• Saj Hotels IPO is a fixed-price issue worth up to Rs 27.63 crores.

• Bidding opens on September 27 and closes on October 1, 2024.

• Saj Hotels SME IPO price is set at Rs 65 per share.

• The minimum amount required for retail investors is Rs 1,30,000.

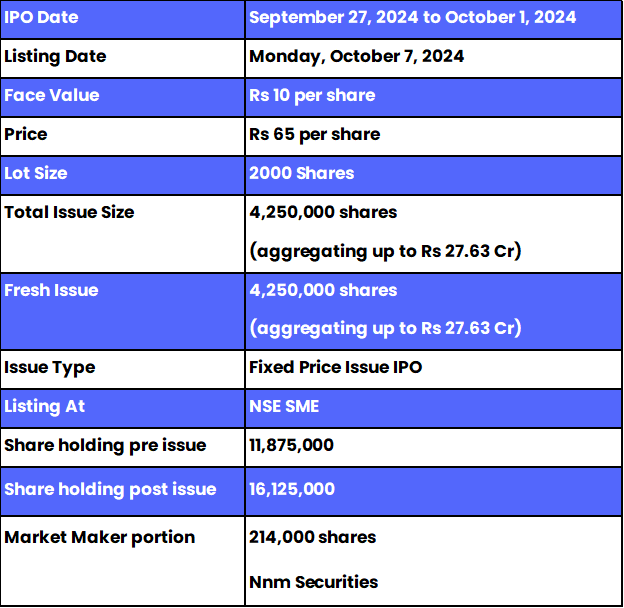

Saj Hotels IPO: Synopsis

Saj Hotels is open for subscription from Friday, September 27, 2024, and closes on Tuesday, October 1, 2024. The price for this IPO is set at Rs 65 per share.

Saj Hotels IPO is offering entirely a fresh issue of 42.50 lakh equity shares worth up to Rs 27.63 crore.

The allotment for this new IPO is expected to be finalised on Thursday, October 3, 2024. The listing of this IPO will be done on Monday, October 7, 2024, at NSE SME segment.

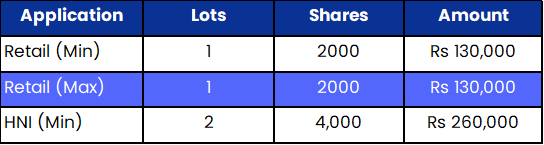

The minimum lot size set for the retail category is 1 lot, i.e., 2000 shares. For retail investors, the minimum and maximum investment amount required is Rs 130,000. However, for the HNI category, the minimum lot size is 2 lots, i.e., 4000 shares amounting to Rs 260,000.

The IPO is managed by Corpwis Advisors Private Limited, which is the book-running lead manager of this public issue. The company has appointed Satellite Corporate Services Private Limited as the registrar for the issue.

Also Read | Forge Auto International IPO: Important Details of IPO

Saj Hotels Limited: About the Company

Saj Hotels Limited is an incorporated firm whose venture started in February 1981. It provides hospitality services and offers resort accommodations, villas, and dining experiences on three owned/leased properties. Two of the properties are managed and one is leased to other companies. The resorts can be used as venues for conferences, weddings, and other social events with comfort and convenience at various destinations.

Saj Hotels has now raised its stakes to 50% in My Own Rooms Dot In Private Limited. The group can make memorable customers by offering breathtaking natural scenery and essential services such as restaurants, spas, and event facilities while working through seasonal changes. To date, May 2024, Saj Hotels has a staff force of 144 employees manning its operations.

Saj Hotels IPO: Objectives

The Company intends to use the funds raised for the following purposes: capital expenditure for the expansion of existing resort properties, funding working capital requirements, and covering general corporate expenses.

Saj Hotels IPO: Other Important Details

Time Table of Saj Hotels IPO

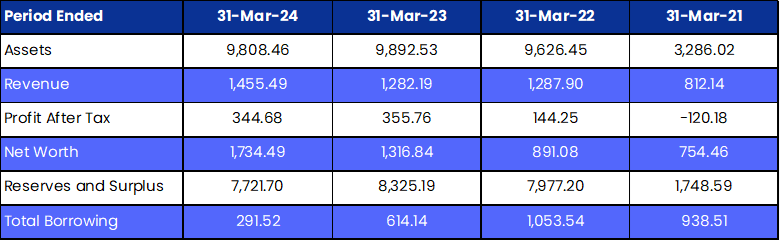

Saj Hotels IPO: Financial Metrics (Amt in Rs Lakhs)

The company’s revenue was reported to be Rs 1,455.49 lakh for the year ended March 2024, which shows a growth of 13.52%. The profit after tax dropped to Rs 344.68 lakhs, marking a decrease of -3.11% for the year ended March 2024.

Minimum Investment: Lot Size Details

Promoters of Saj Hotels Limited and Their Holdings

The company's promoters are Rahul Maganlal Timbadia, Kartik Maganlal Timbadia and Karna Kartik Timbadia. They collectively hold 84.12% of the company's shares. However, post-IPO, their shareholding will be 61.94%.

Saj Hotels Limited: Strength of Company

1. The company, established in 1981, has decades of experience in the hospitality industry, offering resort accommodations and villa rentals.

2. Saj Hotels offers various amenities, including restaurants, spas, and wedding facilities, catering to a wide range of guest needs.

3. The company owns or leases three resort properties, providing diverse accommodation and event venues.

FAQs

1. What are the core details available for the Saj Hotels IPO?

Saj Hotels IPO is a Fixed-price public issue value of worth up to Rs 27.63 crore equity shares. This upcoming IPO is offering entirely a fresh issue of 42.50 lakh equity shares. The allotment for this new IPO is expected to be finalised on Thursday, October 3, 2024.

2. How can I apply for the Saj Hotels IPO?

The public subscription of this new IPO opens on September 27 and closes on October 1, 2024. Click here to initiate the application process.

3. Who is the lead manager(s) for the Saj Hotels IPO?

Corpwis Advisors Private Limited is appointed as the book-running lead manager for the IPO.

4. Who is appointed as the registrar for Saj Hotels IPO?

Satellite Corporate Services Private Limited has been appointed as the registrar for this public issue.

5. How will the net proceeds from the IPO be utilised?

The company intends to use the funds raised for the following purposes: capital expenditure for the expansion of existing resort properties, funding working capital requirements, and covering general corporate expenses.

6. How can I check the allotment status of the IPO?

Investors who applied for an IPO can check the allotment status of the Saj Hotels IPO by visiting here, for further updates, follow Bigul.

Also Read | Divyadhan Recycling Industries IPO: Important Details of IPO

.jpg)

.jpg)