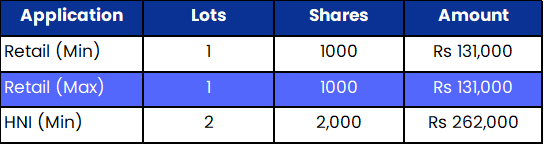

- The minimum amount required for retail investors is Rs 1,31,000.

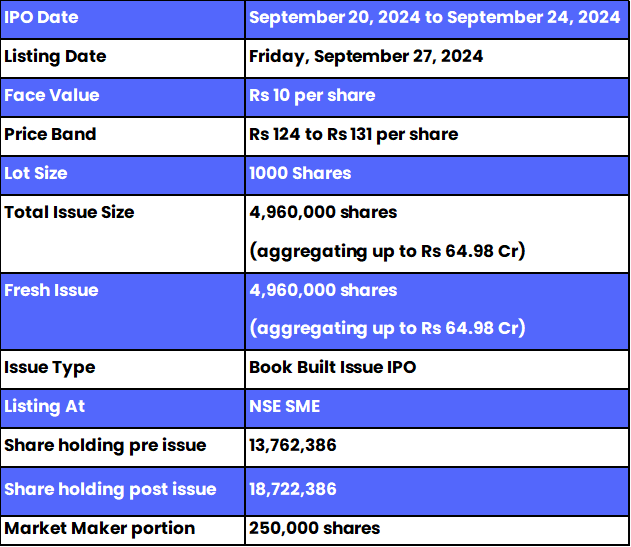

SD Retail IPO: Synopsis

SD Retail is open for subscription from Friday, September 20, 2024, and closes on Tuesday, September 24, 2024. The price band for this IPO is set at Rs 124 – Rs 131 per share.

SD Retail IPO is offering entirely a fresh issue of 49.60 lakh equity shares worth up to Rs 64.98 crore.

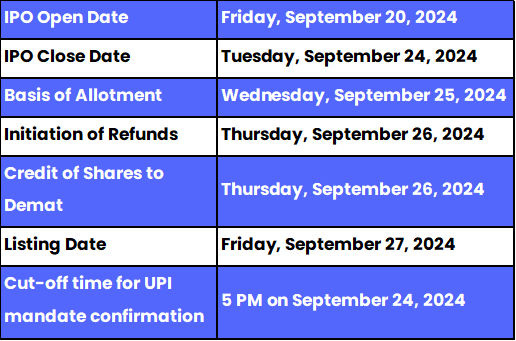

The allotment for this new IPO is expected to be finalised on Wednesday, September 25, 2024. Whereas the listing of this IPO will be done on Friday, September 27, 2024, at NSE SME segment.

The minimum lot size set for the retail category is 1 lot, i.e., 1000 shares. For retail investors, the minimum and maximum investment amount required is Rs 131,000. However, for the HNI category, the minimum lot size is 2 lots, i.e., 2000 shares amounting to Rs 262,000.

The IPO is managed by Beeline Capital Advisors Private Limited, which is the book-running lead manager of this public issue. The company has appointed Kfin Technologies Limited as the registrar for the issue.

Also Read | BikeWo GreenTech IPO: Read All the Important Details

SD Retail Limited: About the Company

SD Retail Limited, incorporated in May 2004, is the company behind the "SWEET DREAMS" brand, specialising in stylish and comfortable sleepwear for men, women, and children aged 2-16. The brand celebrates the transition from work to home life by offering sleepwear that for the wide range of body types.

As of February 29, 2024, SWEET DREAMS products are sold through distributors, exclusive brand outlets (EBOs), multi-brand outlets (MBOs), and popular e-commerce platforms like Myntra, AJIO, Nykaa, Flipkart, Amazon, and the company's website. The company's asset-light model enhances scalability and supports efficient retail operations without owning physical store properties.

SD Retail IPO: Objectives

The company intends to utilise the funding received from the fresh issue for various purposes, including capital expenditure for establishing new exclusive brand outlets (EBOs), funding working capital requirements, and addressing general corporate purposes.

SD Retail IPO: Other Important Details

Time Table of SD Retail IPO

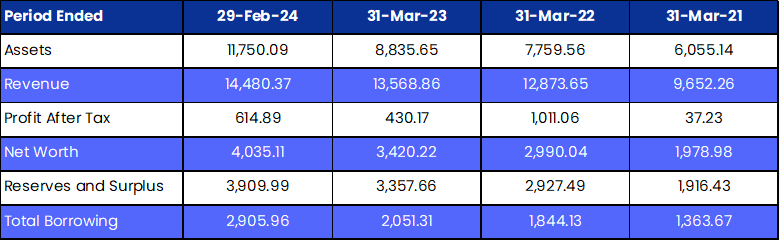

SD Retail IPO: Financial Metrics (Amt in Rs Lakhs)

Minimum Investment: Lot Size Details

Promoters of SD Retail Limited and Their Holdings

The company's promoters are Mr. Hitesh Pravinchandra Ruparelia and Mr. Utpalbhai Pravinchandra Ruparelia, M/s. Sweet Dreams Loungewear (India) LLP (Formerly known as Sweet Dreams Loungewear (India) Private Limited) and M/s. Grace Garments LLP. They collectively hold 88.82% of the company's shares. However, post-IPO, changes in their shareholding have not yet been disclosed.

FAQs

1. What are the core details available for the SD Retail IPO?

SD Retail IPO is a Book-built public issue worth Rs 64.98 crore in equity shares. This upcoming IPO is offering entirely a fresh issue of 49.60 lakh equity shares, with no offer for sale. The allotment for this new IPO is expected to be finalised on Wednesday, September 25, 2024.

2. How can I apply for the SD Retail IPO?

The public subscription of this new IPO opens on September 20 and closes on September 24, 2024. Click here to initiate the application process.

3. Who is the lead manager(s) for the SD Retail IPO?

Beeline Capital Advisors Private Limited was appointed as the book-running lead manager for the IPO.

4. Who is appointed as the registrar for SD Retail IPO?

Kfin Technologies Limited has been appointed as the registrar for this public issue.

5. How will the net proceeds from the IPO be utilised?

The company intends to utilise the funding received from the fresh issue for various purposes, including capital expenditure for establishing new exclusive brand outlets (EBOs), funding working capital requirements, and addressing general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied for an IPO can check the allotment status of the SD Retail IPO by visiting here, for further updates, follow Bigul.

Also Read | Paramount Speciality Forgings IPO: Important Details of IPO

.jpg)

.jpg)