- Innomet Advanced Materials Limited IPO is a fixed-price issue worth up to Rs 34.24 crores.

- Bidding opens on September 11 and closes on September 13, 2024.

- Innomet Advanced Materials Limited SME IPO price is set at Rs 100 per share.

- The minimum amount required for retail investors is Rs 1,20,000.

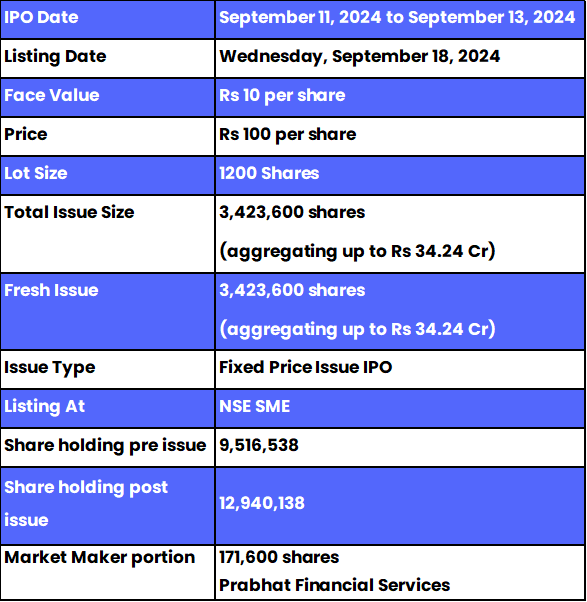

Innomet Advanced Materials Limited IPO: Synopsis

Innomet Advanced Materials Limited IPO is open for subscription from Wednesday, September 11, 2024, and closes on Friday, September 13, 2024. The price for this IPO is set at Rs 100 per share.

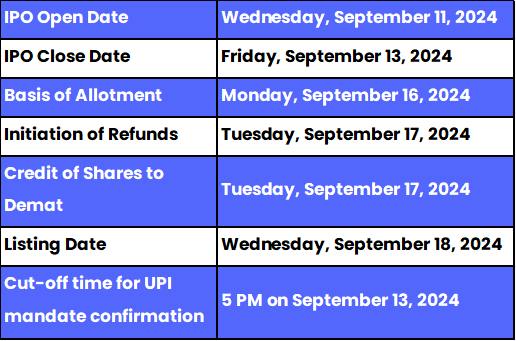

Innomet Advanced Materials Limited IPO is offering entirely a fresh issue of 34.23 lakh equity shares worth up to Rs 34.24 crore equity shares. The allotment for this new IPO is expected to be finalised on Monday, September 16, 2024. The listing of this IPO will be done on Wednesday, September 18, 2024, at the NSE SME segment.

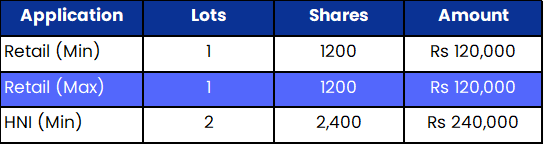

The minimum lot size set for the retail category is 1 lot, i.e., 1200 shares. For retail investors, the minimum and maximum investment amount required is Rs 120,000. However, for the HNI category, the minimum lot size is 2 lots, i.e., 2400 shares amounting to Rs 240,000.

The IPO is managed by Expert Global Consultants Private Limited, which is the book-running lead manager of this public issue. The company has appointed Skyline Financial Services Private Limited as the registrar for the issue.

Also Read | Share Samadhan IPO: Everything You Need To Know

Innomet Advanced Materials Limited Limited: About the Company

Innomet Advanced Materials Limited, incorporated in 1984, specialises in manufacturing metal powders and tungsten heavy alloys. The company operates two divisions, Innomet Powders and Innotung, producing a diverse range of products such as copper, bronze, brass, nickel, tin, and stainless-steel powders, along with custom grades designed for specific industrial applications.

Innomet is ISO 9001:2015 certified, ensuring high standards in its manufacturing processes. Its products are supplied across India and internationally, reaching markets in the US, UK, Germany, Japan, and Italy. As of March 31, 2024, the company employs 56 people across various departments.

Innomet Advanced Materials Limited IPO: Objectives

The company proposes to utilise the proceeds from the net issue for the various purposes including funding for working capital requirements, Capital Expenditure for machinery and equipment, Repayment/Prepayment in full or part of some bank and financial institution borrowings outstanding as on the date of this Information Memorandum, General corporate purposes and Issue-related expenses.

Innomet Advanced Materials Limited IPO: Other Important Details

Time Table of Innomet Advanced Materials Limited IPO

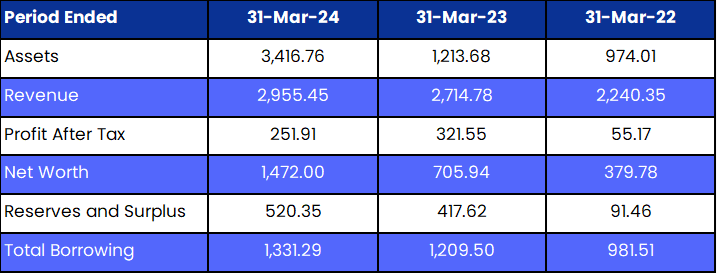

Innomet Advanced Materials Limited IPO: Financial Metrics (Amt in Rs Lakhs)

Minimum Investment: Lot Size Details

Promoters of Innomet Advanced Materials Limited Limited and Their Holdings

The company's promoters are Lakshmi Kanthamma Chilakapati, Saritha Devi Chilakapati and Vinay Choudhary Chilakapati. They collectively held 74.52% of the company's shares. However, their shareholding will be 54.80%.

FAQs

1. What are the core details available for the Innomet Advanced Materials Limited IPO?

Innomet Advanced Materials Limited IPO is a fixed-price public issue of 34.24 lakh equity shares. This upcoming IPO is offering entirely a fresh issue of 34.24 lakh equity shares. The allotment for this new IPO is expected to be finalised on Monday, September 16, 2024.

2. How can I apply for the Innomet Advanced Materials Limited IPO?

The public subscription of this new IPO opens on September 11 and closes on September 13, 2024. Click here to initiate the application process.

3. Who is the lead manager(s) for the Innomet Advanced Materials Limited IPO?

Expert Global Consultants Private Limited was appointed as the book-running lead manager for the IPO.

4. Who is appointed as the registrar for this IPO?

Skyline Financial Services Private Limited has been appointed as the registrar for this public issue.

5. How will the net proceeds from the IPO will be utilised?

The company proposes to utilise the proceeds from the net issue for the various purposes including funding for working capital requirements, Capital Expenditure for machinery and equipment, Repayment/Prepayment in full or part of some bank and financial institution borrowings outstanding as on the date of this Information Memorandum, General corporate purposes and Issue-related expenses.

6. How can I check the allotment status of the IPO?

Investors who applied for an IPO can check the allotment status of the Innomet Advanced Materials Limited IPO by visiting here . For further updates, follow Bigul.

Also Read | SPP Polymer Limited IPO: Important Details of Upcoming IPO

.jpg)

.jpg)

.jpg)

.jpg)