• Divyadhan Recycling Industries IPO is a book-built issue worth up to Rs 24.17 crore.

• Bidding opens on September 26 and closes on September 30, 2024.

• Divyadhan Recycling Industries SME IPO price band is set at Rs 60 – Rs 64 per share.

• The minimum amount required for retail investors is Rs 1,28,000.

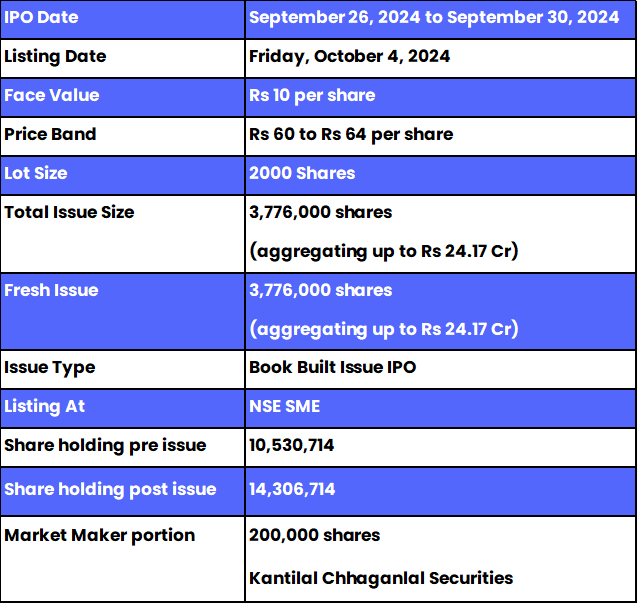

Divyadhan Recycling Industries IPO: Synopsis

Divyadhan Recycling Industries is open for subscription from Thursday, September 26, 2024, and closes on Monday, September 30, 2024. The price band for this IPO is set at Rs 60 – Rs 64 per share.

Divyadhan Recycling Industries' IPO is offering a fresh issue of 37.76 lakh equity shares worth up to Rs 24.17 crore.

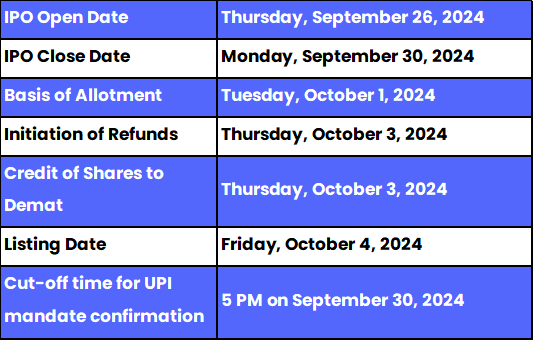

The allotment for this new IPO is expected to be finalised on Tuesday, October 1, 2024. The listing of this IPO will be done on Friday, October 4, 2024, at the NSE SME segment.

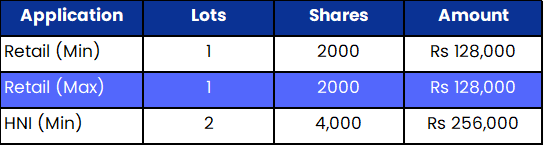

The minimum lot size set for the retail category is 1 lot, i.e., 2000 shares. For retail investors, the minimum and maximum investment amount required is Rs 128,000. However, for the HNI category, the minimum lot size is 2 lots, i.e., 4000 shares amounting to Rs 256,000.

The IPO is managed by Narnolia Financial Services Limited, which is the book-running lead manager of this public issue. The company has appointed Skyline Financial Services Private Limited as the registrar for the issue.

Also Read | Sahasra Electronics Solutions IPO: Important Details of IPO

Divyadhan Recycling Industries Limited: About the Company

Divyadhan Recycling Industries Limited is an incorporated company in May 2010. The company primarily produces Recycled Polyester Staple Fibre (R-PSF) and recycled pellets. Business segments include recycled fibre gathered from post-consumer PET bottles and recycled pellets from the same material. These two products lead to sustainable manufacturing and environmental conservation.

