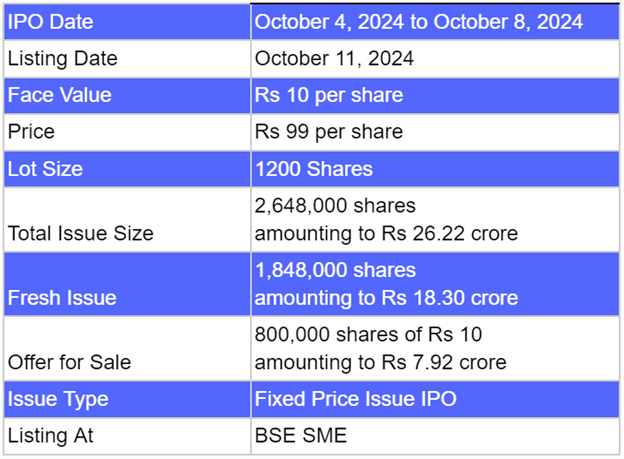

Khyati Global Ventures IPO subscription opens from Friday, October 4, 2024, and closes on Tuesday, October 8, 2024. It is a fixed price issue of Rs 26.22 crores. This upcoming IPO is a combination of fresh issue and offer-for-sale. The fresh issue is of 18.48 lakh equity shares amounting to Rs 18.30 crores and OFS is of 8 lakh equity shares amounting to Rs 7.92 crore.

Khyati Global Ventures IPO price band is Rs 99 per share. The minimum lot size set for the retail category is 1200 shares. The minimum lot size requirement for the HNI category is 2 lots consisting of 2400 shares. The minimum amount required for retail investors is Rs 1,21,000 (99 x 1200 shares). However, for the HNI category, the minimum investment amount required is Rs 2,42,000 (99 x 2400 shares).

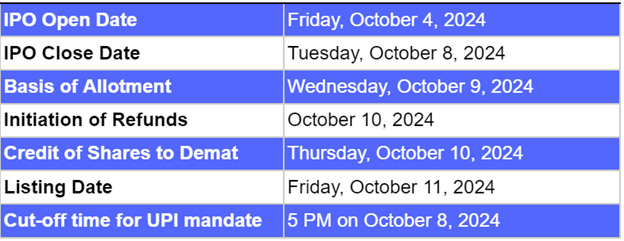

Khyati Global Ventures IPO allotment is expected to be finalised on Friday, October 11, 2024. The listing will be on the BSE SME platform on Friday, October 11, 2024. Currently, Khyati Global Ventures IPO GMP is zero which indicates that the listing price is expected to be near Rs 99 per share.

Also Read | NeoPolitan Pizza and Foods IPO: Unlocking the IPO in Detail

Khyati Global Ventures IPO: Listing Date, Lot Size, Issue Size, Price Band

Khyati Global Ventures IPO: About the Company

Khyati Global Ventures Limited was founded in 1983, formerly known as Khyati Advisory Services Limited. The company is an exporter of repackers of a variety of FMCG products which include sub-categories of food, non-food FMCG products, household products, and festive handicrafts. The company also deals in pharmaceutical products.

The product portfolio includes, Non-Food FMCG products, Food products, Pharmaceutical products, Festive, pooja and handicraft products, Household products. The company’s customers include wholesalers and importers of supermarkets operating a chain of supermarkets abroad. The company deals in globally recognized Indian brands such as Everest, Parle G, MDH, Fortune, Aashirvaad, Gowardhan etc.

Khyati Global Ventures IPO Objectives

Khyati Global Ventures IPO Objectives: The net proceeds from this IPO will be used for the funding of the day-to-day capital needs of the company. The remaining money will be used for fulfilling the general corporate purposes.

Khyati Global Ventures IPO: Key Dates, Allotment, Listing Date

Khyati Global Ventures IPO Subscription Details, IPO Reservation

Khyati Global Ventures IPO subscription details will be available after the IPO opens on 4 october 2024. In the retail investor category 50% of the net offer is reserved and the remaining 50% of the net offer is reserved for the investors category like Qualified Institutional Buyers and Non-institutional investors.

Khyati Global Ventures IPO Allotment Details

Khyati Global Ventures IPO Allotment details are not yet available. Once the subscription ends after the closing of IPO bidding. The allotment of investors who applied for IPO will be available in the registrar website, Bigshare services Private Limited.

