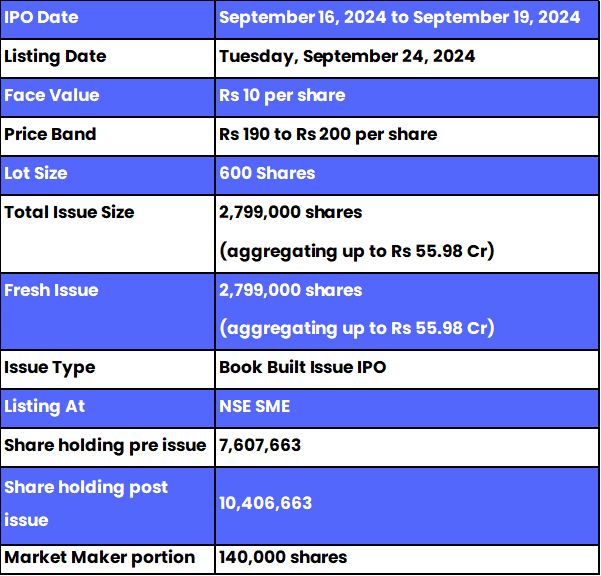

- Pelatro IPO is a book-built issue worth up to Rs 55.98 crores.

- Bidding opens on September 16 and closes on September 19, 2024.

- Pelatro SME IPO price band is set at Rs 190 – Rs 200 per share.

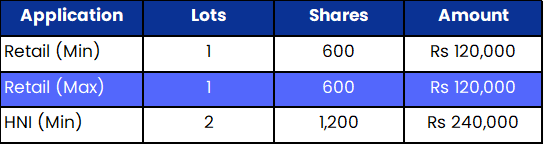

- The minimum amount required for retail investors is Rs 1,20,000.

Pelatro IPO: Synopsis

Pelatro is open for subscription from Monday, September 16, 2024, and closes on Thursday, September 19, 2024. The price band for this IPO is set at Rs 190 – Rs 200 per share.

Pelatro IPO is offering entirely a fresh issue of 27.99 lakh equity shares worth up to Rs 55.98 crore.

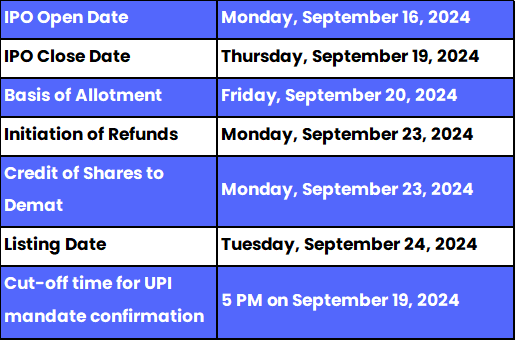

The allotment for this new IPO is expected to be finalised on Friday, September 20, 2024. Whereas the listing of this IPO will be done on Tuesday, September 24, 2024, at NSE SME segment.

The minimum lot size set for the retail category is 1 lot, i.e., 600 shares. For retail investors, the minimum and maximum investment amount required is Rs 120,000. However, for the HNI category, the minimum lot size is 2 lots, i.e., 1200 shares amounting to Rs 240,000.

The IPO is managed by Cumulative Capital Private Limited, which is the book-running lead manager of this public issue. The company has appointed Bigshare Services Private Limited as the registrar for the issue.

Also Read | Western Carriers IPO: All You Need To Know Before Applying

Pelatro Limited: About the Company

Pelatro Limited was incorporated on March 21, 2013, offers a dynamic customer engagement platform called mViva, designed to foster customer-centric interactions between businesses and their end users. The platform supports businesses in analysing customer behavior and needs through comprehensive features such as data collection, analytics, intelligence gathering, and campaign execution. Pelatro's core offerings include Campaign Management, Loyalty Management, Lead Management, and Data Monetization Solutions.

As of May 31, 2024, the platform has been deployed or is being implemented in 38 telecom networks across 30 countries, with a growing focus on banks and financial institutions. With 296 employees and a global customer base, the company stands out for its proprietary technology, specialist knowledge, and scalable, asset-light business model.

Pelatro IPO: Objectives

The company intends to utilise the funding received from the fresh issue for various purposes, including capital expenditure for the purchase and installation of IT equipment, computer hardware, servers, and other ancillary equipment, investing in its subsidiary, meeting the Company’s working capital needs, and addressing general corporate purposes.

Pelatro IPO: Other Important Details

Time Table of Pelatro IPO

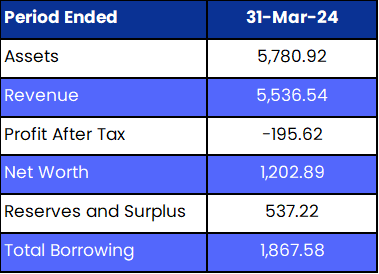

Pelatro IPO: Financial Metrics (Amt in Rs Lakhs)

Minimum Investment: Lot Size Details

Promoters of Pelatro Limited and Their Holdings

The company's promoters are Subash Menon, Sudeesh Yezhuvath, Kiran Menon, and Varun Menon. They collectively hold 73.31% of the company's shares. However, post-IPO, change in their shareholding is not yet disclosed.

FAQs

1. What are the core details available for the Pelatro IPO?

Pelatro IPO is a Book-built public issue of 27.99 lakh equity shares. This upcoming IPO is offering entirely a fresh issue of 27.99 lakh equity shares. The allotment for this new IPO is expected to be finalised on Friday, September 20, 2024.

2. How can I apply for the Pelatro IPO?

The public subscription of this new IPO opens on September 16 and closes on September 19, 2024. Click here to initiate the application process.

3. Who is the lead manager(s) for the Pelatro IPO?

Cumulative Capital Private Limited was appointed as the book-running lead manager for the IPO.

4. Who is appointed as the registrar for Pelatro IPO?

Bigshare Services Private Limited has been appointed as the registrar for this public issue.

5. How will the net proceeds from the IPO be utilised?

The company intends to utilise the funding received from the fresh issue for various purposes, including capital expenditure for the purchase and installation of IT equipment, computer hardware, servers, and other ancillary equipment, investing in its subsidiary, meeting the company’s working capital needs, and addressing general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied for an IPO can check the allotment status of the Pelatro IPO by visiting here, for further updates, follow Bigul.

Also Read | Osel Devices IPO: All Important Points Discussed Below

.jpg)

.jpg)

.jpg)

.jpg)