- Paramount Dye Tec IPO is a book-built issue of Rs 28.43 crores.

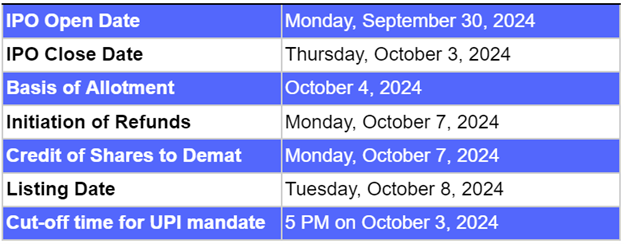

- This upcoming IPO bidding opens on Sep 30 and closes on Oct 3, 2024.

- Paramount Dye Tec SME IPO price is set at Rs 111 to Rs 117 per share.

- The minimum investment required is Rs 1,40,400.

Paramount Dye Tec IPO: Synopsis

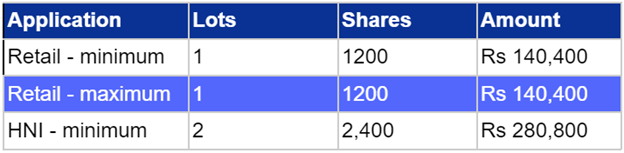

Paramount Dye Tec IPO is open for subscription starting Monday, September 30, 2024, and closing on Thursday, October 3, 2024. This upcoming IPO price is Rs 111 to Rs 117 per share. The minimum lot size set for the retail category is 1200 shares. Meanwhile, the minimum lot size for the HNI category is 2 lots consisting of 2400 shares.

The minimum investment required for retail category investors is Rs 1,40,400 (117 x 1200 shares). However, for the HNI category, the minimum investment amount required is Rs 2,80,800 (117 x 2400 shares).

Paramount Dye Tec IPO is a book-built issue of Rs 28.43 crores. This upcoming IPO is an entirely fresh issue of 24.3 lakh equity shares. The allotment for this new IPO is expected to be finalised on Friday, October 4, 2024.

Paramount Dye Tec IPO will be listed on NSE SME on Tuesday, October 8, 2024.

Gretex Corporate Services Limited is the book-running lead manager, Bigshare Services Private Limited is the registrar for this IPO. The market maker for this IPO is Gretex Share Broking.

Also Read | HVAX Technologies IPO: Unlocking the IPO in Detail

Paramount Dye Tec IPO: About the company

Paramount Dye Tec Limited was founded in 2014, engaged in the business of producing yarns by recycling waste synthetic fibre, catering to the B2B segment of the textile industry. Paramount offers a range of products, including synthetic fiber and yarns such as acrylic, polyester, nylon, wool, hand-knitting, and acrylic blend yarns, known for their quality, durability, and lasting excellence.

The company deals in acrylic cloth as well as other products such as blended yarn, nylon, polyester yarns, and acrylic yarn. Paramount Dye has two manufacturing facilities situated in Village Mangarh and Village Koom Khurd, Punjab. The company is working to expand its spinning capacity to convert fiber into yarn, which is a strategic move that minimally increases expenses while significantly boosting profitability.

Paramount Dye Tec IPO: Objectives

The funds raised through this IPO offer will be used for setting up the manufacturing plant of the company. The remaining funds will be used for the repayment of the past loans availed by the company and fulfilling the expenses toward the registration of land purchased by the promoter and meeting the general corporate purposes.

Paramount Dye Tec IPO: Other Important Details

Time-Table of Paramount Dye Tec IPO

Paramount Dye Tec IPO: Financial Metrics (Amt in Rs Lakhs)

Paramount Dye Tec posted revenue of Rs 2,367.90 lakhs and net profit of Rs 354.90 lakhs for the period ending on 31 Mar 2024. In the third quarter of FY24 the company reported a revenue of Rs 2,955.91 lakhs and PAT of Rs 278.65 lakhs.

Minimum Investment: Lot Size Details

Promoters of Paramount Dye Tec Limited and Their Holdings

The promoters of Paramount Dye Tec are Mr. Kunal Arora and Ms. Palki Arora. The promoter shareholdings before the IPO were 90.97%; however, after the IPO, shareholdings will decline to 64.97%.

Paramount Dye Tec: Strength of Company

● Utilisation of recycled synthetic waste as raw material.

● Cost benefits as compared to its competitors by converting waste into usable fibre and yarn.

● Custom yarn solutions for customers as per their specific requirements.

● Expanding spinning capacity to convert fibre into yarn is a strategic move that minimally increases expenses while significantly boosting profitability.

FAQs

1. What are the details of the Paramount Dye Tec IPO?

Paramount Dye Tec IPO is a book-built issue of Rs 28.43 crores. This upcoming IPO is an entirely fresh issue of 24.3 lakh equity shares. The allotment for this new IPO is expected to be finalised on Friday, October 4, 2024.

2. Who are the lead managers for the Paramount Dye Tec IPO?

Gretex Corporate Services Limited is appointed as the book-running lead manager for the IPO.

3. What is the role of Bigshare Services in this IPO?

Bigshare Services Private Limited is the registrar for Paramount Dye Tec Limited, handling the IPO's administrative aspects.

4. How can I apply for the Paramount Dye Tec IPO?

The public subscription of this new IPO will open on September 30, 2024. Click here to initiate the application process.

5. How will the net proceeds from the IPO be utilised?

The funds raised through this IPO offer will be used for setting up the manufacturing plant of the company. The remaining funds will be used for the repayment of the past loans availed by the company and fulfilling the expenses toward the registration of land purchased by the promoter and meeting the general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied can check the allotment status of the Paramount Dye Tec Limited IPO by visiting here. For further updates follow Bigul.

Also Read | Nexxus Petro Industries IPO: Unlocking the IPO in Detail

.jpg)

.jpg)

.jpg)