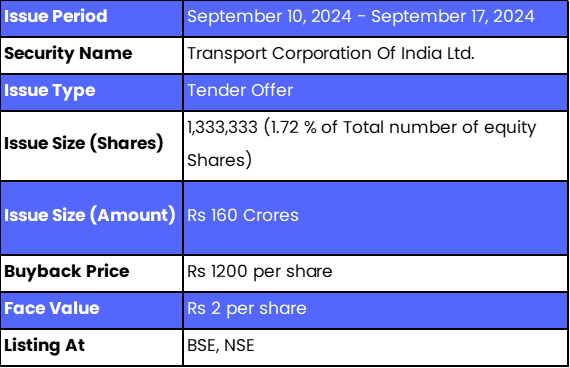

Transport Corporation Of India plans to buy back 13.33 lakh of its own shares, which is 1.72% of the total free float market shares. The company intends to offer the issue type as a tender offer. In this offer, Transport Corporation Of India is willing to purchase its shares from existing shareholders at a fixed price of Rs 1200 per share. The total value of this Buyback is Rs 160 crores, which is the amount the company is willing to spend to acquire these shares. Share Buybacks are often initiated by companies to return value to shareholders or demonstrate confidence in their own financial health. In this case, Transport Corporation Of India is making a formal offer to buy a specific number of its shares at a specified price from the market. Transport Corporation Of India Limited has appointed Ambit Private Limited as the lead manager for this Buyback and Kfin Technologies Limited as the registrar.

Also Read | Ladderup Finance Buyback: All You Need to Know Before Applying

Details of Transport Corporation Of India Limited

Transport Corporation of India Limited founded in 1995, the company provides wide-ranging multimodal logistics solutions. Its services involve complete supply chain management from start to end, 3PL/4PL logistics, port logistics, cold storage, reefer transport, and specialized handling of bulk liquids, gases, and heavy loads. TCI also offers warehousing, Indian rail and container transportation, and coastal shipping, promising flawless logistics across industries.

The company expands services into SAARC and Middle East regions with import, export, and distribution services. It also offers flexible freight solutions such as LTL (Less Than Truckload) and FTL (Full Truckload), based on an extensive network of carriers that ensure cost-effectiveness as well as efficiency of transport.

Necessity of the Issue

The firm has started to repurchase the excess cash to its equity shareholders in proportion to the holdings. It is done in the hope that some of the key ratios in financial terms, such as the return on equity, improve because the equity base gets reduced and, thereby, increases long-term value for the shareholders. The shareholders can opt to sell their shares for cash or hold on to them and see the percentage of ownership rise for free to them as a result of the Buyback. There is also a special reserve under the Buyback for small shareholders; it is one area that the corporation believes will benefit most public shareholders classified as small. This approach not only suits the interests of smaller shareholders but also adds to the financial well-being of the company. At the same time, it gives flexibility to the equity holders.

Transport Corporation Of India Limited Buyback details

Timetable of Transport Corporation Of India Buyback

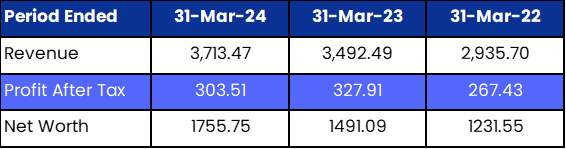

Company’s Financials of Transport Corporation Of India Limited (Amt in Rs Crores)

The company reported its net revenue of Rs 3,713.47 crores and Profit after Tax of Rs 303.51 crores for the year ended March 31, 2024, and net revenue of Rs 3,492.49 crores and Rs 327.91 crores for the year ended March 31, 2023. Transport Corporation Of India Limited witnessed a 6% increase in revenue and a 7% decline in profit after tax, respectively.

Buyback Ratio and Entitlements

The Buyback ratio for the upcoming offer is categorized into two segments. For the Reserved Category, which includes Small Shareholders, the entitlement ratio is set at 9 equity shares for every 71 fully paid-up equity shares held on the Record Date, with a total of 2,00,000 shares being offered. In contrast, the General Category, encompassing all other eligible shareholders, has an entitlement ratio of 12 equity shares for every 763 fully paid-up equity shares held on the Record Date, with 11,33,333 shares available for this group.

FAQs

1. How many shares is Transport Corporation Of India Limited planning to buy back?

Transport Corporation Of India Limited plans to repurchase its 13.33 lakh equity shares, which represents 1.72% of the total number of free-float equity shares of the company.

2. What is the total size of the Transport Corporation Of India Limited Buyback?

The total size of the Transport Corporation Of India Limited Buyback is Rs 160 crores.

3. What is the last date for buying Transport Corporation Of India Limited shares to be eligible for Buyback?

The last date to purchase shares to be eligible for Transport Corporation Of India Buyback is September 03, 2024.

4. What is the Buyback price for Transport Corporation Of India Limited shares?

Transport Corporation Of India Limited set a Buyback price of Rs 1200 per share.

5. What is the record date for the Transport Corporation Of India Limited Buyback?

The record date of the Transport Corporation Of India Buyback is September 04, 2024.

6. How has the company performed financially?

The company reported its net revenue of Rs 3,713.47 crores and Profit after Tax of Rs 303.51 crores for the year ended March 31, 2024, and net revenue of Rs 3,492.49 crores and Rs 327.91 crores for the year ended March 31, 2023. Transport Corporation Of India Limited witnessed a 6% increase in revenue and a 7% decline in profit after tax, respectively.

7. Who is the lead manager for the Transport Corporation Of India Limited Buyback?

Transport Corporation Of India Limited has appointed Ambit Private Limited as the lead manager for this issue.

8. How do I check my allotment status for the Transport Corporation Of India Limited Buyback?

The registrar of Transport Corporation Of India Limited Buyback is Kfin Technologies Limited. You can check your allotment status by here.

9. How can I apply for the Transport Corporation Of India Limited Buyback?

The public subscription is now open, you can click here to apply for the Transport Corporation Of India Limited Buyback 2024 with Bigul.

10. From where can I get the Letter of Offer for this Buyback?

You can download the Letter of Offer by visiting here.

Also Read | Aarti Drugs Limited Buyback: What Investors Need to Know

.jpg)

.jpg)

.jpg)