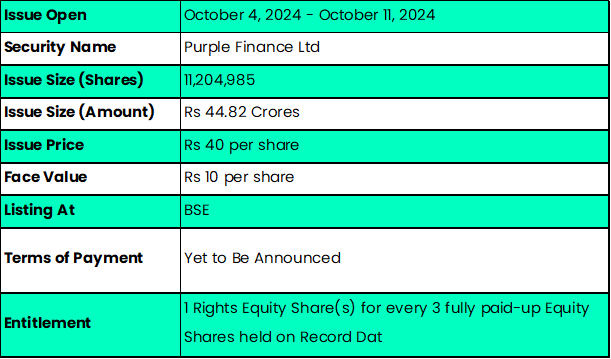

• Purple Finance Rights Issue Bid/offer opens from October 4, 2024 till October 11, 2024

• The company issued a total of 1.12 crore Equity shares amounting to Rs 44.82 crore

• The company set the rights issue price at Rs 40 per share

Purple Finance Limited is offering a rights issue to its existing shareholders. The company issued a total of 11,204,985 Equity shares with a decided issue price of Rs 40 per share, a total amounting to Rs 44.82 crores. Meanwhile, the face value is reported as Rs 10 per share. The last date to purchase the shares of Purple Finance to get eligible for this rights issue is September 25, 2024. It is important to note that the record date for eligibility is September 26, 2024. However, Purva Sharegistry India Private Limited is appointed as the registrar for this rights issue. If we look at the entitlement ratio, it is mentioned that 1 Rights Equity Share(s) is used for every 3 fully paid-up Equity Shares held on Record Date. Bidding for this rights issue will be opening from October 4, 2024 till October 11, 2024.

Also Read | Sahana System Limited Rights Issue: Read More in Detail

About Purple Finance Limited

Purple Finance Limited, incorporated in 1993, has, over three decades, become a name to reckon with financial services and products. A non-deposit-taking NBFC registered with the Reserve Bank of India, this company commenced its limited operations with lending in 2013. In the year 2022, five experts having more than 125 years of collective leadership experience joined founder Amitabh Chaturvedi to establish a new age and digital-first NBFC with an emphasis on the MSME sector. Purple Finance will empower micro and small enterprises through secured business loans, thereby helping to alleviate the financial challenges that MSMEs face in nation-building towards a more simplified, faster credit decision, totally transparent process, and competitive pricing. Purple Finance shall introduce financial might back amongst the entrepreneurs; with innovative digital-driven approaches, support growth towards success in increasingly challenging business environments.

Purple Finance Limited: Objectives

The company plans to use the proceeds from the Issue, for the following purposes: augmenting the capital base, and general corporate purposes.

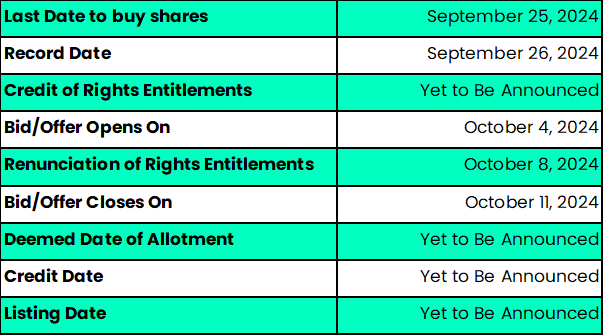

Important Dates for Purple Finance Rights Issue

Timetable of Purple Finance Rights Issue

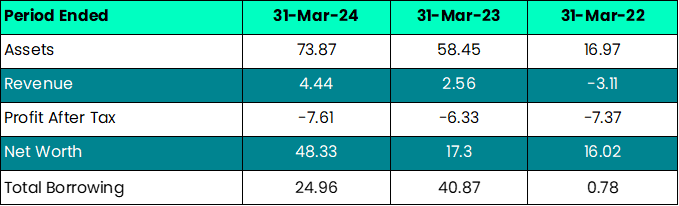

Financial Performance of Purple Finance Limited (Amt in Rs Crore)

For the period ending March 31, 2024, the company saw a 26.4% increase in assets, rising from Rs 58.45 crore to Rs 73.87 crore. Revenue grew by 73.4%, from Rs 2.56 crore to Rs 4.44 crore. Total borrowings decreased by 38.9%, dropping from Rs 40.87 crore to Rs 24.96 crore, signaling improved financial stability.

Lead manager(s), Registrar of Rights Issue & Letter of Offer

The firm has not yet disclosed the name of the appointed lead manager for the rights issue. On the other hand, Purva Sharegistry India Private Limited has been appointed as a registrar for this rights issue. You can check your allotment status here. To read the letter of offer in detail, click here.

FAQs

1. What are the important dates for Purple Finance's rights issue?

The important dates include the opening & closing dates of the rights issue October 4, 2024, and October 11, 2024, respectively.

2. What is the last date for buying shares to get eligible for this rights issue?

To get eligible for the rights issue of Purple Finance Limited, an investor can buy its shares till September 25, 2024.

3. What is the record date for the Purple Finance Rights Issue?

The record date, which is the date to determine the shareholder's eligibility for the Rights Issue is September 26, 2024.

4. How can I apply for the Purple Finance Limited Rights Issue?

You can apply for Purple Finance Rights Issues 2024 in two ways one is Net Banking (ASBA) and the other is by visiting Registrar's Website (R-WAP Facility).

5. How can I check the allotment status of the Purple Finance Issue?

The registrar for this rights issue is Purva Sharegistry India Private Limited. You can check your allotment status here.

6. From where can I get the Letter of Offer for this Rights Issue?

You can download the Letter of Offer by visiting here.

7. Where will the Purple Finance Rights Issue be listed?

The Rights Issue will be listed on the BSE.

8. What is the entitlement ratio for the Purple Finance Limited Rights Issue?

The entitlement ratio is set at 1 Rights Equity Share (s) for every 3 fully paid-up equity share (s) held on the record date.

Also Read | Narmada Agrobase Rights Issue: Important Details to Check

.jpg)

.jpg)