- Share Samadhan IPO is a book-built issue of Rs 24.06 crores.

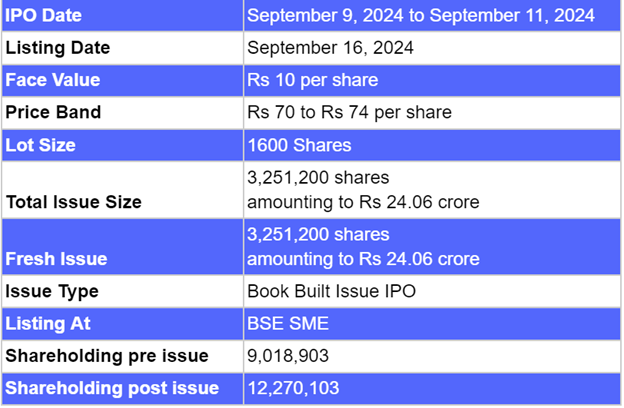

- This upcoming IPO bidding opens on Sep 9 and closes on Sep 11, 2024.

- Share Samadhan SME IPO price is set at Rs 70 to Rs 74 per share.

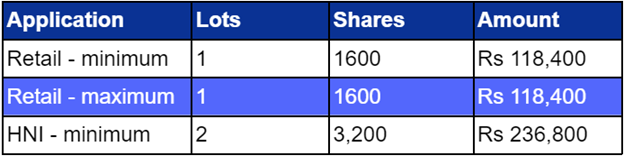

- The minimum investment required is Rs 1,18,400.

Share Samadhan IPO: Synopsis

Share Samadhan IPO is open for subscription starting Monday, September 9, 2024, and closing on Wednesday, September 11, 2024. This upcoming IPO's price is Rs 70 to Rs 74 per share. The minimum lot size set for the retail category is 1600 shares. Meanwhile, the minimum lot size for the HNI category is 2 lots consisting of 3200 shares.

The minimum investment required for retail category investors is Rs 1,37,600 (74 x 1600 shares). However, for the HNI category, the minimum investment amount required is Rs 2,36,800 (74 x 3200 shares).

Share Samadhan IPO is a fixed book-built issue of Rs 24.06 crores. This upcoming IPO is a fresh issue of 32.51 lakh equity shares. The allotment for this new IPO is expected to be finalised on Thursday, September 12, 2024. Share Samadhan IPO will be listed on BSE SME on Monday, September 16, 2024.

Narnolia Financial Services Limited is the book-running lead manager, Skyline Financial Services Private Limited is the registrar, and Nikunj Stock Brokers is the market maker for this IPO.

Also Read | SPP Polymer Limited IPO: Important Details of Upcoming IPO

Share Samadhan IPO: About the Company

Share Samadhan Limited was incorporated in 2011, offers a wide range of services for helping clients to protect and recover their investments efficiently. The company has three main businesses - Investment Retrieval Services, Wealth Protection services and Litigation funding solutions.

Investment Retrieval Services, which provides advisory services to unlock value and resolve investor issues related to various financial assets such as equities, preference shares, mutual funds, debentures, bonds, insurance, provident funds, deposits, bank accounts, debt, and other asset classes. The company also offers wealth protection services through Wealth Samadhan Card. Wealth Samadhan Card is a comprehensive digital solution to protect and optimise the protection of investment data.

Share Samadhan IPO: Objectives

The funds will be used for the expenditure in technology, unidentified acquisition for the company and to meet the working capital needs. The remaining money will be allocated for the general corporate purposes and meeting the issue expenses.

Share Samadhan IPO: Other Important Details

Time-Table of Share Samadhan IPO

Share Samadhan IPO: Financial Metrics (Amt in Rs Lakhs)

Share Samadhan posted revenue of Rs 996.13 lakhs and net profit of Rs 391.01 lakhs for the period ending on 31 Mar 2024. The company’s revenue increased by 261% and net profit increased by 716% between the FY ending on 31 Mar 2024 and 31 Mar 2023.

Minimum Investment: Lot Size Details

Promoters of Share Samadhan Limited and Their Holdings

The promoters of Share Samadhan are Mr. Abhay Kumar Chandalia and Mr. Vikash Kumar Jain. The promoters' shareholdings before the IPO were 85.05%; however, after the IPO, shareholdings will decline to 62.52%.

Share Samadhan: Strength of Company

- Share Samadhan has three main businesses - Investment Retrieval Services, Wealth Protection services and Litigation funding solutions.

- The company's return on capital employed is 47.99%.

- Share Samadhan's net profit showed a sharp jump from Rs 47.92 lakhs to Rs 39.01 lakhs between the year ending FY23 and FY24.

FAQs

1. What are the details of the Share Samadhan IPO?

Share Samadhan IPO is a fixed book-built issue of Rs 24.06 crores. This upcoming IPO is a fresh issue of 32.51 lakh equity shares. The allotment for this new IPO is expected to be finalised on Thursday, September 12, 2024.

2. Who are the lead managers for the Share Samadhan IPO?

Narnolia Financial Services Limited is appointed as the book-running lead manager for the IPO.

3. Who is the registrar for this IPO?

Skyline Financial Services Private Limited is the registrar for Share Samadhan Limited, handling the IPO's administrative aspects.

4. How can I apply for the Share Samadhan IPO?

The public subscription of this new IPO will open on September 9, 2024. Click here to initiate the application process.

5. How will the net proceeds from the IPO be utilised?

The funds will be used for the expenditure in technology, unidentified acquisition for the company and to meet the working capital needs. The remaining money will be allocated for the general corporate purposes and meeting the issue expenses.

6. How can I check the allotment status of the IPO?

Investors who applied can check the allotment status of the Share Samadhan Limited IPO by visiting here. For further updates follow Bigul.

Also Read | Trafiksol ITS Technologies IPO: What You Need To Know

.jpg)

.jpg)

.jpg)