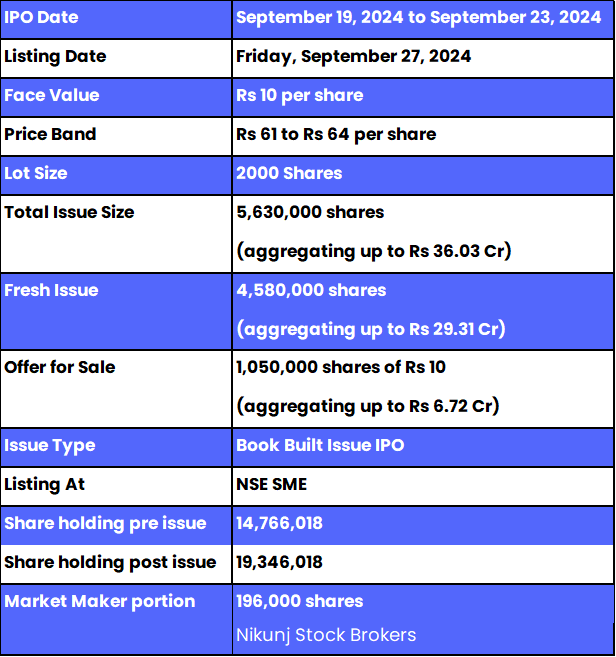

- Phoenix Overseas IPO is a book-built issue worth up to Rs 36.03 crore.

- Bidding opens on September 19 and closes on September 23, 2024.

- Phoenix Overseas SME IPO price band is set at Rs 61 – Rs 64 per share.

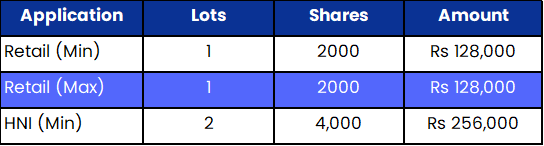

- The minimum amount required for retail investors is Rs 1,28,000.

Phoenix Overseas IPO: Synopsis

Phoenix Overseas is open for subscription from Thursday, September 19, 2024, and closes on Monday, September 23, 2024. The price band for this IPO is set at Rs 61 – Rs 64 per share.

Phoenix Overseas IPO is offering a fresh issue of 45.80 lakh equity shares worth up to Rs 29.31 crore and an offer for sale of up to 10.50 lakh equity share amounting up to 6.72 crore. This sums up total aggregate size of 56.30 lakh equity shares up to Rs 36.03 crore.

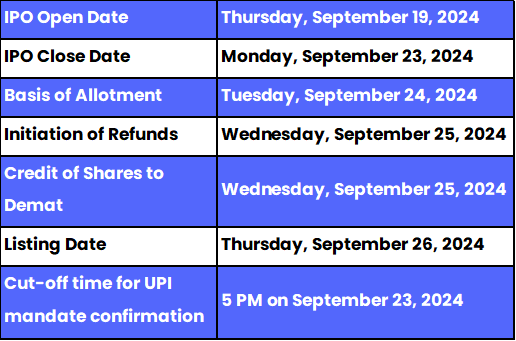

The allotment for this new IPO is expected to be finalised on Tuesday, September 24, 2024. The listing of this IPO will be done on Thursday, September 26, 202, at NSE SME segment.

The minimum lot size set for the retail category is 1 lot, i.e., 2000 shares. For retail investors, the minimum and maximum investment amount required is Rs 128,000. However, for the HNI category, the minimum lot size is 2 lots, i.e., 4000 shares amounting to Rs 256,000.

The IPO is managed by Khandwala Securities Limited, which is the book-running lead manager of this public issue. The company has appointed Cameo Corporate Services Limited as the registrar for the issue.

Also Read | Rappid Valves India IPO: Unlocking the IPO in Detail

Phoenix Overseas Limited: About the Company

Phoenix Overseas Limited is incorporated in December 2002 and operates in trading and marketing of animal feeds, agricultural products, and commodity crops such as corn, oil cakes, dry red chilies, cumin seeds, food grains, and soya bean meal. The company mainly operates as a B2B trading outfit in the commodities space, majorly playing in the corn/maise and oil cakes market. It has significantly entrenched itself as an integrated player in the agro commodities space and caters to both domestic and international markets.

Apart from agro trading, the company also undertakes manufacturing readymade accessories, jute, cotton, canvas, and leather bags for men and ladies. The firm exports its products to France, Italy, Germany, the UAE, and Australia, among others. The manufacturing plant of the company is in Sodhpur, Kolkata. By September, 30 2024, there were 29 people working with Phoenix Overseas and three contractual employees.

Phoenix Overseas IPO: Objectives

The Company intends to allocate the Net Proceeds from the Offer towards meeting its working capital needs, supporting inorganic growth strategies, and covering general corporate purposes.

Phoenix Overseas IPO: Other Important Details

Time Table of Phoenix Overseas IPO

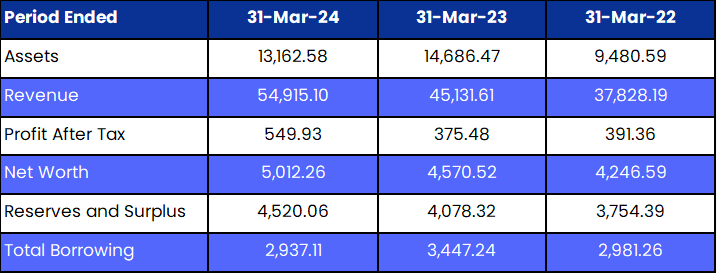

Phoenix Overseas IPO: Financial Metrics (Amt in Rs Lakhs)

Phoenix Overseas Limited saw a 1% rise in revenue, while its profit after tax (PAT) surged by 163% between the fiscal years ending March 31, 2024, and March 31, 2023.

Minimum Investment: Lot Size Details

Promoters of Phoenix Overseas Limited and Their Holdings

The company's promoters are Aparesh Nandi, Jayanta Kumar Ghosh and Uday Narayan Singh, BCPL Railway Infrastructure Limited, AN Dealers LLP, JKG Commercial LLP, UNS Commercial LLP and Tricon Logistics Engineering Consultancy Private Limited and Kanhai Singh Welfare Trust. They collectively hold 99.16% of the company's shares. However, post-IPO change in their shareholding is not disclosed.

FAQs

1. What are the core details available for the Phoenix Overseas IPO?

Phoenix Overseas IPO is a Book-built public issue of 56.30 lakh equity shares. This upcoming IPO is offering a fresh issue of 45.80 lakh equity shares and an offer for sale of up to 10.50 lakh equity. The allotment for this new IPO is expected to be finalised on Tuesday, September 24, 2024.

2. How can I apply for the Phoenix Overseas IPO?

The public subscription of this new IPO opens on September 19 and closes on September 23, 2024. Click here to initiate the application process.

3. Who is the lead manager(s) for the Phoenix Overseas IPO?

Khandwala Securities Limited was appointed as the book-running lead manager for the IPO.

4. Who is appointed as the registrar for Phoenix Overseas IPO?

Cameo Corporate Services Limited has been appointed as the registrar for this public issue.

5. How will the net proceeds from the IPO be utilised?

The company intends to allocate the Net Proceeds from the Offer towards meeting its working capital needs, supporting inorganic growth strategies, and covering general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied for an IPO can check the allotment status of the Phoenix Overseas IPO by visiting here, for further updates, follow Bigul.

Also Read | SD Retail IPO: Important Details of IPO

.jpg)

.jpg)

.jpg)