Purpose for Portfolio Evaluation?

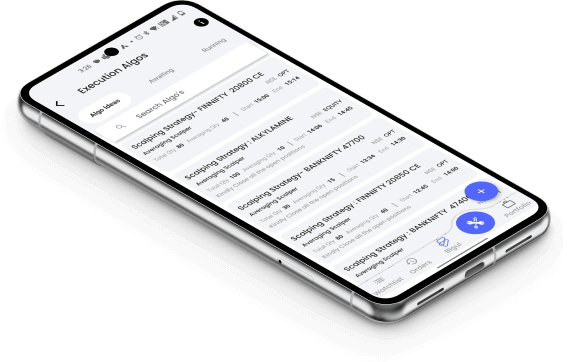

The purpose of portfolio evaluation is to assess the performance of a portfolio of investments, identify areas where the portfolio may be underperforming or overperforming, and make recommendations for changes to improve performance or manage risk. The innovative tool Review Portfolio's Performance based on past data performance evaluation; Evaluate diversification – the allocation of your portfolio into various different asset classes, sectors, and geographic regions; Monitor Portfolio i.e., keeps an eye on your portfolio to look out for any deviations.