- Osel Devices IPO is a book-built issue of Rs 70.66 crores.

- This upcoming IPO bidding opens on Sep16 and closes on Sep 18, 2024.

- Osel Devices SME IPO price is set at Rs 155 to Rs 160 per share.

- The minimum investment required is Rs 1,28,000.

Osel Devices IPO: Synopsis

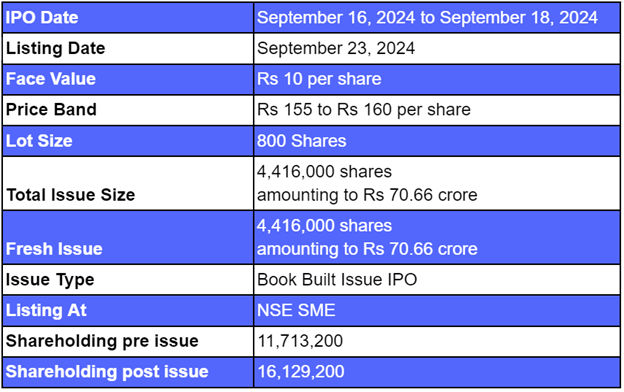

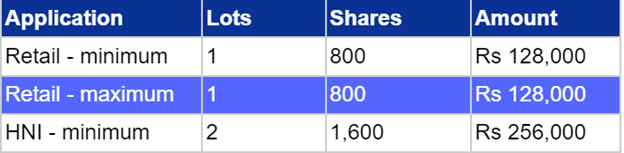

Osel Devices IPO is open for subscription starting Monday, September 16, 2024, and closing on Wednesday, September 18, 2024. This upcoming IPO's price band is Rs 155 to Rs 160 per share. The minimum lot size set for the retail category is 800 shares. Meanwhile, the minimum lot size for the HNI category is 2 lots consisting of 1600 shares.

The minimum investment required for retail category investors is Rs 1,28,000 (160 x 800 shares). However, for the HNI category, the minimum investment amount required is Rs 2,56,000 (160 x 1600 shares).

Osel Devices IPO is a book-built issue of Rs 70.66 crores. This upcoming IPO is an entirely fresh issue of 44.16 lakh equity shares. The allotment for this new IPO is expected to be finalised on Thursday, September 19, 2024. Osel Devices IPO will be listed on NSE SME on Monday, September 23, 2024. Horizon Management Private Limited is the book-running lead manager, Mas Services Limited is the registrar, and Giriraj Stock Broking is the market maker for this IPO.

Also Read | Popular Foundations IPO: Important Details of IPO

Osel Devices IPO: About the Company

Osel Devices Limited was founded in 2006 and engaged in the business of manufacturing a range of LED display systems and hearing aids. LED display systems include all major components for commercial use such as advertising media, billboards, corporate boardrooms, presentations, display promotions, command centres, and front signs. The company's LED display systems are equipped with a content management system that allows them to be connected to a phone or computer and displayed on screen.

Osel Devices also manufactures hearing aids, commonly known as health aids, to assist people with disabilities, the elderly, and the chronically ill who have low hearing levels. The company's main customer for hearing aids is the Artificial Limbs Manufacturing Corporation of India. Also, they manufacture digitally programmable and non-programmable hearing aids.

Osel Devices IPO: Objectives

The net funds received from this IPO will be used for the repayment and prepayment of the past borrowing taken by the company to clear the debt. The remaining funds will be allocated for funding the day-to-day capital needs of the company and fulfilling the general corporate purposes.

Osel Devices IPO: Other Important Details

Time-Table of Osel Devices IPO

Osel Devices IPO: Financial Metrics (Amt in Rs Lakhs)

Osel Devices posted revenue of Rs 45.462.68 lakhs and net profit of Rs 392.76 lakhs for the period ending on 31 Mar 2024. The company’s revenue increased by 112% and net profit increased by 129% between the FY ending on 31 Mar 2024 and 31 Mar 2023.

Minimum Investment: Lot Size Details

Promoters of Osel Devices Limited and Their Holdings

The promoters of Osel Devices are Rajendra Ravi Shanker Mishra and Jyotsna Jawahar. The promoters' shareholdings before the IPO were 98.50%; however, after the IPO, shareholdings will decline to 71.53%.

Osel Devices: Strength of Company

- Manufacturer of LED display systems and hearing aids with a long-standing market presence.

- Cost-efficient production and punctual order processing, Quality assurance and quality control of the products.

- Osel Devices Limited had a geographical presence and was comfortable providing after-sales services.

FAQs

1. What are the details of the Osel Devices IPO?

Osel Devices IPO is a book-built issue of Rs 70.66 crores. This upcoming IPO is an entirely fresh issue of 44.16 lakh equity shares. The allotment for this new IPO is expected to be finalised on Thursday, September 19, 2024.

2. Who are the lead managers for the Osel Devices IPO?

Horizon Management Private Limited is appointed as the book-running lead manager for the IPO.

3. What is the role of Mas Services in this IPO?

Mas Services Limited is the registrar for Osel Devices Limited, handling the IPO's administrative aspects.

4. How can I apply for the Osel Devices IPO?

The public subscription of this new IPO will open on September 16, 2024. Click here to initiate the application process.

5. How will the net proceeds from the IPO be utilised?

The net funds received from this IPO will be used for the repayment and prepayment of the past borrowing taken by the company to clear the debt. The remaining funds will be allocated for funding the day-to-day capital needs of the company and fulfilling the general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied can check the allotment status of the Osel Devices Limited IPO by visiting here. For further updates follow Bigul.

Also Read | Sodhani Academy IPO: Checkout the Important Details Here

.jpg)

.jpg)

.jpg)