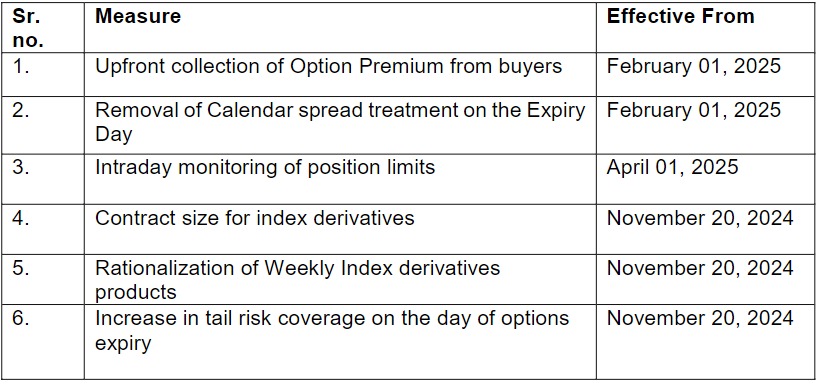

SEBI announced on Tuesday that the regulator will start implementing the new rules framework for tightening up the trading in the F & O segment. SEBI released a 6 step framework including increasing the contract size to Rs 15 lakh from Rs 5-10 lakh and limiting weekly expiries to one per exchange.

SEBI new rules come into effect from November 20, 2024 and are based on recommendations by an Expert Working Group to strengthen the equity index derivatives framework.

Also Read | SEBI Board Meeting: No Changes in F&O Expiry, Enhancement in T+O Settlement

SEBI: Upfront Collection of Option Premium from Options Buyers

SEBI said upfront collection of option premium from options buyers will taken to avoid any undue intraday leverage to the end client, and to discourage any practice of allowing any positions beyond the collateral at the end-client level, it has been decided to mandate the collection of options premium upfront from option buyers by the trading member. This rule comes into effect from February 1, 2025.

Removal of Calendar Spread Treatment on Expiry Day

This would also align calendar spread treatment with a cross-margin framework on correlated indices having different expiries, wherein such cross-margin benefit is fully revoked at the start of the first of the expiring correlated indices.

Intraday Monitoring of Position Limits

Sebi had instructed stock exchanges to monitor existing position limits for equity index derivatives as there is a risk of positions being created beyond permissible limits amid huge volumes on expiry day.

Contract Size for Index Derivatives

Sebi has increased the minimum contract size for index futures and options from Rs 5-10 lakh currently to Rs 15 lakh at the time of its introduction in the market. This rule is effective from November 20, 2024.

Limiting Weekly Index Expiry to One Per Exchange

To decrease the speculation in the index weekly expiry. SEBI decided to limit the weekly expiry to one per exchange. From Nov 20, 2024 Only Nifty and Sensex contracts will expire on a weekly basis. Other indices will expire on a monthly basis.

Increase in Tail risk Coverage on the day of Options Expiry

SEBI has decided to increase the tail risk coverage by levying an additional ELM of 2% for short options contracts. This would be applicable for all open short options at the start of the day, as well on short options contracts initiated during the day that are due for expiry on that day.

Also Read | SEBI Proposes Measures to Curb F&O Trading; Will it Impact Traders?

.jpg)

.jpg)

.jpg)