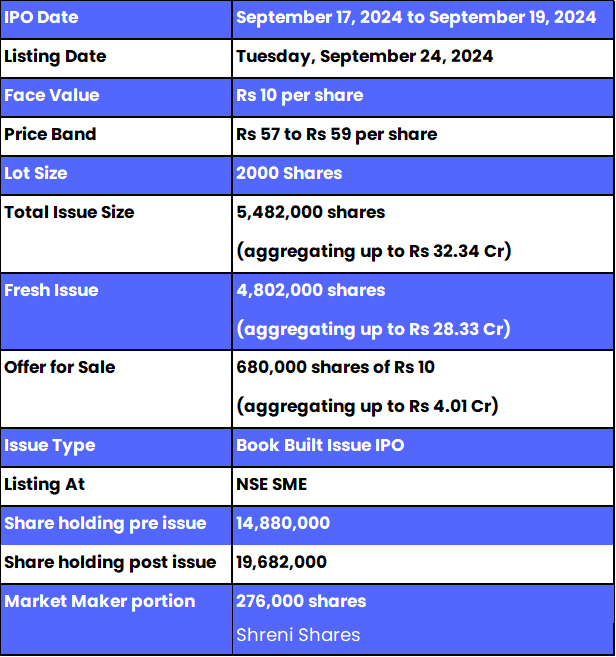

- Paramount Speciality Forgings IPO is a book-built issue worth up to Rs 32.34 crore.

- Bidding opens on September 17 and closes on September 19, 2024.

- Paramount Speciality Forgings SME IPO price band is set at Rs 57 – Rs 59 per share.

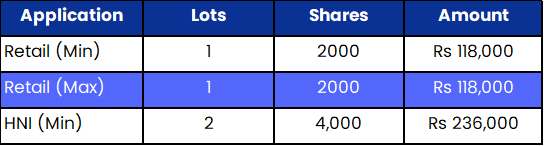

- The minimum amount required for retail investors is Rs 1,18,000.

Paramount Speciality Forgings IPO: Synopsis

Paramount Speciality Forgings is open for subscription from Tuesday, September 17, 2024, and closes on Thursday, September 19, 2024. The price band for this IPO is set at Rs 57 – Rs 59 per share.

Paramount Speciality Forgings IPO is offering a fresh issue of 48.02 lakh equity shares worth up to Rs 28.33 crore and an offer for sale of up to 6.80 lakh equity share amounting up to 4.01 crore. This sums up total aggregate size of 54.82 lakh equity shares up to Rs 32.34 crore.

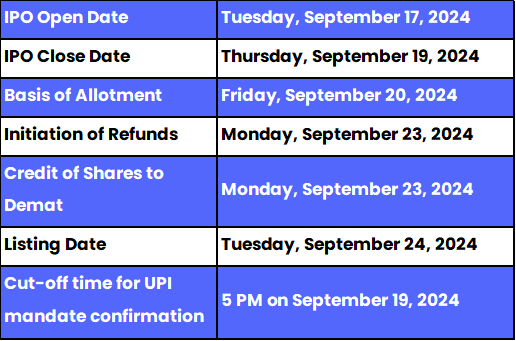

The allotment for this new IPO is expected to be finalised on Friday, September 20, 2024. The listing of this IPO will be done on Tuesday, September 24, 2024, at NSE SME segment.

The minimum lot size set for the retail category is 1 lot, i.e., 2000 shares. For retail investors, the minimum and maximum investment amount required is Rs 118,000. However, for the HNI category, the minimum lot size is 2 lots, i.e., 4000 shares amounting to Rs 236,000.

The IPO is managed by Swaraj shares and securities private limited, which is the book-running lead manager of this public issue. The company has appointed Purva Sharegistry India Private Limited as the registrar for the issue.

