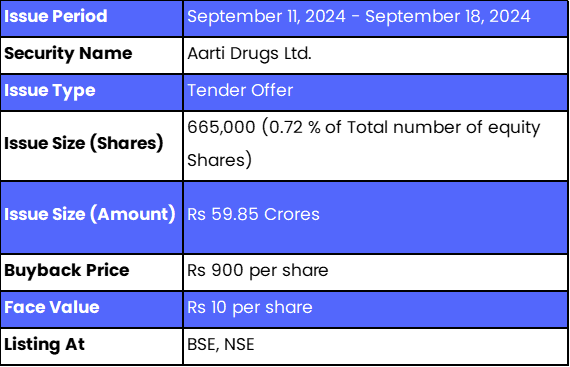

Aarti Drugs plans to buy back 6.65 lakh of its own shares, which is 0.72% of the total free float market shares. The company intends to offer the issue type as a tender offer. In this offer, Aarti Drugs is willing to purchase its shares from existing shareholders at a fixed price of Rs 900 per share. The total value of this buyback is Rs 59.85 crores, which is the amount the company is willing to spend to acquire these shares. Share buybacks are often initiated by companies to return value to shareholders or demonstrate confidence in their own financial health. In this case, Aarti Drugs is making a formal offer to buy a specific number of its shares at a specified price from the market. Aarti Drugs Limited has appointed Inga Ventures Private Limited as the lead manager for this buyback and Link Intime India Private Limited as the registrar.

Also Read | Arex Industries Buyback: Things To Know Before Applying?

Details of Aarti Drugs Limited

Aarti Drugs Limited was incorporated in 1984. The company focuses on speciality chemicals as well as bulk drugs. Its product range comprises more than 40 items in the form of bulk APIs, key intermediates, and speciality chemicals, with therapeutic groups covering antibiotics, anti-inflammatories, antidiabetics, and much more, including both life-saving and lifestyle-related diseases. The firm operates 13 manufacturing units in Maharashtra's Palghar and Tarapur and 3 in Gujarat. It also has a research and development centre at the former. Aarti Drugs exports its product portfolio to more than 100 countries and has acquired key authority certifications such as WHO-GMP, EUGMP, and TGA Australia.

Necessity of the Issue

The company is starting to make the buyback an activity that will help it better manage its equity and return the excess cash to its shareholders. This is with the ultimate goal of enhancing value for shareholders through a better return on equity and improved earnings per share through equity base reduction. It offers the shareholders a choice to either sell their equity shares for cash or hold onto them in order to get a boost up in their percentage shareholding post-buyback, without any investment at all. The regulations established conduct a buyback under the tender offer with 15% reservation for small shareholders. Thus, the small shareholder gets their full entitlement or an extra allocation of shares. For large public shareholders, by reserving 15% in the buyback, the company not only adds value to its shareholders but also can enhance the management of its equity.

Aarti Drugs Limited Buyback details

Timetable of Aarti Drugs Buyback

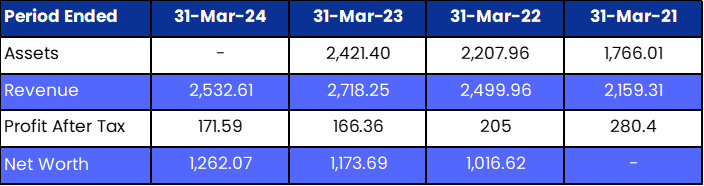

Company’s Financials of Aarti Drugs Limited (Amt in Rs Crores)

The company reported its net revenue of Rs 2,532.61 crores and Profit after Tax of Rs 171.59 crores for the year ended March 31, 2024, and net revenue of Rs 2,718.25 crores and Rs 166.36 crores for the year ended March 31, 2023. Aarti Drugs Limited witnessed a 7% decline in revenue and a 3% increase in profit after tax, respectively.

Buyback Ratio and Entitlements

The buyback ratio for the upcoming offer is categorized into two segments. For the Reserved Category, which includes Small Shareholders, the entitlement ratio is set at 9 equity shares for every 706 fully paid-up equity shares held on the Record Date, with a total of 99,750 shares being offered. In contrast, the General Category, encompassing all other eligible shareholders, has an entitlement ratio of 5 equity shares for every 744 fully paid-up equity shares held on the Record Date, with 5,65,250 shares available for this group.

FAQs

1. How many shares is Aarti Drugs Limited planning to buy back?

Aarti Drugs Limited plans to repurchase its 6.65 lakh equity shares, which represents 0.72% of the total number of free-float equity shares of the company.

2. What is the total size of the Aarti Drugs Limited buyback?

The total size of the Aarti Drugs Limited buyback is Rs 59.85 crores.

3. What is the last date of buying Aarti Drugs Limited shares to be eligible for Buyback?

The last date to purchase shares to be eligible for Aarti Drugs buyback is September 04, 2024.

4. What is the buyback price for Aarti Drugs Limited shares?

Aarti Drugs Limited set a buyback price of Rs 900 per share.

5. What is the record date for the Aarti Drugs Limited buyback?

The record date of the Aarti Drugs Buyback is September 05, 2024.

6. How has the company performed financially?

The company reported its net revenue of Rs 2,532.61 crores and Profit after Tax of Rs 166.36 crores for the year ended March 31, 2024, and net revenue of Rs 2,718.25 crores and Rs 166.36 crores for the year ended March 31, 2023. Aarti Drugs Limited witnessed a 7% decline in revenue and a 3% increase in profit after tax, respectively.

7. Who is the lead manager for the Aarti Drugs Limited buyback?

Aarti Drugs Limited has appointed Inga Ventures Private Limited as the lead manager for this issue.

8. How do I check my allotment status for the Aarti Drugs Limited buyback?

The registrar of Aarti Drugs Limited Buyback is Link Intime India Private Limited. You can check your allotment status by visiting here.

9. How can I apply for the Aarti Drugs Limited buyback?

The public subscription is now open, you can click here to apply for the Aarti Drugs Limited Buyback 2024 with Bigul.

10. From where can I get the Letter of Offer for this Buyback?

You can download the Letter of Offer by visiting here.

Also Read | Jai Corp Limited Buyback: Important details investors should know

.jpg)

.jpg)

.jpg)

.jpg)