With a production unit at Village Kalyanpur, Tehsil Baddi, Himachal Pradesh, Divyadhan has an annual capacity of 8,030 metric tons for fibre and 4,320 metric tons for pellets. The Company is ISO 9001:2015 certified for Quality Management and ISO 14001:2015 certified for Environmental Management and as of August 31, 2024, it has about 83 employees.

Divyadhan Recycling Industries IPO: Objectives

The objectives of the issue are to meet capital expenditure requirements, address general corporate purposes, and cover Issue-related expenses.

Divyadhan Recycling Industries IPO: Other Important Details

Time Table of Divyadhan Recycling Industries IPO

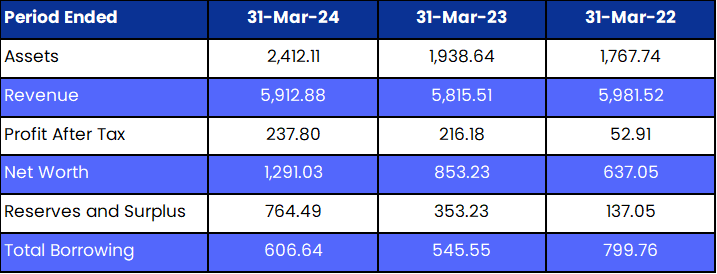

Divyadhan Recycling Industries IPO: Financial Metrics (Amt in Rs Lakhs)

Divyadhan Recycling Industries Limited saw an 1.67% rise in revenue, while its profit after tax (PAT) surged by 10% between the fiscal years ending March 31, 2024, and March 31, 2023.

Minimum Investment: Lot Size Details

Promoters of Divyadhan Recycling Industries Limited and Their Holdings

The company's promoters are Mr. Pratik Gupta and Mr. Varun Gupta. They collectively hold 94.06% of the company's shares. However, post-IPO, their shareholding will be 69.24%.

Divyadhan Recycling Industries Limited: Strength of Company

1. The company, established in 2010, specialises in manufacturing Recycled Polyester Staple Fibre (R-PSF) and Recycled Pellets.

2. The company is ISO 9001:2015 and ISO 14001:2015 certified, ensuring quality and environmental management.

3. Divyadhan Recycling converts post-consumer PET bottles into sustainable products, supporting environmental sustainability.

4. The company has a manufacturing capacity of 8,030 metric tons of fibre and 4,320 metric tons of pellets annually.

FAQs

1. What are the core details available for the Divyadhan Recycling Industries IPO?

Divyadhan Recycling Industries IPO is a book-built public issue worth up to Rs 24.17 crore equity shares. This upcoming IPO is offering entirely a fresh issue of 37.76 lakh equity shares. The allotment for this new IPO is expected to be finalised on Tuesday, October 1, 2024.

2. How can I apply for the Divyadhan Recycling Industries IPO?

The public subscription of this new IPO opens on September 26 and closes on September 30, 2024. Click here to initiate the application process.

3. Who is the lead manager(s) for the Divyadhan Recycling Industries IPO?

Narnolia Financial Services Limited was appointed as the book-running lead manager for the IPO.

4. Who is appointed as the registrar for Divyadhan Recycling Industries IPO?

Skyline Financial Services Private Limited has been appointed as the registrar for this public issue.

5. How will the net proceeds from the IPO be utilised?

The objectives of the Issue are to meet capital expenditure requirements, address general corporate purposes, and cover Issue-related expenses.

6. How can I check the allotment status of the IPO?

Investors who applied for an IPO can check the allotment status of the Divyadhan Recycling Industries IPO by visiting here, for further updates, follow Bigul.

Also Read | Thinking Hats Entertainment IPO: Important Details of IPO

.jpg)

.jpg)