Also Read | Deccan Transcon Leasing IPO: Unlocking the IPO in Detail

Paramount Speciality Forgings Limited: About the Company

Paramount Speciality Forgings Limited was incorporated in 1994. It is a recognised manpower source and fabrication facility in India, offering critical forged components to various industries related to petrochemicals, oil and gas, fertilisers, and nuclear power. The company comprises two plants located at Kamothe and Khalapur, Maharashtra, through which it offers a wide array of forging products, including tube sheet blanks, forged rings, girth flanges, valve bodies, and many more. Their plants maintain ISO 9001-2008, ISO 14001-2004, and BS OHSAS 18001-2007 certifications.

Renowned for quality and process efficiency, Paramount uses automated manufacturing systems to maximise productivity, cut costs, and improve product quality. Building on long-term customer relationships and strong digital marketing efforts, the company is one of the most qualified suppliers in this industry and is managed by a highly professional management team with years of experience.

Paramount Speciality Forgings IPO: Objectives

The company intends to use the Net Proceeds from the Fresh Issue to fund the following objectives: capital expenditure for the purchase of machinery and equipment needed for expansion at the Khopoli Plant, and to cover general corporate purposes.

Paramount Speciality Forgings IPO: Other Important Details

Time Table of Paramount Speciality Forgings IPO

Paramount Speciality Forgings IPO: Financial Metrics (Amt in Rs Lakhs)

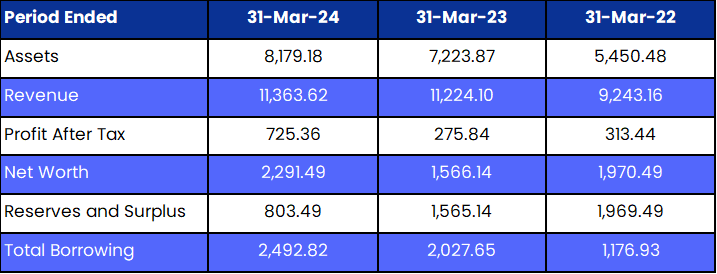

Paramount Speciality Forgings Limited saw a 1% rise in revenue, while its profit after tax (PAT) surged by 163% between the fiscal years ending March 31, 2024, and March 31, 2023.

Minimum Investment: Lot Size Details

Promoters of Paramount Speciality Forgings Limited and Their Holdings

The company's promoters are Aliasgar Roshan Hararwala, Aliasgar Abdulla Bhagat, Mohammed Salim Hararwala, Abdulla Aliasgar Bhagat, Hoozefa Saleem Hararwala, Abbasali Salim Hararwala, Zahid Mohamadi Hararwala and Roshan Alihusain Hararwala. They collectively hold 100% of the company's shares. However, post-IPO, their shareholding will be 72.15%.

FAQs

1. What are the core details available for the Paramount Speciality Forgings IPO?

Paramount Speciality Forgings IPO is a Book-built public issue of 54.82 lakh equity shares. This upcoming IPO is offering a fresh issue of 48.02 lakh equity shares and an offer for sale of up to 6.80 lakh equity. The allotment for this new IPO is expected to be finalised on Friday, September 20, 2024.

2. How can I apply for the Paramount Speciality Forgings IPO?

The public subscription of this new IPO opens on September 17 and closes on September 19, 2024. Click here to initiate the application process.

3. Who is the lead manager(s) for the Paramount Speciality Forgings IPO?

Swaraj Shares and Securities Private Limited was appointed as the book-running lead manager for the IPO.

4. Who is appointed as the registrar for Paramount Speciality Forgings IPO?

Purva Sharegistry India Private Limited has been appointed as the registrar for this public issue.

5. How will the net proceeds from the IPO be utilised?

The company intends to use the Net Proceeds from the Fresh Issue to fund the following objectives: capital expenditure for the purchase of machinery and equipment needed for expansion at the Khopoli Plant, and to cover general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied for an IPO can check the allotment status of the Paramount Speciality Forgings IPO by visiting here, for further updates, follow Bigul.

Also Read | Pelatro IPO: Important Details of IPO

.jpg)

.jpg)

.jpg)