- Rapid Investments Rights Issue bid opens on September 26, 2024.

- The Rights Issue size is Rs 8.40 crore.

- The upcoming issue’s price is set at Rs 100 per share.

- The bid offer closes on October 10, 2024.

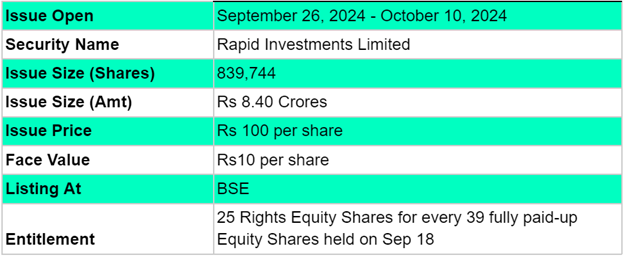

Rapid Investments Limited Rights Issue: Synopsis

Rapid Investments Limited is coming up with its rights issue. The bid opens on September 26, 2024 and closes on October 10, 2024. The last Date to buy shares is on Wednesday, September 17, 2024. The record date of this new issue is Wednesday, September 18, 2024. The issue size is 8,39,744 equity shares amounting to Rs 8.40 crores. The issue price is Rs 100 per share, and the face value is Rs 10 per share.

This issue will allow existing shareholders to buy Rapid Investments equity shares at a discounted price. Rapid Investments' share price is Rs 127.25 per share. The eligible holders are being offered 25 Rights Equity shares for every thirty 39 fully paid-up equity shares held on a September 18, 2024, record date. Through this rights issue, the company plans to raise Rs 8.40 crores. The register for this issue is Link Intime India Private Limited and book-running lead managers are yet to be announced.

Also Read | Ganesha Ecoverse Rights Issue: Key Points to checkout

Rapid Investments Limited: About the company

Rapid Investments Limited was incorporated in the year 1978 and is a non-banking financial company registered with RBI. It provides loans for home construction or purchase and MSME finance. Currently, Rapid Investments operates in Rajasthan, with over 10 branches, and ambitious plans of branch expansion and loan growth within the state. Rapid Investments lays immense emphasis on rural and semi-urban markets, more so in Rajasthan, to cater to the needs of small traders, agricultural concerns, and self-employed people. Its market capitalization as of September 2024 stands at Rs 17 crore. The total asset holding is about Rs 10 crore, while its revenues stand at Rs 1.88 crore.

Rapid Investments Limited: Objectives

The net proceeds from this rights issue will be used to increase the capital base of the company. The remaining funds will be used for meeting the general corporate purposes and fulfill the issue related expenses.

Important Details for Rapid Investments Limited Rights Issue

Timetable of Rapid Investments Limited Rights Issue

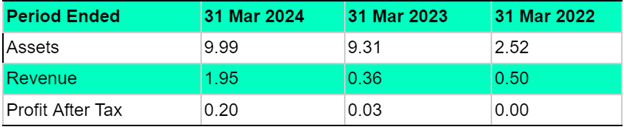

Rapid Investments Limited: Financial Metrics (Amt in Rs Crores)

Rapid Investments Limited posted a revenue of Rs 1.95crore and net profit of Rs 0.20 crore for the period ending on March 31 2024. The revenue figures increased by 440% and net profit increased by 489% between the FY ending on 31 Mar 2024 and 31 Mar 2023.

Lead managers, Registrar of Rights Issue

The details of the book-running lead managers and for this issue are yet to be announced. However, the registrar for this issue is Link Intime Private Limited. You can check the allotment status by visiting their website.

FAQs

1. What are the details of the Rapid Investments Limited Rights Issue?

The issue size is 8,39,744 equity shares amounting to Rs 8.40 crores. The issue price is Rs 100 per share, and the face value is Rs 10 per share. This issue will allow existing shareholders to buy Rapid Investments equity shares at a discounted price. Rapid Investments' share price is Rs 127.25 per share.

2. When does the Rights Issue open and close?

The bid opens on September 26, 2024 and closes on October 10, 2024. The last Date to buy shares is on Wednesday, September 17, 2024.

3. How can I apply for the Rapid Investments Limited Rights Issue?

You can apply for the Rights Issue once it opens for a subscription. Just visit the Link Intime India website to apply for the rights issue online.

4. How can I check the allotment status of the Rapid Investments Limited Issue?

The registrar for this upcoming rights issue is Link Intime India Private Limited. Investors can check out the allotment by visiting the registrar's website.

5. What is the objective of the Rapid Investments Limited Rights Issue?

The net proceeds from this rights issue will be used to increase the capital base of the company. The remaining funds will be used for meeting the general corporate purposes and fulfill the issue related expenses.

6. What is the record date for the Rapid Investments Limited Rights Issue?

The record date determining the shareholders eligible for the Rights Issue, is set for September 18, 2024.

7. Where will the Rapid Investments Limited Right Issue be listed?

The Rights Issue will be listed on the BSE.

8. What is the entitlement ratio for the Rapid Investments Limited Right Issue?

The entitlement ratio is set at 25 Rights equity Shares for every 39 fully paid up equity shares held on record date September 18, 2024.

Also Read | Patel Integrated Logistics Rights Issue: Things To Know

.jpg)

.jpg)