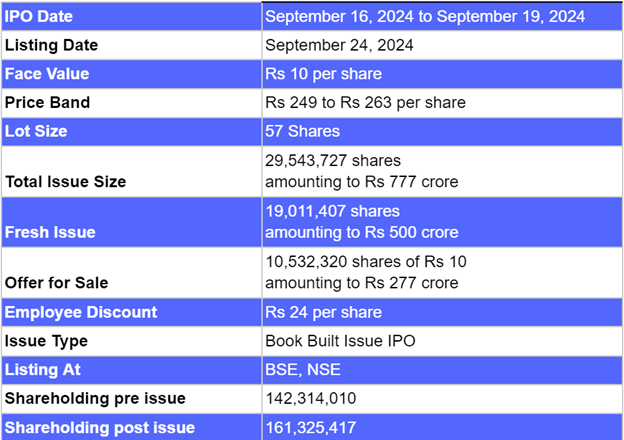

- Northern Arc Capital IPO is a book-built issue of Rs 777 crore.

- This upcoming IPO bidding opens on Sep 16 and closes on Sep 19, 2024.

- Northern Arc Capital IPO price band is set at Rs 249 to Rs 263 per share.

- The minimum investment required Rs 14,991.

Northern Arc Capital IPO: Synopsis

Northern Arc Capital IPO is open for subscription starting Friday, Sep 16, 2024 and closing on Wednesday, Sep 19, 2024. The price of this upcoming IPO is decided at Rs 249 to Rs 263 per share.

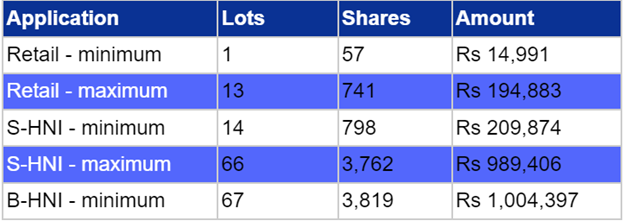

The minimum lot size for the retail category is 57 shares. The minimum lot size for small NII is 14 lots consisting of 798 shares. Meanwhile, the minimum lot for big non-institutional investors is 67 lots with 3,819 shares.

The minimum investment required for retail category investors is Rs 14,934 (262 x 57 shares). However, for small non-institutional investors, the minimum investment amount required is Rs 2,09,874 (263 x 798 shares) for big non-institutional investors, it is Rs 10,04,397 (263 x 3,819 shares).

Northern Arc Capital IPO is a book-built issue of Rs 777 crores. This issue is a combination of fresh issue and offer-for-sale. The fresh issue is of Rs 1.9 crore equity shares amounting to Rs 500 crores. The offer-for-sale is of 1.05 crore equity shares amounting to Rs 277 crores.

The allotment for this IPO is expected to be finalised on Friday, September 20, 2024.

Northern Arc Capital Limited's IPO will be listed on both the exchanges BSE and NSE, and the listing date is fixed for Tuesday, September 24, 2024.

ICICI Securities Ltd, Axis Bank Ltd and Citigroup Global Markets India Private Ltd are the book-running lead managers of Northern Arc Capital Limited. Kfin Technologies Private Limited is the registrar for this new IPO.

Also Read | Arkade Developers Limited IPO: Check These Details Before Applying

Northern Arc Capital IPO: About the Company

Northern Arc Capital Limited was founded in 2009, engaged in the business of offering retail loans to the underserved household and business in India. The company’s business model is diversified across different offerings, sectors, products, geographies, and borrower categories.

Northern Arc Capital has expertise in lending across various focus sectors in India, especially in micro, small, and medium enterprise finance, microfinance, consumer finance, vehicle finance, affordable housing finance, and agriculture finance. The company has been active in MSME finance for over 14 years, MFI finance for 15 years and consumer finance for nine years.The company is working on three main businesses - Lending, Placement and fund management.

Northern Arc Capital has an end-to-end integrated technology product suite customised to multiple sectors. This includes an in-house technology stack consisting 1) Nimbus, a curated debt platform that enables end-to-end processing of debt transactions 2) nPOS, a co-lending and co-origination technology solution based on application programming interfaces 3) Nu Score, a customised machine learning-based analytical module designed to assist originator partners in the loan underwriting process and 4) AltiFi, an alternative retail debt investment platform.

Northern Arc Capital IPO: Objectives

The net funds received from this initial public offer will be allocated to meet the future capital need toward the onward lending. The remaining money will be used for meeting the day-to-day needs for the smooth functioning of the business.

Northern Arc Capital IPO: Other Important Details

Northern Arc Capital IPO: Time-Table

Northern Arc Capital Limited: Financial Metrics (Amt in Rs Crore)

Northern Arc Capital reported revenue of Rs 1,906.03 crore and net profit of Rs 317.69 crore for the period ending March 31 2024. The company’s revenue increased by 45% and PAT increased by 31% between the FY ending with March 31 2024 and March 31 2023.

Lot Size of Northern Arc Capital IPO

Northern Arc Capital IPO: Strength of the Company

- Northern Arc Capital’s business model is diversified across different offerings, sectors, products, geographies, and borrower categories.

- The company's price-to-book value ratio is at 1.49.

- Northern Arc Capital is a profitable company, and its net profit is rising steadily.

FAQs

1. What are the details of Northern Arc Capital Limited IPO 2024?

Northern Arc Capital IPO is a book-built issue of Rs 777 crores. This issue is a combination of fresh issue and offer-for-sale. The fresh issue is of Rs 1.9 crore equity shares amounting to Rs 500 crores. The offer-for-sale is of 1.05 crore equity shares amounting to Rs 277 crores.

2. Who are the lead managers for the Northern Arc Capital Limited IPO?

ICICI Securities Ltd, Axis Bank Ltd and Citigroup Global Markets India Private Ltd are the lead managers for this IPO.

3. What is the role of Link Intime India in this IPO?

Link Intime India Private Limited is the registrar for Northern Arc Capital Limited, handling the IPO's administrative aspects.

4. How can I apply for the Northern Arc Capital Limited IPO?

The public subscription of this IPO will open on September 16, 2024. Click here to continue the application process.

5. How will the net proceeds from the IPO be utilised?

The net funds received from this initial public offer will be allocated to meet the future capital need toward the onward lending. The remaining money will be used for meeting the day-to-day needs for the smooth functioning of the business.

6. How can I check the allotment status of the IPO?

Investors can check out the allotment status of the Northern Arc Capital Limited IPO 2024 by visiting here.

Also Read | Deccan Transcon Leasing IPO: Unlocking the IPO in Detail

.jpg)

.jpg)

.jpg)