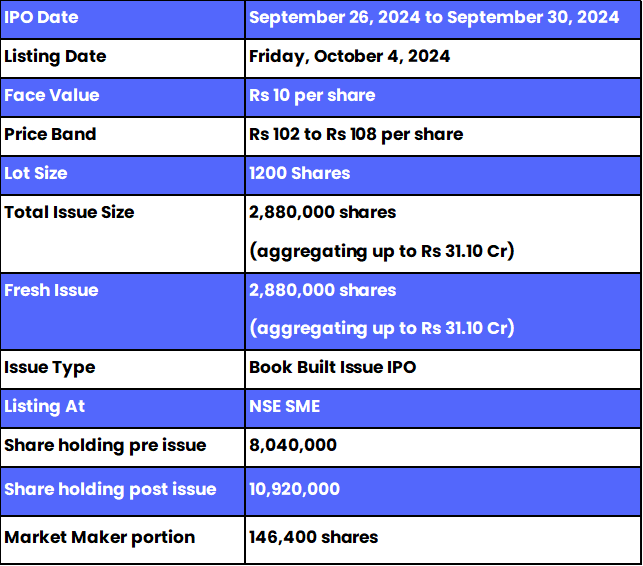

• Forge Auto International IPO is a book-built issue worth up to Rs 31.10 crore.

• Bidding opens on September 26 and closes on September 30, 2024.

• Forge Auto International SME IPO price band is set at Rs 102 – Rs 108 per share.

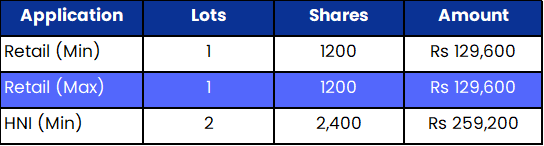

• The minimum amount required for retail investors is Rs 1,29,600.

Forge Auto International IPO: Synopsis

Forge Auto International is open for subscription from Thursday, September 26, 2024, and closes on Monday, September 30, 2024. The price band for this IPO is set at Rs 102 – Rs 108 per share.

Forge Auto International IPO is offering a fresh issue of 28.80 lakh equity shares worth up to Rs 31.10 crore.

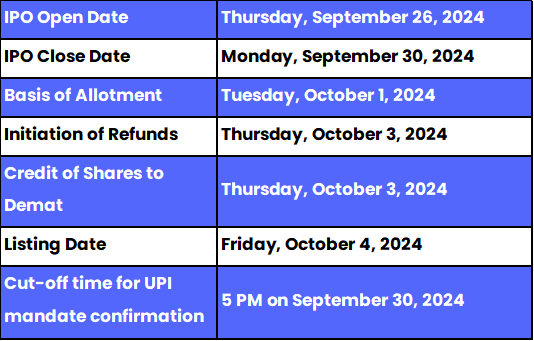

The allotment for this new IPO is expected to be finalised on Tuesday, October 1, 2024. The listing of this IPO will be done on Friday, October 4, 2024, at the NSE SME segment.

The minimum lot size set for the retail category is 1 lot, i.e., 1200 shares. For retail investors, the minimum and maximum investment amount required is Rs 129,600. However, for the HNI category, the minimum lot size is 2 lots, i.e., 1200 shares amounting to Rs 259,200.

The IPO is managed by Hem Securities Limited, which is the book-running lead manager of this public issue. The company has appointed Bigshare Services Private Limited as the registrar for the issue.

Also Read | Divyadhan Recycling Industries IPO: Important Details of IPO

Forge Auto International Limited: About the Company

Forge Auto International Limited, incorporated in the year 2001, is an engineering company specialising in forging and manufacturing complex, safety-critical, precision-machined components. The company caters to the automobile and non-automotive sectors. Their products find application in automobiles, tractors, railways, agriculture, and hydraulics for a clientele of original equipment manufacturers, both domestic and international.

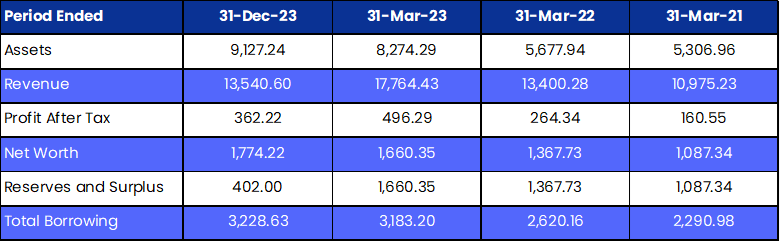

Revenue has increased manyfold from Rs 10,951.99 lakhs from Fiscal 2021 to Rs 17,664.85 lakhs in Fiscal 2023 through products like forging and machining. Being ISO 9001:2015, ISO 14001:2015, OHSAS 18001:2007 certified with IATF 16949:2016, and ZED GOLD certification by the Government of India, Forge Auto has clearly dedicated itself to quality, sustainability, and zero defects in manufacturing.

Forge Auto International IPO: Objectives

The Net Proceeds are proposed to be used for the following purposes: meeting working capital requirements, repaying specific borrowings availed by the company, and addressing general corporate purposes.

Forge Auto International IPO: Other Important Details

Time Table of Forge Auto International IPO

Forge Auto International IPO: Financial Metrics (Amt in Rs Lakhs)

Minimum Investment: Lot Size Details

Promoters of Forge Auto International Limited and Their Holdings

The company's promoters are Parmod Gupta and Rajan Mittal. They collectively held 100% of the company's shares pre-IPO. However, post-IPO changes in their shareholding have not been disclosed.

Forge Auto International Limited: Strength of Company

1. The company holds multiple certifications, including ISO 9001 and ZED GOLD, for quality and sustainability.

2. Revenue grew from Rs 10,951.99 lakhs in Fiscal 2021 to Rs 17,664.85 lakhs in Fiscal 2023, reflecting strong growth.

3. The company’s revenue grew from Rs 10,951.99 lakhs in Fiscal 2021 to Rs 17,664.85 lakhs in Fiscal 2023, reflecting strong growth.

FAQs

1. What are the core details available for the Forge Auto International IPO?

Forge Auto International IPO is a book-built public issue of 28.80 lakh equity shares. This upcoming IPO is offering entirely a fresh issue of 28.80 lakh equity shares, worth up to Rs 31.10 crore. The allotment for this new IPO is expected to be finalised on Tuesday, October 1, 2024.

2. How can I apply for the Forge Auto International IPO?

The public subscription of this new IPO opens on September 26 and closes on September 30, 2024. Click here to initiate the application process.

3. Who is the lead manager(s) for the Forge Auto International IPO?

Hem Securities Limited was appointed as the book-running lead manager for the IPO.

4. Who is appointed as the registrar for Forge Auto International IPO?

Bigshare Services Limited has been appointed as the registrar for this public issue.

5. How will the net proceeds from the IPO be utilised?

The Net Proceeds are proposed to be used for the following purposes: meeting working capital requirements, repaying specific borrowings availed by the company, and addressing general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied for an IPO can check the allotment status of the Forge Auto International IPO by visiting here, for further updates, follow Bigul.

Also Read | Sahasra Electronics Solutions IPO: Important Details of IPO

.jpg)

.jpg)

.jpg)