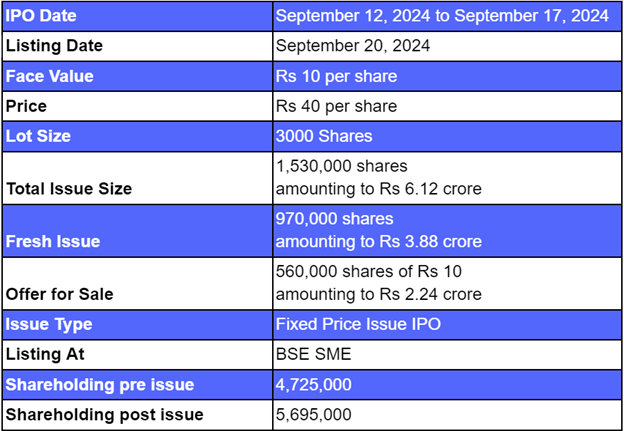

- Sodhani Academy IPO is a fixed price issue of Rs 6.12 crores.

- This upcoming IPO bidding opens on Sep 12 and closes on Sep 17, 2024.

- Sodhani Academy SME IPO price is set at Rs 40 per share.

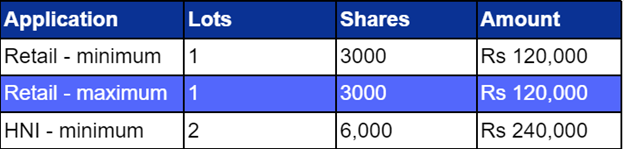

- The minimum investment required is Rs 1,20,000.

Sodhani Academy IPO: Synopsis

Sodhani Academy IPO is open for subscription starting Thursday, September 12, 2024, and closing on Tuesday, September 17, 2024. This upcoming IPO's price is Rs 40 per share. The minimum lot size set for the retail category is 3000 shares. Meanwhile, the minimum lot size for the HNI category is 2 lots consisting of 6000 shares.

The minimum investment required for retail category investors is Rs 1,12,000 (40 x 3000 shares). However, for the HNI category, the minimum investment amount required is Rs 2,40,000 (40 x 6000 shares).

Sodhani Academy IPO is a fixed price issue of Rs 6.12 crores. This upcoming IPO is a mixture of fresh issue and offer-for-sale. The fresh issue is of 9.7 lakh equity shares amounting to Rs 3.88 crores and OFS component is of 5.6 lakhs equity shares amounting to Rs 2.24 crores.

The allotment for this new IPO is expected to be finalised on Wednesday, September 18, 2024. Sodhani Academy IPO will be listed on BSE SME on Friday, September, 20, 2024.

Srujan Alpha Capital Limited is the book-running lead manager, Cameo Corporate Services Limited is the registrar for this IPO.

Also Read | Envirotech Systems IPO: Important Details of Upcoming IPO

Sodhani Academy IPO: About the Company

Sodhani Academy Limited was founded in 2009, offers financial training, consulting and learning services. Sodhani Academy focuses on the area of financial education and awareness, which refers to the knowledge and understanding of various financial concepts and skills that enable learners to make informed and responsible decisions in financial matters. This includes the ability to manage money effectively, budget wisely, save and invest prudently, and understand basic financial products and services.

The company has a recognized name and reputation for quality in its field of operation, as well as considerable experience and a credible track record in financial education. The company uses state-of-the-art technology to deliver its courses, allowing learners to use up-to-date course content and learn at their own pace. The company relies on the practice-oriented teaching method to provide course participants with knowledge that helps them achieve appropriate and sustainable financial freedom.

Sodhani Academy IPO: Objectives

The net proceeds from this issue will be used for building the content studio and offline training infrastructure, Information technology procurement, content development for course material. The remaining funds will be used for enhancement of brand visibility, awareness and fulfilling general corporate purposes.

Sodhani Academy IPO: Other Important Details

Time-Table of Sodhani Academy IPO

Sodhani Academy IPO: Financial Metrics (Amt in Rs Lakhs)

Sodhani Academy posted revenue of Rs 140.09 lakhs and net profit of Rs 86.33 lakhs for the period ending on 30 Nov 2023. Earlier, on 31 March 2023, the company reported a revenue of Rs 203.45 lakhs and PATof Rs 138.60 lakhs.

Minimum Investment: Lot Size Details

Promoters of Sodhani Academy Limited and Their Holdings

The promoters of Sodhani Academy are Mr. Rajesh Kumar Sodhani, Mrs. Priya Sodhani and Rajesh Kumar Sodhani HUF . The promoters' shareholding before the IPO were 99.99%; however, after the IPO, shareholdings details are not yet available.

Sodhani Academy: Strength of Company

- Sodhani Academy offers financial training, consulting and learning services.

- The trainers have a proven track record in financial education and financial literacy, making them highly effective.

- Sodhani Academy relies on the practice-oriented teaching method to provide course participants with knowledge that helps them achieve appropriate and sustainable financial freedom.

FAQs

1. What are the details of the Sodhani Academy IPO?

Sodhani Academy IPO is a fixed price issue of Rs 6.12 crores. This upcoming IPO’s is a mixture of Rs fresh issue and offer-for-sale. The fresh issue is of 9.7 lakh equity shares amounting to Rs 3.88 crores and OFS component is of 5.6 lakhs equity shares amounting to Rs 2.24 crores. .

2. Who are the lead managers for the Sodhani Academy IPO?

Srujan Alpha Capital is appointed as the book-running lead manager for the IPO.

3. What is the role of Cameo Corporate Services in this IPO?

Cameo Corporate Services Limited is the registrar for Sodhani Academy Limited , handling the IPO's administrative aspects.

4. How can I apply for the Sodhani Academy IPO?

The public subscription of this new IPO will open on September 12, 2024. Click here to initiate the application process.

5. How will the net proceeds from the IPO be utilised?

The net proceeds from this issue will be used for building the content studio and offline training infrastructure, Information technology procurement, content development for course material. The remaining funds will be used for enhancement of brand visibility, awareness and fulfilling general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied can check the allotment status of the Sodhani Academy Limited IPO by visiting here . For further updates follow Bigul .

Also Read | Innomet Advanced Materials Limited IPO: Key Insights of SME IPO

.jpg)

.jpg)

.jpg)