- Popular Foundations IPO is a fixed-price issue worth up to Rs 19.87 crores.

- Bidding opens on September 13 and closes on September 18, 2024.

- Popular Foundations SME IPO price is set at Rs 37 per share.

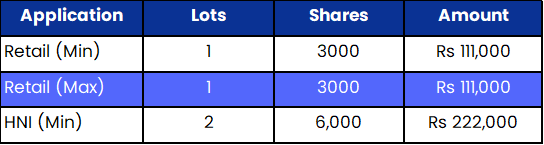

- The minimum amount required for retail investors is Rs 1,11,000.

Popular Foundations IPO: Synopsis

Popular Foundations is open for subscription from Friday, September 13, 2024, and closes on Wednesday, September 18, 2024. The price for this IPO is set at Rs 37 per share.

Popular Foundations IPO is offering entirely a fresh issue of 53.70 lakh equity shares worth up to Rs 19.80 crore.

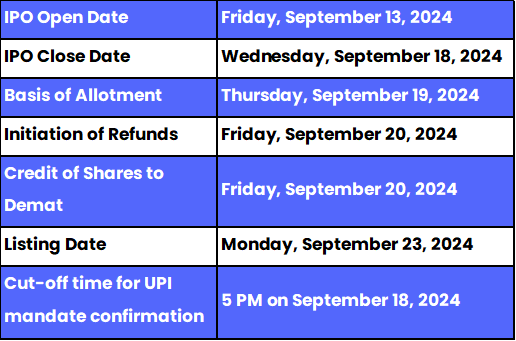

The allotment for this new IPO is expected to be finalised on Thursday, September 19, 2024. The listing of this IPO will be done on Monday, September 23, 2024, at BSE SME segment.

The minimum lot size set for the retail category is 1 lot, i.e., 3000 shares. For retail investors, the minimum and maximum investment amount required is Rs 111,000. However, for the HNI category, the minimum lot size is 2 lots, i.e., 6000 shares amounting to Rs 222,000.

The IPO is managed by Srujan Alpha Capital Advisors LLP, which is the book-running lead manager of this public issue. The company has appointed Bigshare Services Private Limited as the registrar for the issue.

Also Read | Sodhani Academy IPO: Checkout the Important Details Here

Popular Foundations Limited: About the Company

Popular Foundations Limited, founded in 1998, specialises in providing engineering and construction services with a focus on non-residential and non-government projects. The company has successfully executed projects in Chennai and across other locations like Pondicherry, Bangalore, and Coimbatore, delivering end-to-end solutions for factories, educational institutions, and commercial developments.

With a robust business model centered on customer satisfaction, fair pricing, and strategic market positioning, Popular Foundations has built a strong reputation for quality design and on-time project completion. As of September 7, 2024, the company employed 86 staff members across its sites and headquarters, contributing to its continued growth in the construction sector.

Popular Foundations IPO: Objectives

The company intends to utilise the funding received from the fresh issue for various purposes, including prepayment or repayment of certain outstanding borrowings, funding its working capital requirements, and addressing general corporate purposes.

Popular Foundations IPO: Other Important Details

Time Table of Popular Foundations IPO

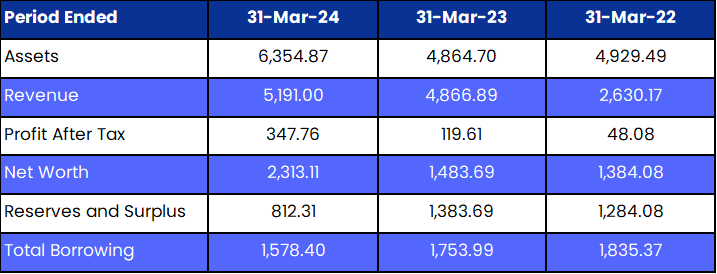

Popular Foundations IPO: Financial Metrics (Amt in Rs Lakhs)

Minimum Investment: Lot Size Details

Promoters of Popular Foundations Limited and Their Holdings

The company's promoters are Mr. Ananthanarayanan Sankaralingam Venkatesh and Mrs. Vinita Venkatesh. They collectively hold 83.36% of the company's shares. However, post-IPO, their shareholding will be 61.39%.

FAQs

1. What are the core details available for the Popular Foundations IPO?

Popular Foundations IPO is a Fixed-price public issue of 53.70 lakh equity shares. This upcoming IPO is offering entirely a fresh issue of 53.70 lakh equity shares. The allotment for this new IPO is expected to be finalised on Thursday, September 19, 2024.

2. How can I apply for the Popular Foundations IPO?

The public subscription of this new IPO opens on September 13 and closes on September 18, 2024. Click here to initiate the application process.

3. Who is the lead manager(s) for the Popular Foundations IPO?

Srujan Alpha Capital Advisor LLP was appointed as the book-running lead manager for the IPO.

4. Who is appointed as the registrar for Popular Foundations IPO?

Bigshare Services Private Limited has been appointed as the registrar for this public issue.

5. How will the net proceeds from the IPO be utilised?

The company intends to utilise the funding received from the fresh issue for various purposes, including prepayment or repayment of certain outstanding borrowings, funding its working capital requirements, and addressing general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied for an IPO can check the allotment status of the Popular Foundations IPO by visiting here, for further updates, follow Bigul.

Also Read | Envirotech Systems IPO: Important Details of Upcoming IPO

.jpg)

.jpg)

.jpg)