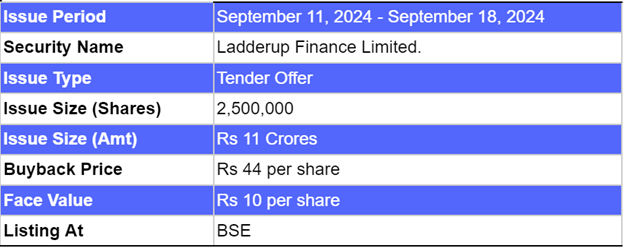

Ladderup Finance Buyback is a tender offer, and the issue size is of 25,00,000 equity shares at price of Rs 44 per share, amounting up to Rs 11 crores. The face value is at Rs 10 per share. The issue is 19.45% of the total number of equity shares. Ladderup Finance shares are listed on BSE.

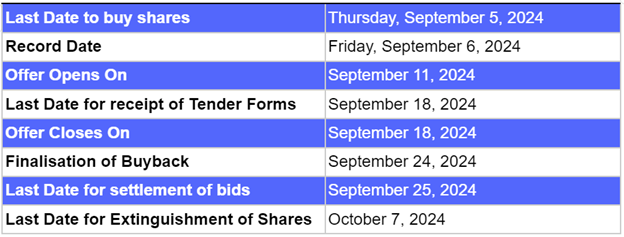

The Buyback issue period is between September 11 to September 18, 2024. The last date to buy shares is Thursday, September 5, 2024 and the record date is Friday, September 6, 2024.

The lead manager handling the Buyback is Mark Corporate Advisors Private Limited, and the registrar for this Buyback is Link Intime India Private Limited. On Monday, September 16, 2024, Ladderup Finance share price was trading at Rs 43 per share.

Also Read | Aarti Drugs Limited Buyback: What Investors Need to Know

Ladderup Finance Buyback: About the company

Ladderup Finance Limited is a NBFC company in India that provides a range of financial services, primarily focusing on investment banking and advisory services. Incorporated in 1993, Ladderup Finance specialises in offering structured financial solutions, catering to the needs of corporates, high-net-worth individuals, and institutional clients.

The company’s services include corporate finance, mergers and acquisitions advisory, capital raising, wealth management, and financial restructuring. It also provides loans to businesses and individuals, operating in segments such as real estate financing, SME financing, and personal loans.

Ladderup Finance Buyback: Necessity of the Buyback

Ladderup Finance Limited is coming with Buyback to service the equity more efficiently. Additionally, the Company's management strives to increase the value of equity shareholders. This Buyback may help in improving financial ratios like earning per share, return on capital employed and return on equity, by reduction in the equity base, thereby leading to long term increase in shareholders' value.

Essential Details of Ladderup Finance Buyback

Time-Table For Ladderup Finance Buyback

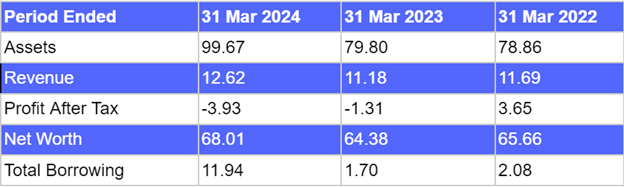

Financials of Ladderup Finance Limited (Amt in Rs Crores)

The company reported a revenue of Rs 12.62 crore and net loss of Rs -3.93 crores for the FY ended on 31 March 2024. Ladderup Finance revenue increased by 13% and profit after tax dropped by -200% between the FY ending with 31 March 2024 and 31 March 2023.

Buyback Ratio

For the reserved category for the small shareholders 265 Equity Shares out of every 288 fully paid up Equity Shares held on the record date September 6, 2024. For the general category, 177 Equity Shares out of every 428 fully paid up Equity Shares held on the record date.

FAQs

1. What are the details of the Ladderup Finance Buyback Offer?

Ladderup Finance Buyback is a tender offer, and the issue size is of 25,00,000 equity shares at price of Rs 44 per share, amounting up to Rs 11 crores. The face value is at Rs 10 per share.

2. When is the Issue period of Ladderup Finance Limited Buyback?

The Buyback issue period is between September 11 to September 18, 2024. The last date to buy shares is Thursday, September 5, 2024 and the record date is Friday, September 6, 2024.

3. How do I check the allotment status of the Ladderup Finance Limited Buyback?

The registrar for the Ladderup Finance Limited Buyback is Link Intime India Private Limited. Investors can check the status by clicking here. Shareholders should stay tuned for further information.

4. Who can participate in the Ladderup Finance Limited Buyback?

All Ladderup Finance Limited shareholders holding the company shares on the record date, September 6, 2024 are eligible to participate in the Buyback. This includes both retail and institutional investors.

5. What are the necessities for Ladderup Finance Buyback?

Ladderup Finance Limited is coming with Buyback to service the equity more efficiently. Additionally, the Company's management strives to increase the value of equity shareholders. This Buyback may help in improving financial ratios like earning per share, return on capital employed and return on equity, by reduction in the equity base, thereby leading to long term increase in shareholders' value.

6. What is the Buyback ratio for the shareholders?

For the reserved category for the small shareholders 265 Equity Shares out of every 288 fully paid up Equity Shares held on the record date September 6, 2024.

7. What are the dates for the finalisation of Buyback and settlement of bids?

The buyback acceptance will be finalised on September 24 and settlement of bids will be on September 25, 2024.

8. Who are the lead managers of Ladderup Finance Buyback?

The lead manager handling this buyback offer is Mark Corporate Advisors Private Limited.

Also Read | Arex Industries Buyback: Things To Know Before Applying?

.jpg)

.jpg)

.jpg)