- SPP Polymer IPO is a fixed price issue worth up to Rs 24.49 crores.

- Bidding opens on September 10 and closes on September 12, 2024.

- SPP Polymer SME IPO price set at Rs 59 per share.

- The minimum amount required for retail investors is Rs 1,18,000.

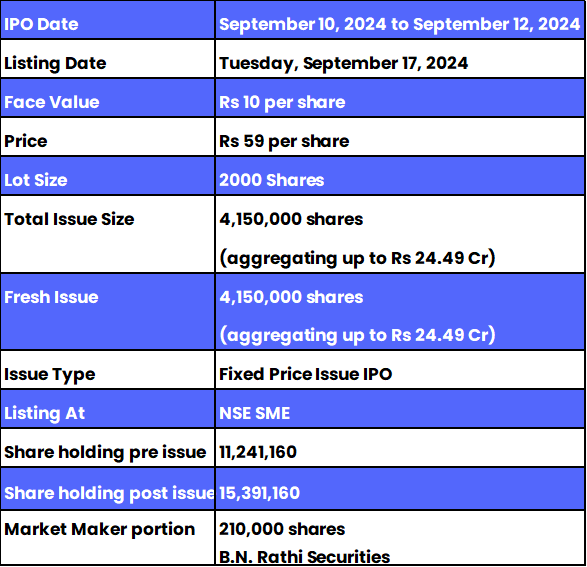

SPP Polymer IPO: Synopsis

SPP Polymer IPO is open for subscription from Tuesday, September 10, 2024, and closes on Thursday, September 12, 2024. The price for this IPO is set at Rs 59 per share.

SPP Polymer Limited is offering entirely a fresh issue of 41.50 lakh equity shares worth up to Rs 24.49 crore equity shares. The allotment for this new IPO is expected to be finalised on Friday, September 13, 2024. The listing of this IPO will be done on Tuesday, September 17, 2024, at the NSE SME segment.

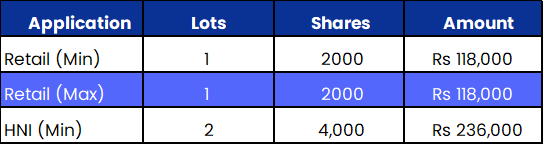

The minimum lot size set for the retail category is 1 lot, i.e., 2000 shares. For retail investors, the minimum and maximum investment amount required is Rs 118,000. However, for the HNI category, the minimum lot size is 2 lots, i.e., 4000 shares amounting to Rs 236,000.

The IPO is managed by Interactive Financial Services Limited, which is the book-running lead manager of this public issue. The company has appointed Kfin Technologies Limited as the registrar for the issue

Also Read | Trafiksol ITS Technologies IPO: What You Need To Know

SPP Polymer Limited: About the Company

SPP Polymers Limited was incorporated in 2004 as SPP Food Products Private Limited to manufacture HDPE/PP Woven fabric and bags, Non-woven fabrics, and Multifilament Yarn. Situated in Rudrapur City, Uttarakhand, the company aims at providing a wide range of products according to customers' specifications. Its annual production capacity comprises HDPE/PP Woven Fabric and bags of 12,000 MT, 4,000 MT of Non-woven Fabric, and Multifilament Yarn of 300 MT.

Its industries cater to agro-pesticides, cement, chemicals, fertilisers, textiles, and steel. SPP Polymers has been certified with ISO 9001:2015 for the Quality management system, 45001:2018 for occupational safety and health management systems, 14001:2015 for environmental management, and SA 8000: 2014. It employs four staff as of December 31, 2024.

SPP Polymer IPO: Objectives

The company proposes to utilise the funds being raised in the manner and in an estimated schedule of implementation as under: repayment of loans, working capital requirements, and to meet general corporate purposes.

SPP Polymer IPO: Other Important Details

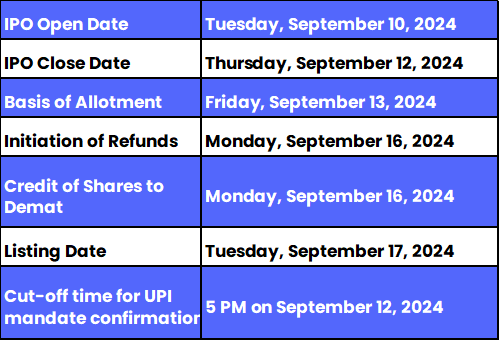

Time Table of SPP Polymer IPO

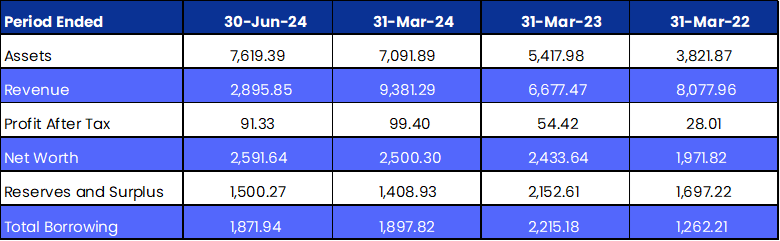

SPP Polymer Limited IPO: Financial Metrics (Amt in Rs Lakhs)

Minimum Investment: Lot Size Details

Promoters of SPP Polymer Limited and Their Holdings

The company's promoters are Dipak Goyal, Mahavir Bahety, Liladhar Mundhara and Asha Ram Bahety. They collectively held 94.99% of the company's shares. However, post-IPO, their shareholding will be 69.37%.

FAQs

1. What are the core details available for the SPP Polymer IPO?

SPP Polymer IPO is a fixed price public issue of 41.50 lakh equity shares. This upcoming IPO is offering entirely a fresh issue of 41.50 lakh equity shares. The allotment for this new IPO is expected to be finalised on Friday, September 13, 2024.

2. How can I apply for the SPP Polymer IPO?

The public subscription of this new IPO opens on September 10 and closes on September 12, 2024. Click here to initiate the application process.

3. Who is the lead manager(s) for the SPP Polymer IPO?

Interactive Financial Services Limited was appointed as the book-running lead manager for the IPO.

4. Who is appointed as the registrar for this IPO?

Kfin Technologies Limited has been appointed as the registrar for this public issue.

5. How will the net proceeds from the IPO will be utilised?

The company proposes to utilise the funds being raised in the manner and in an estimated schedule of implementation as under: repayment of loans, working capital requirements, and to meet general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied for an IPO can check the allotment status of the SPP Polymer IPO by visiting here. For further updates, follow Bigul.

Also Read | Gajanand International Limited IPO: Important Details of IPO

.jpg)

.jpg)

.jpg)