Candlestick trading strategy is widely used by the

price action traders all over the world. In this strategy, traders try to read

the price with the help of candlesticks patterns.

Candlestick patterns play an important role in

quantitative trading strategies due to their simple pattern formation and ease

of understanding.

Candlestick trading strategy requires only a basic

understanding of how candlesticks are formed and also a few ideas about the

several ways in which these candlesticks can be interpreted usefully. However,

if you are new to this strategy, this blog will help you obtain a complete

understanding of candlesticks. Let us start with the basics.

Candlestick Trading is used in quantitative trading

for interpreting the open, high, low, and close price fluctuations of the

tradable instrument (security, derivative, currency, bond, etc.). The name

comes from the fact that it appears to be in the shape of a real-life

candlestick.

The candlestick are distinguished by several colors:

●

White or green candlesticks indicate an uptrend

in the marketed instrument.

● Black or red

candlesticks indicate a downtrend in the marketed instrument.

These strategies have different sizes, shapes, and

even colors. The reason behind this is that the candlesticks are based on

prices. Since the prices keep fluctuating, the size and shape of the

candlesticks also change due to the nature of their anatomy. And that makes

their strategies different. These distinct shapes and sizes are suggestive of

market psychology, but, at times, they can be most effective in helping you to

forecast the future market direction.

Candlestick patterns are the graphical

representations of price fluctuations, which are basically created by the open,

high, low, and close prices of a financial instrument. These are used to

discover trading patterns that technical analysts use to make trading

decisions.

Also, sometimes you will identify similar-looking

candlesticks or a group of the same appearing repeatedly, which can give you a

particular trend for that time period.

These are quite popular chart patterns. Traders

identify a variety of these in trading charts to predict stock price movement.

Some of these are considered strong trend reversal signals, and so, when

traders recognize them in trading charts, they design trading strategies around

them. We have discussed several of the candlestick trading strategies in

earlier blogs. So, in this blog, we are going to elaborate on the master candle

strategy, a popular and universal trading strategy used in the FOREX market.

Among candlestick patterns, the engulfing patterns

are quite popular and considered one of the strongest trend reversal

indications. Master candles (MC) are also a type of engulfing candle. For those

who are unfamiliar with the phrase “master candle,” it is a prominent long-body

candle that creates a breakout.

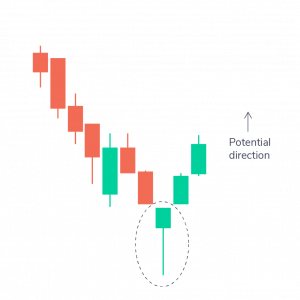

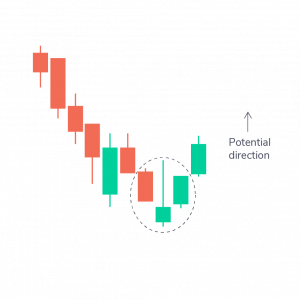

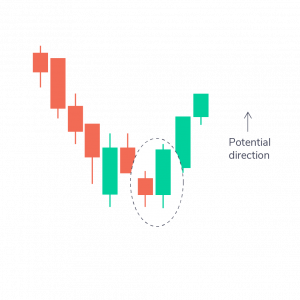

A textbook master candle forms when an asset price

fluctuates within a range, followed by four candles, all opening, and closing

inside the body of the first (or the MC, which engulfs the opening and closing

of the four specified candles). A master candle appears as a clear signal to a

breakout point, and a master candle trading strategy includes planning a trade

in the break.

In the foreign exchange market, a breakout is a point

in the current trend that implies early signs of a potential trend change,

allowing traders to take a position. It occurs when an asset’s price changes

above the resistance line or below the support line with increased volume. A

breakout trader will presume a long position when the price fluctuates above

the resistance level and, conversely, move into a short position when the

support line is violated.

A master candle is a significant breakout pattern, and the primary benefit is that it is bias-free. It indicates a breakout regardless of the ongoing market trend.

The master candlestick trading strategy is a breakout

trading strategy that allows you to identify a new range of price between the

maximum and minimum of the candle. When the breakout occurs, we can expect the

price to fluctuate significantly in the direction in which the breakout

occurred. It is, therefore, important to incorporate this as a strategy in your

FOREX trading.

A master candle is direction-neutral. So, when a

master candle appears on the trading chart, the trader waits for confirmation

candles to appear in either direction. The trader opens a position only after

confirming it isn’t a bogus breakout.

Rules to follow while using the master candle trading

strategy

●

One primary rule that applies to the master

candle is not to trade around the support or resistance.

●

If the support or resistance is closer than the

size of the MC, then restrain from trading.

●

Place a stop loss in the adverse direction of

the trend at the other end of the MC. For example, when entering a long

position, the stop loss is set at the MC’s low.

●

An ideal MC size is generally 30-150 pips

(percentage in points), depending on the traded pair.

●

If traders identify a candle that is too wide

to maintain all the risk parameters, they usually place the stop in the middle

of the MC.

●

Avoid trading when the MC falls outside the pip

range specified above.

●

Traders usually place an order limit with a

5–10 pip buffer.

● Take a position

when a candle breaks the high or low of the MC.

The thumb rules for entering long or short applying a

master candle suggest the following.

