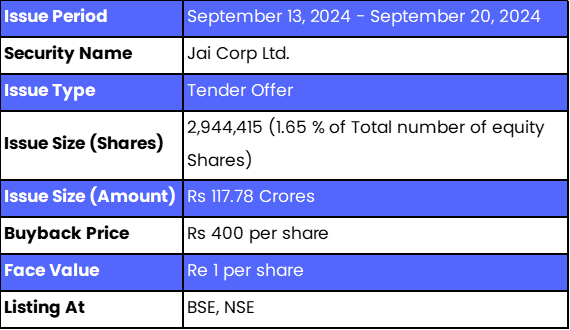

Jai Corp plans to buy back 29.44 lakh of its own shares which is 1.65% of the total free float market shares. The company intends to offer the issue type as a tender offer. In this offer, Jai Corp is willing to purchase its shares from existing shareholders at a fixed price of Rs 400 per share. The total value of this buyback is Rs 117.78 crore, which is the amount the company is willing to spend to acquire these shares. Share buybacks are often initiated by companies to return value to shareholders or demonstrate confidence in their own financial health. In this case, Jai Corp is making a formal offer to buy a specific number of its shares at a specified price from the market. Jai Corp has appointed Navigant Corporate Advisors Limited as the lead manager for this buyback and Kfin Technologies Limited as the registrar.

Also Read | Insecticides India Buyback: Checkout Important Details?

Details of Jai Corp Limited

Jai Corp was incorporated in 1985 and engaged mainly in steel manufacturing, plastics processing, and yarn spinning. The company, over the years, has been undertaking a phased expansion of its plastic processing business with entering newer lines of business such as development of special economic zones, infrastructure, venture capital, and real estate. It is available on both Bombay Stock Exchange and National Stock Exchange. In the present scenario, Jai Corp continues to focus on emerging opportunities there while continuing its core business operations there.

Necessity of the Issue

The company is going for a buyback to distribute excess cash among shareholders pro rata according to their holdings, thereby enhancing total returns. It will reduce the equity base and enhance several key financial metrics, such as EPS and ROE. It also results in increasing long-term value for the shareholders, and it allows the shareholders to either sell for cash or retain their shares, thus giving a higher percentage of ownership without further investment after the buyback. The process of buying back shares is done through a tender offer that includes a 15% reservation for small shareholders. Hence, small shareholders will receive all their entitlement and are therefore entitled to more shares. Thus, the company will be helping small shareholders on its quest towards financial health and optimum shareholder returns.

Jai Corp Limited Buyback details

Timetable of Jai Corp Buyback

Company’s Financials of Jai Corp Limited (Amt In Crore)

The company reported its net revenue of 499.75 crore and Profit after Tax of 52.48 crore for the year ended March 31, 2024, and net revenue of 619.46 crore and -13.54 crore for the year ended March 31, 2023. Jai Corp Limited witnessed a 19% decline in revenue and a 488% increase in profit after tax, respectively.

Buyback Ratio and Entitlements

The Buyback Ratio for eligible shareholders is categorized into two groups. For the Reserved Category, small shareholders are entitled to buy back 1 equity share for every 18 fully paid-up equity shares they hold as of the record date, with a total of 4,41,663 shares offered under this category. For the General Category, other eligible shareholders are entitled to buy back 18 equity shares for every 1,225 fully paid-up equity shares held on the record date, with 25,02,752 shares offered for buyback under this category.

FAQs

1. How many shares is Jai Corp Limited planning to buy back?

Jai Corp Limited plans to repurchase its 2,944,415 equity shares, which represents 1.65% of the total number of equity shares of the company.

2. What is the total size of the Jai Corp Limited buyback?

The total size of the Jai Corp Limited buyback is ₹117.78 crores.

3. What is the last date for buying shares to be eligible for the buyback?

The last date to purchase shares to be eligible for the buyback is September 09, 2024.

4. What is the buyback price for Jai Corp Limited shares?

Jai Corp Limited set a buyback price of Rs 400 per share.

5. What is the record date for the Jai Corp Limited buyback?

The record date of the Jai Corp Buyback is September 10, 2024.

6. How has the company performed financially?

The company reported its net revenue of 499.75 crore and Profit after Tax of 52.48 crore for the year ended March 31, 2024, and net revenue of 619.46 crore and -13.54 crore for the year ended March 31, 2023. Jai Corp Limited witnessed a 19% decline in revenue and a 488% increase in profit after tax, respectively.

7. Who is the lead manager for the Jai Corp Limited buyback?

Jai Corp Limited has appointed Navigant Corporate Advisors Limited as the lead manager for this issue.

8. How can I apply for the Jai Corp Limited buyback?

The public subscription is now open, you can click here to apply for the Jai Corp Limited Buyback 2024 with Bigul.

9. How do I check my allotment status for the Jai Corp Limited buyback?

The registrar of Jai Corp Limited Buyback is Kfin Technologies Limited. You can check your allotment status by visiting here.

Also Read | Cheviot Company Limited Buyback: Important details investors should know

.jpg)

.jpg)