- Manba Finance IPO is a book-built issue of Rs 150.84 crore.

- This upcoming IPO bidding opens on Sep 23 and closes on Sep 25, 2024.

- Manba Finance IPO price band is set at Rs 114 to Rs 120 per share.

- The minimum investment required Rs 15000.

Manba Finance IPO: Synopsis

Manba Finance IPO is open for subscription starting Monday, Sep 23, 2024 and closing on Wednesday, Sep 25, 2024. The price of this upcoming IPO is decided at Rs 114 to Rs 120 per share.

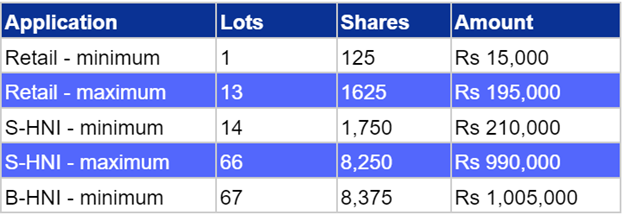

The minimum lot size for the retail category is 125 shares. The minimum lot size for small NII is 14 lots consisting of 1750 shares. Meanwhile, the minimum lot for big non-institutional investors is 67 lots with 8,375 shares.

The minimum investment required for retail category investors is Rs 15,000 ( 120 x 125 shares). However, for small non-institutional investors, the minimum investment amount required is Rs 2,09,874 (120 x 1750 shares) for big non-institutional investors, it is Rs 10,04,397 (120 x 8,375 shares).

Manba Finance IPO is a book-built issue of Rs 150.84 crores. This issue is a fresh issue of 1.26 crore shares. The allotment for this IPO is expected to be finalised on Thursday, September 26, 2024. Manba Finance Limited's IPO will be listed on BSE exchange only, and the listing date is fixed for Monday, September 30, 2024. Hem Securities Limited are the book-running lead managers of Manba Finance Limited. Link Intime India Private Limited is the registrar for this new IPO.

Checkout the Video to Know the Interesting Facts of Manba Finance IPO

Also Read | Northern Arc Capital IPO: Unlocking the IPO in Detail

Manba Finance IPO: About the company

Manba Finance Limited is an NBFC company established in 1996, engaged in the business of disbursing loans. It provides financial service solutions for different kinds of loans, such as two-wheeler loans, three-wheeler loans, and pre-owned two-wheeler loans. Other than this Manba Finance also offers small business loans and personal loans.

According to the Manba Finance website data, the company has disbursed more than 900K loans and has an 800+ dealers network in 64 locations across five states. Company had a team of 1300+ members working together to achieve their goal.

This NBFC had Asset Under Management of Rs 800 crore as on December 2023. Manba’s loan portfolio comprises 99% of new auto loans with a ticket size of around 0.8 lakh. Moreover, the company also provides financial services to its target customers who are looking for quick loan sanctioning and disbursement.

Manba Finance IPO: Objectives

The net funds received from this IPO will cover the public offer-related expenses, and the remaining funds will be kept in cash to increase the capital base and meet the future business of the company.

Manba Finance IPO: Other Important Details

Manba Finance IPO: Time-Table

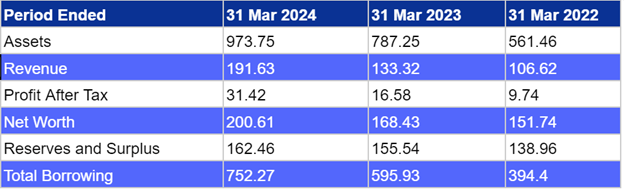

Manba Finance Limited: Financial Metrics (Amt in Rs Crore)

Manba Finance reported revenue of Rs 191.63 crore and net profit of Rs 31.42 crore for the period ending March 31 2024. The company’s revenue increased by 44% and PAT increased by 90% between the FY ending with March 31 2024 and March 31 2023.

Lot Size of Manba Finance IPO

Manba Finance IPO: Strength of the Company

Manba Finance offers financial solutions for two wheelers, three wheelers and also provides small business loans and personal loans.

The company's price-to-book value ratio is at 2.25.

Manba Finance has branches in urban, semi-urban, and metropolitan cities and towns that serve the surrounding rural areas.

FAQs

1. What are the details of Manba Finance Limited IPO 2024?

Manba Finance IPO is a book-built issue of Rs 150.84 crores. This issue is a fresh issue of 1.26 crore shares. The allotment for this IPO is expected to be finalised on Thursday, September 26, 2024.

2. Who are the lead managers for the Manba Finance Limited IPO?

Hem Securities Limited are the lead managers for this IPO.

3. What is the role of Link Intime India in this IPO?

Link Intime India Private Limited is the registrar for Manba Finance Limited, handling the IPO's administrative aspects.

4. How can I apply for the Manba Finance Limited IPO?

The public subscription of this IPO will open on September 23, 2024. Click here to continue the application process.

5. How will the net proceeds from the IPO be utilised?

The net funds received from this IPO will cover the public offer-related expenses, and the remaining funds will be kept in cash to increase the capital base and meet the future business of the company.

6. How can I check the allotment status of the IPO?

Investors can check out the allotment status of the Manba Finance Limited IPO by visiting here.

Also Read | Arkade Developers Limited IPO: Check These Details Before Applying

.jpg)

1.jpg)

.jpg)