NSDL spare bank cheques include money markets like, equity shares, preference shares, units in mutual funds, sovereign gold bonds, corporation’s attachments or debentures, etc and it includes for instance secured debt instruments; money market instruments in addition to government securities held within the dematerialised form.

This list below reflects the items found in Demat Accounts:

1. Personal information

This statement contains your name, PAN Card number, Demat account number, date of birth, etc. You can check it through the statement. In case the information is incorrect, you can get it corrected from the Depository Participant.

2. Folio Number

A folio number is a unique number assigned to each investor. Your investments are tagged with this number. This too could be rectified in case of errors from the DP.

3. Mutual fund names and details

This shall contain information concerning all your mutual fund investments.

4. Dividend Payouts

Any dividends received from investments since inception and till date, this statement is issued will appear here.

5. Net Asset Value (NAV)

The price of each unit in the investment. This statement will contain the NAV of each investment only till the date of the statement. Remember that NAV changes constantly, and therefore this may not be the exact cost when you see your statement.

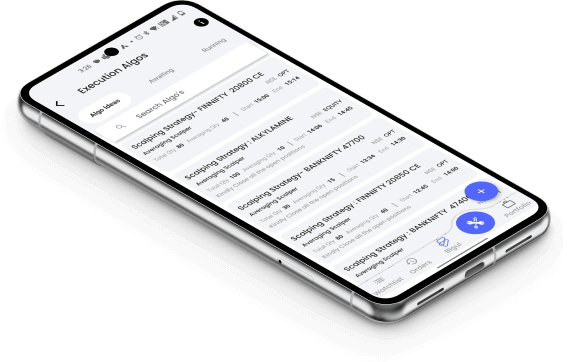

6. Transaction Summary

This means a view of all the transactions done by you from your Demat account. This also means each purchase and sale taken by you.

Regular Monitoring and its Importance

It is very important to keep track of shares. You must ensure that the broker has transferred the shares you purchased from the common pool account to your Demat account after settlement and payout.

The assumption is that when the payment is carried forward, shares will get transferred on their own. Most of the time this is true. But it is also not uncommon for some of the purchased shares not to have been credited into the purchaser’s Demat account.

Hence, your broker could be lending out your shares to someone else, which you may not even know. Secondly, your broker may use your shares to meet their margin requirements at any given exchange.