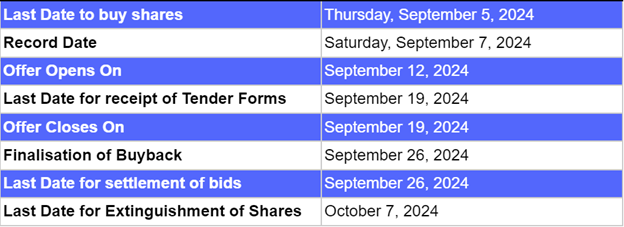

Arex Industries Buyback is a tender offer, and the issue size is of 3,60,000 equity shares at price of Rs 195 per share, amounting up to Rs 7.02 crores. The face value is at Rs 10 per share. Arex Industries shares are listed on BSE. The Buyback issue period is between September 12 to September 19, 2024. The last date to buy shares is Thursday, September 5, 2024 and the record date is Saturday, September 7, 2024.

The lead manager handling the Buyback is Interactive Financial Services Limited, and the registrar for this Buyback is Link Intime India Private Limited. On Monday, September 16, 2024, Arex Industries share price was trading at Rs 188.40 per share.

Also Read | Jai Corp Limited Buyback: Important details investors should know

Arex Industries Buyback: About the Company

Arex Industries Limited produces and exports high quality narrow woven fabrics and related textile products for customers in both domestic and global markets. The company’s product portfolio includes making of narrow woven fabrics that are used for clothing, cars, and medical use. They also manufacture a variety of elastic tapes and webbings to meet specific client needs. The company customises solutions to meet clients' unique needs, ensuring high customer satisfaction.

The company has modern manufacturing facilities with advanced technology, ensuring high-quality standards. They have a significant presence in both domestic and international markets, allowing them to serve a diverse range of clients. Arex Industries has received awards for its commitment to quality and innovation and is a leading exporter of narrow-woven fabrics. Arex Industries continues to invest in research and development to meet the evolving needs of its customers.

Arex Industries Buyback: Necessity of the Buyback

This Buyback will help the Arex Industries to return surplus cash to its shareholders. The Buyback consists of the reservation for the small shareholders. Also, Buyback will help in improving financial ratios like return on equity, by reduction in the equity base, thereby leading to a long-term increase in shareholders' value.

Essential Details of Arex Industries Buyback

Time-Table For Arex Industries Buyback

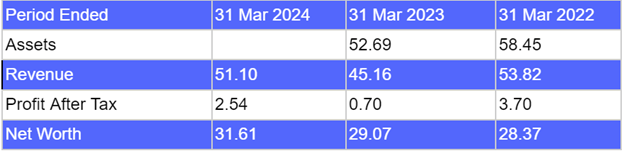

Financials of Arex Industries Limited (Amt in Rs Crores)

The company reported a revenue of Rs 51.10 crore and net profit of Rs 2.54 crores for the FY ended on 31 March 2024. Arex Industries revenue increased by 13% and profit after tax increased by 263% between the FY ending with 31 March 2024 and 31 March 2023.

Buyback Ratio

For the reserved category for the small shareholders 127 Equity Shares out of every 753 Fully paid up Equity Shares held on the record date september 7, 2024. For the general category, 64 Equity Shares out of every 761 Fully paid-up Equity Shares held on the record date.

FAQs

1. What are the details of Arex Industries Buyback Offer?

Arex Industries Buyback is a tender offer, and the issue size is of 3,60,000 equity shares at price of Rs 195 per share, amounting up to Rs 7.02 crores. The face value is at Rs 10 per share.

2. When is the Issue period of Arex Industries Limited Buyback?

The Buyback issue period is between September 12 to September 19, 2024. The last date to buy shares is Thursday, September 5, 2024 and the record date is Saturday, September 7, 2024.

3. How do I check the allotment status of the Arex Industries Limited Buyback?

The registrar for the Arex Industries Limited Buyback is Link Intime India Private Limited. Investors can check the status by clicking here. Shareholders should stay tuned for further information.

4. Who can participate in the Arex Industries Limited Buyback?

All Arex Industries Limited shareholders holding the company shares on the record date, September 7, 2024 are eligible to participate in the Buyback. This includes both retail and institutional investors.

5. What are the necessities for Arex Industries Buyback?

This Buyback will help the company to return surplus cash to its shareholders. The Buyback consists of the reservation for the small shareholders. Also, Buyback will help in improving financial ratios like return on equity, by reduction in the equity base, thereby leading to a long-term increase in shareholders' value.

6. What is the Buyback ratio for the shareholders?

For the reserved category for the small shareholders 127 Equity Shares out of every 753 Fully paid up Equity Shares held on the september 7, 2024.

7. What are the dates for the finalisation of Buyback and settlement of bids?

The buyback acceptance and settlement of bids will be finalised on September 26, 2024.

8. Who are the lead managers of Arex Industries Buyback?

The lead manager handling this buyback offer is Interactive Financial Services.

Also Read | Insecticides India Buyback: Checkout Important Details?

.jpg)

.jpg)