Khyati Global Ventures IPO GMP

Currently, Khyati Global Ventures IPO GMP (grey market premium) is trading at zero. The issue price of this latest IPO is set at Rs 99 per share. It is expected that the listing price can be near to Rs 99. However, if the subscription got oversubscribed then Khyati Global Ventures IPO GMP might rise in the coming days.

Khyati Global Ventures IPO Lot Size Details

Khyati Global Ventures IPO lot size is set at 1200 shares per lot. Investors can bid a minimum of 1200 shares and its multiples. For the retail category, minimum and maximum bid is kept at 1200 shares amounting to Rs 1,18,800. The minimum investment for the HNI category is Rs 2,37,600.

Khyati Global Ventures IPO Promoter Holdings

Khyati Global Ventures IPO promoter holdings are Ramesh Rughani, Chandrika Rughani, Khyati Rughani, Aditi Raithatha and Hiren Raithatha. The promoters' shareholdings before the IPO were 87.46%; however, after the IPO, shareholdings will decline to 62.86%.

Khyati Global Ventures Limited Company Financials (Amt in Lakhs)

Khyati Global Ventures Limited posted revenue of Rs 2,716.92 lakhs and net profit of Rs 94.67 lakhs for the period ending on 30 June 2024. The company’s revenue increased by 9% and PAT increased by 23% between the FY ending on 31 March 2024 and 31 March 2023.

Khyati Global Ventures IPO Registrar

Khyati Global Ventures IPO registrar is Bigshare Services Private Limited. On the date of allotment, Investors can click on Bigshare Services and select the name of the company, and enter PAN number or application ID to know their allotment status.

Khyati Global Ventures IPO Lead Managers

Khyati Global Ventures IPO lead managers are Aryaman Financial Services Limited.

How to apply to Khyati Global Ventures IPO

Interested investors can apply to the Khyati Global Ventures IPO directly from the Bigul trading app and you can also apply by clicking here . Investors can also check the details of other upcoming IPO in Bigul.

Khyati Global Ventures IPO Review

Khyati Global Ventures IPO seems to be not getting positive response from the IPO investors. However, it will be interesting to see whether the IPO is oversubscribed or not on the last day of the bidding process. If it gets oversubscribed then investors may witness minor listing gains. But if it doesn't get fully subscribed then listing is possible with zero premium.

Khyati Global Ventures IPO FAQ

1. What are the details of the Khyati Global Ventures IPO?

Khyati Global Ventures IPO is a fixed price issue of Rs 26.22 crores. This upcoming IPO is a combination of fresh issue and offer-for-sale. The fresh issue is of 18.48 lakh equity shares amounting to Rs 18.30 crores and OFS is of 8 lakh equity shares amounting to Rs 7.92 crore.

2. When will Khyati Global Ventures IPO open and close?

Khyati Global Ventures IPO opens from Friday, October 4, 2024, and closes on Tuesday, October 8, 2024. The allotment date is 9 October 2024 and listing will be on 11 October 2024.

3. What is Khyati Global Ventures IPO GMP?

Khyati Global Ventures IPO GMP (grey market premium) is trading at zero. The issue price of this latest IPO is set at Rs 99 per share. It is expected that the listing price can be near to Rs 99. However, if the subscription got oversubscribed then Khyati Global Ventures IPO GMP might rise in the coming days.

4. What are the details of Khyati Global Ventures IPO reservation?

In the retail investor category 50% of the net offer is reserved and the remaining 50% of the net offer is reserved for the investors category like Qualified Institutional Buyers and Non-institutional investors.

5. Write the details of the IPO Allotment?

Khyati Global Ventures IPO Allotment details are not yet available. Once the subscription ends after the closing of IPO bidding. The allotment of investors who applied for IPO will be available in the registrar website, Bigshare services Private Limited.

6. Who is the registrar and lead managers for Khyati Global Ventures IPO?

Khyati Global Ventures IPO Registrar is Bigshare Services Private Limited. The book-running lead manager for this IPO is Aryaman Financial Services Limited. Investors can check the allotment status in the Bigshare Services Private Limited official website.

Also Read | Subam Papers IPO: Things to Know Before Applying

.jpg)

.jpg)