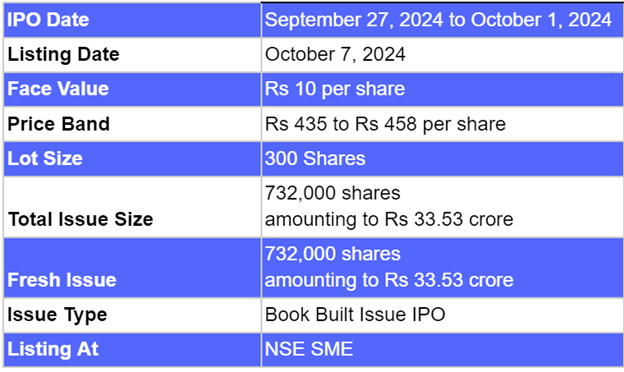

- HVAX Technologies IPO is a book-built issue of Rs 33.53 crores.

- This upcoming IPO bidding opens on Sep 27 and closes on Oct 1, 2024.

- HVAX Technologies SME IPO price is set at Rs 435 to Rs 458 per share.

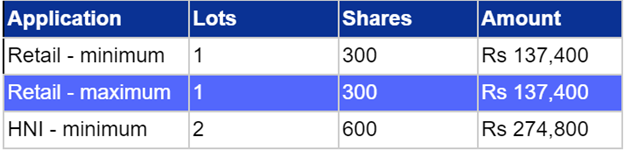

- The minimum investment required is Rs 1,37,400.

HVAX Technologies IPO: Synopsis

HVAX Technologies IPO is open for subscription starting Friday, September 27, 2024, and closing on Tuesday, October 1, 2024. This upcoming IPO price is Rs 435 to Rs 458 per share. The minimum lot size set for the retail category is 300 shares. Meanwhile, the minimum lot size for the HNI category is 2 lots consisting of 600 shares.

The minimum investment required for retail category investors is Rs 1,37,400 (458 x 300 shares). However, for the HNI category, the minimum investment amount required is Rs 2,74,800 (458 x 600 shares).

HVAX Technologies IPO is a book-built issue of Rs 33.53 crores. This upcoming IPO is an entirely fresh issue of 7.32 lakh equity shares. The allotment for this new IPO is expected to be finalised on Thursday, October 3, 2024.

HVAX Technologies IPO will be listed on NSE SME on Monday, October 7, 2024.

Fedex Securities Private Limited is the book-running lead manager, Kfin Technologies Limited is the registrar for this IPO. The market maker for this IPO is Aftertrade Broking.

Also Read | Nexxus Petro Industries IPO: Unlocking the IPO in Detail

HVAX Technologies IPO: About the Company

HVAX Technologies Limited was established in 2010 and provides turnkey engineering, procurement, and execution of controlled environment and cleanroom infrastructure, design, engineering, and consulting services to pharmaceutical and healthcare companies.

HVAX Technologies supplies products like Cleanroom wall panels, Cleanroom ceiling panels, Covings, Riser panels, Cleanroom doors, Flooring systems, Pass boxes, Air showers, LT/HT electrical panels, Prefabricated galvanised iron ducts, Air handling units, Chillers, Building Management Systems Equipment, Utility generation and distribution Equipment manufactured by third parties.

The company's customers include pharmaceutical companies, chemical companies, hospitals, healthcare companies, and FMCG companies. HVAX Technologies has completed around 200 projects in India and in 15 countries. The company has executed 53 projects, 48 projects, and 52 projects in FY 2024, FY 2023, and FY 2022 respectively.

HVAX Technologies IPO: Objectives

The funds raised through this IPO will be used to cover the day-to-day capital needs for the smooth functioning of the business. The remaining funds will be used to fulfil the general corporate purposes.

HVAX Technologies IPO: Other Important Details

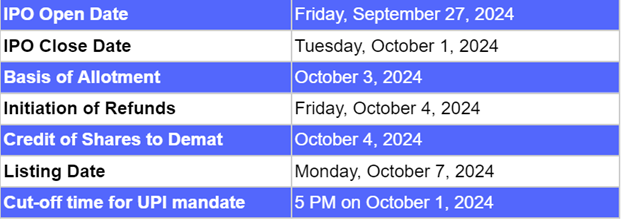

Time-Table of HVAX Technologies IPO

HVAX Technologies IPO: Financial Metrics (Amt in Rs Lakhs)

HVAX Technologies posted revenue of Rs 10,746.99 lakhs and net profit of Rs 939.07 lakhs for the period ending on 31 Mar 2024. The company’s revenue increased by 12% and net profit increased by 80% between the FY ending on 31 Mar 2024 and 31 Mar 2023.

Minimum Investment: Lot Size Details

Promoters of HVAX Technologies Limited and Their Holdings

The promoters of HVAX Technologies are Nirbhaynarayan Singh and Prayagdatt Mishra. The promoter shareholdings before the IPO were 90.50%; however, after the IPO, shareholdings will decline to 66.65%.

HVAX Technologies: Strength of Company

● Experienced promoters and an experienced management team.

● Consistent implementation expertise.

● Strong and consistent financial performance supported by a solid internal control and risk management system.

FAQs

1. What are the details of the HVAX Technologies IPO?

HVAX Technologies IPO is a book-built issue of Rs 33.53 crores. This upcoming IPO is an entirely fresh issue of 7.32 lakh equity shares. The allotment for this new IPO is expected to be finalised on Thursday, October 3, 2024.

2. Who are the lead managers for the HVAX Technologies IPO?

Fedex Securities Private Limited is appointed as the book-running lead manager for the IPO.

3. What is the role of Kfin Technologies Limited in this IPO?

Kfin Technologies Limited is the registrar for HVAX Technologies Limited, handling the IPO's administrative aspects.

4. How can I apply for the HVAX Technologies IPO?

The public subscription of this new IPO will open on September 27, 2024. Click here to initiate the application process.

5. How will the net proceeds from the IPO be utilised?

The funds raised through this IPO will be used to cover the day-to-day capital needs for the smooth functioning of the business. The remaining funds will be used to fulfil the general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied can check the allotment status of the HVAX Technologies Limited IPO by visiting here. For further updates follow Bigul.

Also Read | Saj Hotels IPO: All Important Details of Upcoming SME IPO

.jpg)

.jpg)