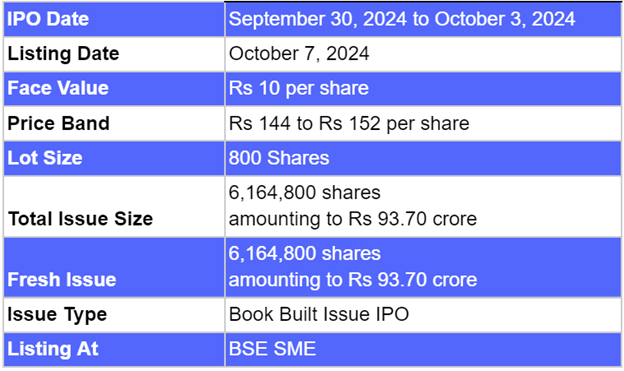

- Subam Papers IPO is a book-built issue of Rs 93.70 crores.

- This upcoming IPO bidding opens on Sep 30 and closes on Oct 3, 2024.

- Subam Papers SME IPO price is set at Rs 144 to Rs 152 per share.

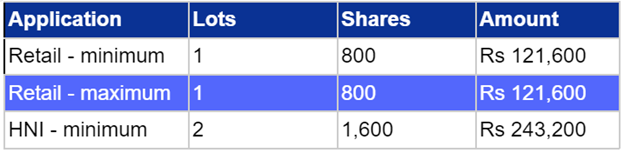

- The minimum investment required is Rs 1,21,600.

Subam Papers IPO: Synopsis

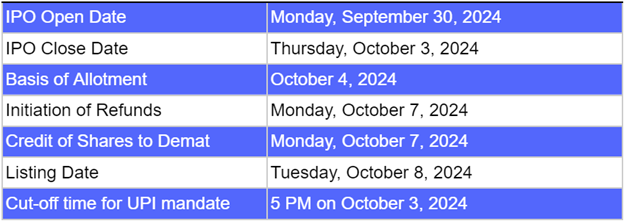

Subam Papers IPO is open for subscription starting Monday, September 30, 2024, and closing on Thursday, October 3, 2024. This upcoming IPO price is Rs 144 to Rs 152 per share. The minimum lot size set for the retail category is 800 shares. Meanwhile, the minimum lot size for the HNI category is 2 lots consisting of 1600 shares.

The minimum investment required for retail category investors is Rs 1,21,600 (152 x 800 shares). However, for the HNI category, the minimum investment amount required is Rs 2,43,200 (152 x 1600 shares).

Subam Papers IPO is a book-built issue of Rs 93.70 crores. This upcoming IPO is an entirely fresh issue of 61.65 lakh equity shares. The allotment for this new IPO is expected to be finalised on Friday, October 4, 2024. Subam Papers IPO will be listed on BSE SME on Tuesday, October 8, 2024.

Gretex Corporate Services Limited is the book-running lead manager, Big Services Private Limited is the registrar for this IPO. The market maker for this IPO is Gretex Share Broking.

Also Read | Paramount Dye Tec IPO: Unlocking the IPO in Detail

Subam Papers IPO: About the company

Subam Papers Limited was incorporated in 2006, is a manufacturer of Kraft Paper and paper products. The company uses waste paper as a raw material. The company's installed capacity for Kraft Paper was 300 metric tons per day, resulting in a total annual capacity of 93,600 tons.

Subam Papers has the ability to manufacture and supply Kraft Paper and Duplex Boards in various shades. Their products offer GSM ranging from 120 to 300, Busting Factor of 16 to 35, and Deckle sizes from 2,000 MM to 4,400 MM, with reel diameters up to 1,400 MM.

Subam maintains a large raw material storage facility to ensure sufficient reserves, which enables consistent production of high-quality products for the packaging industry.The products are used in various industries such as automobiles, textiles, FMCG, food, distilleries, pharmaceuticals, electrical and electronics, and printing, where packaging is essential.

Subam Papers IPO: Objectives

The main funds raised from this IPO, will be used for investment in the subsidiary for financing the day-to-day capital needs for the smooth functioning of the company. The remaining will be used for fulfilling the general corporate purposes.

Subam Papers IPO: Other Important Details

Time-Table of Subam Papers IPO

Subam Papers IPO: Financial Metrics (Amt in Rs Lakhs)

Subam Papers posted revenue of Rs 49,697.31 lakhs and net profit of Rs 3,341.80 lakhs for the period ending on 31 Mar 2024. The company’s revenue decreased by -3% and net profit increased by 12574% between the FY ending on 31 Mar 2024 and 31 Mar 2023.

Minimum Investment: Lot Size Details

Promoters of Subam Papers Limited and Their Holdings

The promoters of Subam Papers are Mr. T Balakumar and Ms. Sudha Alagarsamy.

The promoter shareholdings before the IPO were 94.81%; however, after the IPO, shareholdings will decline to 69.67%.

Subam Papers: Strength of Company

● Paper waste recycling and sustainable packaging solutions.

● Investment in water pumping stations and connecting pipelines, ensuring efficient water distribution throughout the facility. The strategic location near the Thamirabarani River, just 6 km away, provides a distinct advantage.

● ERP technology is used to track and control inventory.

● Fully automated manufacturing process enhancing productivity.

FAQs

1. What are the details of the Subam Papers IPO?

Subam Papers IPO is a book-built issue of Rs 93.70 crores. This upcoming IPO is an entirely fresh issue of 61.65 lakh equity shares. The allotment for this new IPO is expected to be finalised on Friday, October 4, 2024.

2. Who are the lead managers for the Subam Papers IPO?

Gretex Corporate Services Limited is appointed as the book-running lead manager for the IPO.

3. What is the role of Bigshare Services in this IPO?

Bigshare Services Private Limited is the registrar for Subam Papers Limited, handling the IPO's administrative aspects.

4. How can I apply for the Subam Papers IPO?

The public subscription of this new IPO will open on September 30, 2024. Click here to initiate the application process.

5. How will the net proceeds from the IPO be utilised?

The main funds raised from this IPO, will be used for investment in the subsidiary for financing the day-to-day capital needs for the smooth functioning of the company. The remaining will be used for fulfilling the general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied can check the allotment status of the Subam Papers Limited IPO by visiting here. For further updates follow Bigul.

Also Read | HVAX Technologies IPO: Unlocking the IPO in Detail

.jpg)

.jpg)