When you are taking a long position, place a buy stop

pending at five pips above the high of the MC, including the cost of the

spread. However, when taking a short, the positions of the stop-buy limit are

changed, and a stop-sell pending order is placed five pips below the lower

point of the MC.

Candlestick charts patterns are the best way to know

about investor sentiment and the relationship between demand and supply, bears

and bulls, greed, fear, etc.

Traders must remember that while an individual candle

gives sufficient information, patterns can be identified only by comparing one

candle with its preceding and next candles. To gain from them, it is essential

that traders understand patterns in candlestick charts. For better

understanding, let’s split the patterns into two sections:

● Bullish patterns

●

Bearish patterns

Both patterns are important for its analysis.

Bullish Patterns

Bullish patterns are subdivided into various types, which are as follows:

Hammer pattern

It is a candle with a small body and a large lower wick. It is normally located at the bottom of a downward trend. It expresses that, despite selling pressures, a strong buying surge forced the prices up. If the body is green, it signals a stronger bull market than a red body.

Inverse Hammer pattern

It is a candle with a small body and a large upper wick. It is usually placed at the bottom of a downward trend, too. It signals buying pressure followed by selling pressure. It also indicates that buyers will shortly have control.

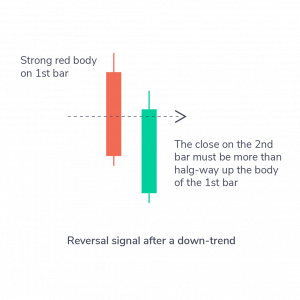

Bullish Engulfing pattern

This is a pattern of two candlesticks where one candle is a short red candle and the other is engulfed by a large green candle. It indicates a bullish market that forces the price up despite opening lower than the previous day.

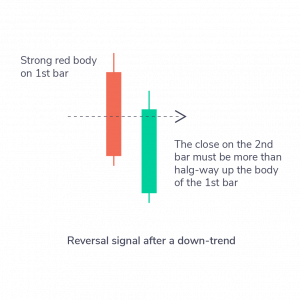

Piercing Line pattern

This is a two-candle pattern with a long red candle followed by a long green candle. Also, the losing price of the other candle needs to be higher than halfway up the body of the first candle. This implies strong buying pressure.

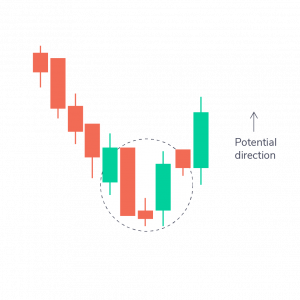

Morning Star pattern

This is a three-candle pattern with one short red candle, one long red candle, and one long green candle. There is normally no overlap between the short and long candles. This is an indication of the minimization of selling pressure and the beginning of a bull market.

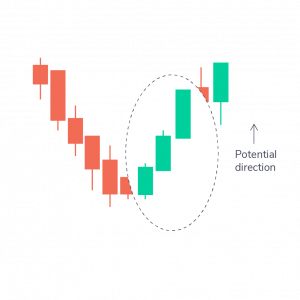

Three White Soldiers pattern

This is a three-candle trend that has three green candles with small wicks. These candles open and close higher than yesterday. After a downtrend, this is a strong signal of an upcoming bull trend.

Bearish Patterns

Hanging Man pattern

It is a candle with a small body and a large lower wick. It is normally located at the top of an upward trend. It indicates that the selling pressures outweighed the buying thrust. It also implies that bears are gaining control of the market.

Shooting Star pattern

This is a candle that has a short body and a long upper wick. It is generally located at the top of an upward trend, too. Usually, the market opens higher than the previous one and rallies a bit before crashing like a shooting star. It implies that selling pressure is taking over the market.

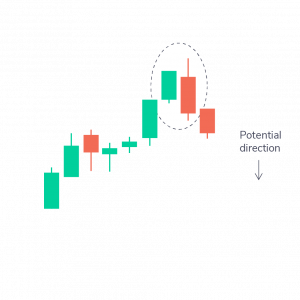

Bearish Engulfing pattern

In candlestick chart analysis, this is a pattern of two candlesticks where the shorter green one is engulfed by the larger red one. It normally occurs at the top of an upward trend. It implies a slowdown in the market’s rise and an upcoming downtrend. If the red candle is lower, then the downtrend is commonly more significant.

Evening Star pattern

This is a three-candle pattern with one short red candle, one long red candle, and one long green candle. There is normally no overlap between the short and long candles. This signals the reversal of an upward trend. This is more momentous if the third candle overcomes the gains of the first candle.

Three Black Crows pattern

This is a three-candle pattern that has all three respective red candles with short wicks. These candles open and close lower than yesterday. After an upward trend, this is a strong signal of an upcoming bear market.

Chart patterns are an essential component of how to read a candle chart.

Conclusion

An MC can be used for any type of asset, but it works best for assets with higher volatility and strong fluctuations, like the FOREX market.

Trading with the signals of a master candle is one of the best straightforward trading strategies, but it isn’t without downsides. You need to search for false breakouts, which will result in unsuccessful trades. It is why more experienced traders avoid entering the market at the first entry after the creation of the master candle. They wait for the scouting parties to display, which are candle chart patterns that create a beachhead, to confirm the sustainability of the price change. In order to get more information about trading strategies, let’s connect with us.

.jpg)

.jpg)

.jpg)