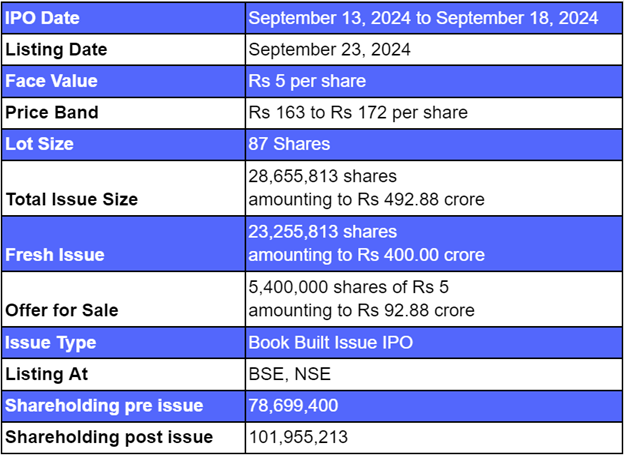

- Western Carriers IPO is a book-built issue of Rs 492.88 crore.

- This upcoming IPO bidding opens on Sep 13 and closes on Sep 18, 2024.

- Western Carriers IPO price band is set at Rs 163 to Rs 172 per share.

- The minimum investment required Rs 14,964.

Western Carriers IPO: Synopsis

Western Carriers IPO is open for subscription starting Friday, Sep 13, 2024 and closing on Wednesday, Sep 18, 2024. The price of this upcoming IPO is decided at Rs 163 to Rs 172 per share.

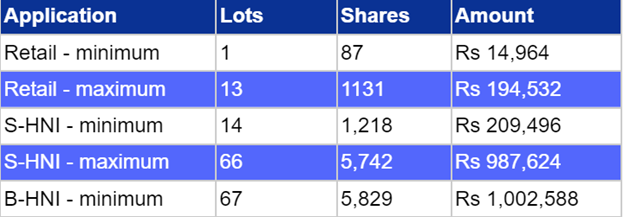

The minimum lot size for the retail category is 87 shares. The minimum lot size for small NII is 14 lots consisting of 1218 shares. Meanwhile, the minimum lot for big non-institutional investors is 67 lots with 5,829 shares.

The minimum investment required for retail category investors is Rs 14,880 (480 x 31 shares). However, for small non-institutional investors, the minimum investment amount required is Rs 2,09,496 (172 x 1218 shares) for big non-institutional investors, it is Rs 10,02,588 (172 x 5,829 shares).

Western Carriers IPO is a book-built issue of Rs 492.88 crores. This issue is a combination of fresh issue and offer-for-sale. The fresh issue is of Rs 2.33 crore equity shares amounting to Rs 400 crores. The offer-for-sale is of 0.54 crore equity shares amounting to Rs 92.88 crores.

The allotment for this IPO is expected to be finalised on Thursday, September 19, 2024.

Western Carriers Limited's IPO will be listed on both the exchanges BSE and NSE, and the listing date is fixed for Monday, September 23, 2024.

Jm Financial Limited, Kotak Mahindra Capital Company Limited is the book-running lead manager of Western Carriers Limited. Link Intime India Private Limited is the registrar for this new IPO.

Also Read | Osel Devices IPO: All Important Points Discussed Below

Western Carriers IPO: About the Company

Western Carriers was incorporated in March 2011, is a Multi-modal, rail-focused, 4PL asset-light logistics company. The company offers fully customizable, multi-modal logistics solutions encompassing road, rail, water, and air transportation and a tailored range of value-added services.

The company provides chartering services to overseas destinations, stevedoring services at Indian ports, and coastal movement of cargo within India. They specialise in combining rail with road movements through an asset-light business model. The company manages and handles the supply chain for increased imports, exports, and production levels for a leading metals and resource group company. As per the latest information available, Western Carriers has served over 1100 customers and has a team of 1350 employees.

Western Carriers IPO: Objectives

The net proceeds from this IPO will be used for the repayment and prepayment of the borrowings taken in the past by the company. The remaining funds will be allocated for the expenditure in the commercial vehicles, 40 feet specialised containers and 20 feet normal shipping containers and reach stackers.

Western Carriers IPO: Other Important Details

Western Carriers IPO: Time-Table

Western Carriers Limited: Financial Metrics (Amt in Rs Crore)

Western Carriers reported revenue of Rs 1,691.41 crore and net profit of Rs 80.35 crore for the period ending March 31 2024. The company’s revenue increased by 3% and PAT increased by 12% between the FY ending with March 31 2024 and March 31 2023.

Lot Size of Western Carriers IPO

Promoters of Western Carriers Limited and Its Holdings

The promoters of Western Carriers Limited are Rajendra Sethia and Kanishka Sethia. The promoter's shareholdings before the IPO is 99% however, after the IPO, the details of the shareholding are not available.

Western Carriers IPO: Strength of the Company

- Western Carriers provides chartering services to overseas destinations, stevedoring services at Indian ports,

- The company's equity ratio is 0.67 and ROCE is at 29.23.

- Western Carriers is a profitable company, and its net profit is rising steadily.

FAQs

1. What are the details of Western Carriers Limited IPO 2024?

Western Carriers IPO is a book-built issue of Rs 492.88 crores. This issue is a combination of fresh issue and offer-for-sale. The fresh issue is of Rs 2.33 crore equity shares amounting to Rs 400 crores. The offer-for-sale is of 0.54 crore equity shares amounting to Rs 92.88 crores.

2. Who are the lead managers for the Western Carriers Limited IPO?

Jm Financial Limited, Kotak Mahindra Capital Company Limited are the lead managers for this IPO.

3. What is the role of Link Intime India in this IPO?

Link Intime India Private Limited is the registrar for Western Carriers Limited, handling the IPO's administrative aspects.

4. How can I apply for the Western Carriers Limited IPO?

The public subscription of this IPO will open on September 13, 2024. Click here to continue the application process.

5. How will the net proceeds from the IPO be utilised?

The net proceeds from this IPO will be used for the repayment and prepayment of the borrowings taken in the past by the company. The remaining funds will be allocated for the expenditure in the commercial vehicles, 40 feet specialised containers and 20 feet normal shipping containers and reach stackers.

6. How can I check the allotment status of the IPO?

Investors can check out the allotment status of the Western Carriers Limited IPO 2024 by visiting here.

Also Read | Popular Foundations IPO: Important Details of IPO

.jpg)

.jpg)

.jpg)