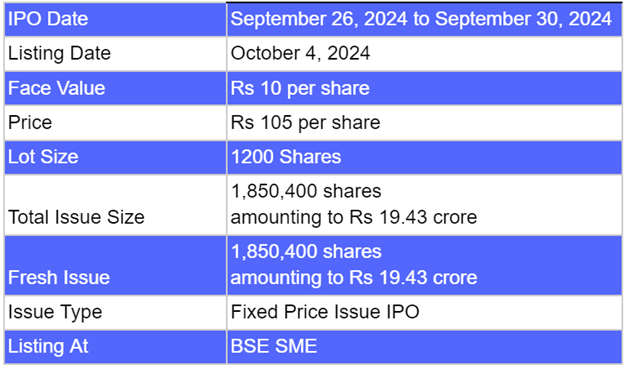

- Nexxus Petro Industries IPO is a fixed price issue of Rs 19.43 crores.

- This upcoming IPO bidding opens on Sep 26 and closes on Sep 30, 2024.

- Nexxus Petro Industries SME IPO price is set at Rs 105 per share.

- The minimum investment required is Rs 1,26,000.

Nexxus Petro Industries IPO: Synopsis

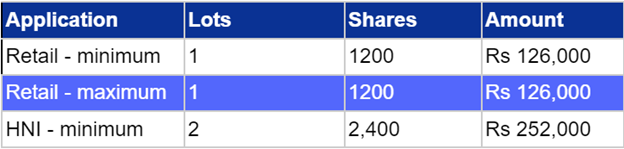

Nexxus Petro Industries IPO is open for subscription starting Thursday, September 26, 2024, and closing on Monday, September 30, 2024. This upcoming IPO price is Rs 105 per share. The minimum lot size set for the retail category is 1200 shares.

Meanwhile, the minimum lot size for the HNI category is 2 lots consisting of 2400 shares. The minimum investment required for retail category investors is Rs 1,26,000 (105 x 1200 shares). However, for the HNI category, the minimum investment amount required is Rs 2,52,000 (105 x 2400 shares).

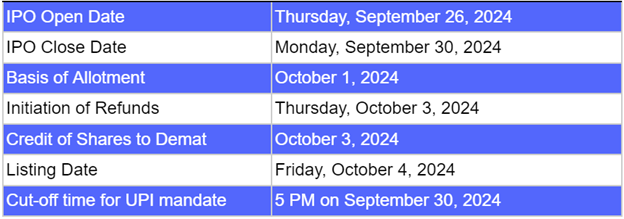

Nexxus Petro Industries IPO is a fixed price issue of Rs 19.43 crores. This upcoming IPO is an entirely fresh issue of 18.5 lakh equity shares. The allotment for this new IPO is expected to be finalised on Tuesday, October 1, 2024. Nexxus Petro Industries IPO will be listed on BSE SME on Friday, October 4, 2024. Srujan Alpha Capital Advisors LLP is the book-running lead manager, Kfin Technologies Limited is the registrar for this IPO and market maker for this IPO is Gretex Share Broking.

Also Read | Saj Hotels IPO: All Important Details of Upcoming SME IPO

Nexxus Petro Industries IPO: About the Company

Nexxus Petro Industries Limited was incorporated in 2021 and is engaged in the trading, manufacturing, and sale of petrochemical products. Nexxus produces and distributes high-quality bitumen, bitumen emulsions, and special bituminous allied products to infrastructure or construction companies, government agencies, road authorities, and the bitumen industry. The company has upgraded its processing unit, boosting production capacity and product quality. This has led to an increase in customers due to its positive approach towards clients. Nexxus Petro Industries has three manufacturing units each in Gujarat, Rajasthan and Madhya Pradesh. The company had a team of 17 permanent employees.

Nexxus Petro Industries IPO: Objectives

The net proceeds from this initial public offer will be used to fund the working capital needs of the company. The remaining money will be used for fulfilling the general corporate purposes.

Nexxus Petro Industries IPO: Other Important Details

Time Table of Nexxus Petro Industries IPO

Nexxus Petro Industries IPO: Financial Metrics (Amt in Rs Lakhs)

Nexxus Petro Industries posted revenue of Rs 23,837.57 lakhs and net profit of Rs 348.47 lakhs for the period ending on 31 Mar 2024. The company’s revenue increased by 67% and net profit increased by 73% between the FY ending on 31 Mar 2024 and 31 Mar 2023.

Minimum Investment: Lot Size Details

Promoters of Nexxus Petro Industries Limited and Their Holdings

The promoters of Nexxus Petro Industries are Haresh Mohanlal Senghani, Rahul Mohanlal Senghani, Hinaben Haresh Senghani and Manishaben Rahul Senghani. The promoter shareholdings before the IPO were 100%; however, after the IPO, shareholdings details are not available.

Nexxus Petro Industries: Strength

● Experienced Management Team to look after day-to-day operations.

● Strong Supplier relationship for business growth

● Factories in Kutch, Gujarat, Pali, Rajasthan, and Bhopal, Madhya Pradesh, are well-equipped with modern machines and advanced processes.

FAQs

1. What are the details of the Nexxus Petro Industries IPO?

Nexxus Petro Industries IPO is a fixed price issue of Rs 19.43 crores. This upcoming IPO is an entirely fresh issue of 18.5 lakh equity shares. The allotment for this new IPO is expected to be finalised on Tuesday, October 1, 2024.

2. Who are the lead managers for the Nexxus Petro Industries IPO?

Srujan Alpha Capital Advisors LLP is appointed as the book-running lead manager for the IPO.

3. What is the role of Kfin Technologies Limited in this IPO?

Kfin Technologies Limited is the registrar for Nexxus Petro Industries Limited, handling the IPO's administrative aspects.

4. How can I apply for the Nexxus Petro Industries IPO?

The public subscription of this new IPO will open on September 26, 2024. Click here to initiate the application process.

5. How will the net proceeds from the IPO be utilised?

The net proceeds from this initial public offer will be used to fund the working capital needs of the company. The remaining money will be used for fulfilling the general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied can check the allotment status of the Nexxus Petro Industries Limited IPO by visiting here. For further updates follow Bigul.

Also Read | Forge Auto International IPO: Important Details of IPO

.jpg)

.jpg)

.jpg)