- Arkade Developers IPO is a book-built issue of Rs 410 crore.

- This upcoming IPO bidding opens on September 16 and closes on September 19, 2024.

- Arkade Developers IPO price is set at Rs 121 - Rs 128 per share.

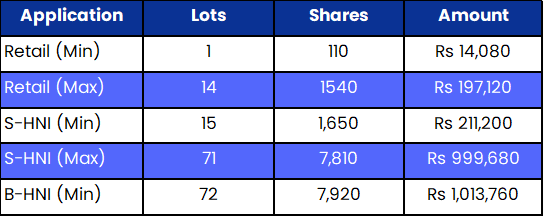

- The minimum investment amount required for retail investors is Rs 14,080.

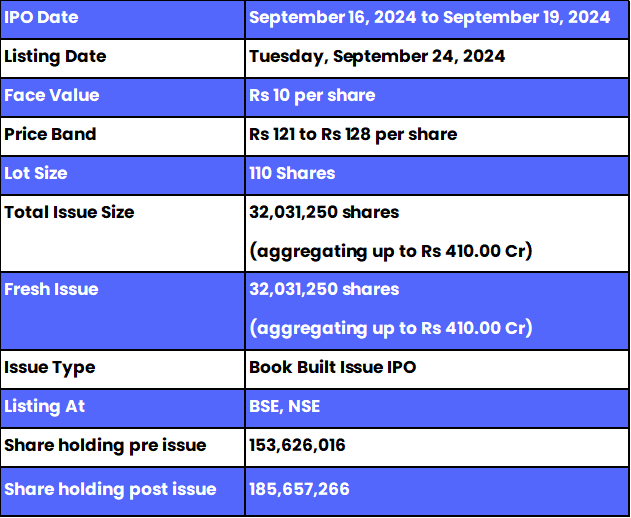

Arkade Developers IPO: Synopsis

Arkade Developers is open for subscription from Monday, September 16, 2024, and closing on Thursday, September 19, 2024. The price band for this IPO is set to Rs 121 - Rs 128 per share.

Arkade Developers IPO is offering entirely a fresh issue of 3.20 crore shares worth up to Rs 410 crore.

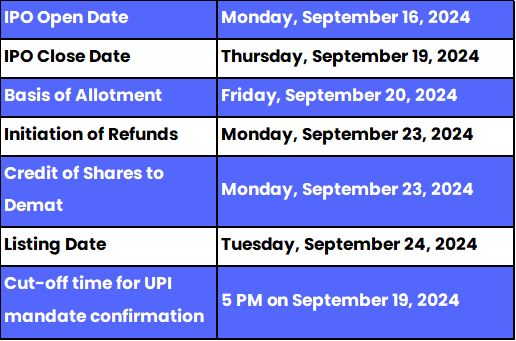

The allotment for this new IPO is expected to be finalised on Friday, September 20, 2024. The listing of this IPO will be done on Tuesday, September 24, 2024, at BSE and NSE.

The IPO is managed by Unistone Capital Private Limited, which is appointed as the book running lead manager of this IPO. The company has appointed Bigshare Services Limited as the registrar for the issue.

Also Read | Deccan Transcon Leasing IPO: Unlocking the IPO in Detail

Arkade Developers Limited: About the Company

Arkade Developers Limited is a Mumbai-based real estate company specialising in high-end residential projects. The company focuses on two main segments: the development of new residential buildings and the redevelopment of existing ones. From 2017 to Q1 2024, Arkade launched 1,220 residential units and sold 1,045 units across the Mumbai Metropolitan Region (MMR). As of June 30, 2024, the company had developed 2.20 million square feet of residential properties and completed 11 redevelopment projects in key Mumbai areas.

Since its inception, Arkade Developers has completed 28 projects, delivering over 4.5 million square meters of built-up area to more than 4,000 customers. The company has a workforce of 201 permanent employees, with an additional 850 contract workers as of June 2024, reflecting its operational scale in the market.

Arkade Developers IPO: Objectives

The company says they will utilise the Net Proceeds received from fresh issue towards several key objectives: funding a portion of the development costs for ongoing projects, including Arkade Nest, Prachi CHSL, and C-Unit (Development Expenses), and funding the acquisition of land for future real estate projects, as well as general corporate purposes.

Arkade Developers IPO: Other Important Details

Time-Table of Arkade Developers IPO

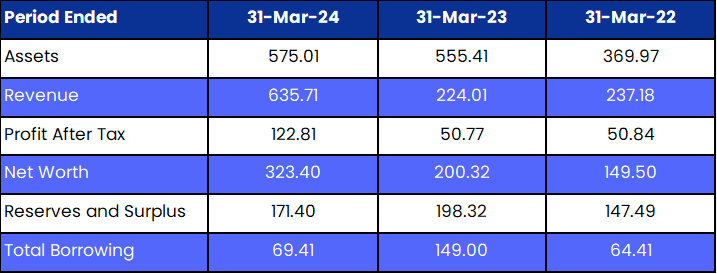

Arkade Developers Ltd Financial Metrics (Amt in Rs Crore)

Lot Size Details of Arkade Developers Limited IPO

Promoters of Arkade Developers Limited and Their Holdings

Mr. Amit Mangilal is the promoter(s) of the company. He holds 85.58% of the company's shares. However, post-IPO, the change in his shareholding has not yet been disclosed.

FAQs

1. What are the core details available for Arkade Developers IPO?

Arkade Developers IPO is a book-built issue of Rs 410 crore. This upcoming IPO offers entirely a fresh issue of 3.20 crore equity shares. The allotment for this new IPO is expected to be finalised on Friday, September 20, 2024.

2. How can I apply for the Arkade Developers IPO?

The public subscription of this new IPO opens on Monday, September 16, 2024 and closes on Thursday, September 19, 2024. Click here to initiate the application process.

3. Who are the lead managers for the Arkade Developers IPO?

Unistone Capital Private Limited were appointed as the book-running lead manager for this IPO.

4. Who is appointed as the registrar for this IPO?

Bigshare Services Private Limited has been appointed as the registrar for this public issue.

5. How can I check the allotment status of the IPO?

Investors who applied for IPO can check the allotment status of Arkade Developers Limited by visiting here, for further updates, follow Bigul.

Also Read | Pelatro IPO: Important Details of IPO

.jpg)

.jpg)

.jpg)