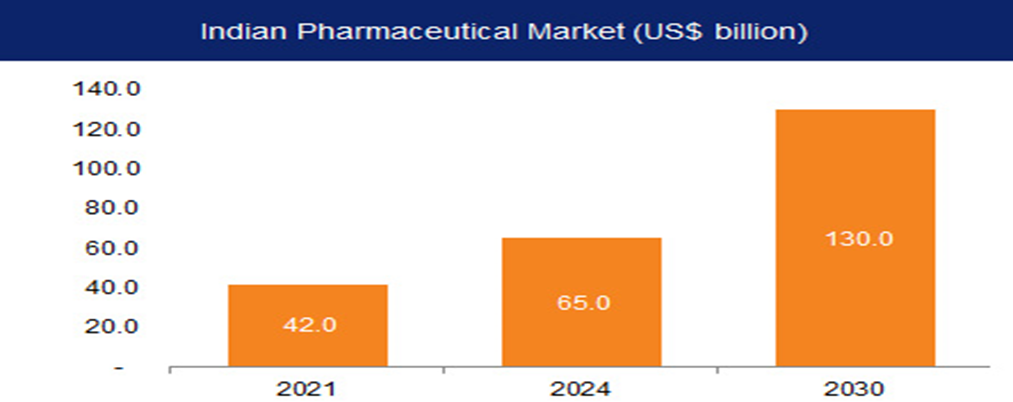

India is the largest provider of generic drugs globally and is ranked third in pharmaceutical production by volume. According to Indian Economic Survey of 2021 domestic pharmaceutical market stood at US $42 Billion in 2021 and is expected to reach US $65 Billion by 2024 and US $130 Billion by 2030.

Generic drugs, over-the-counter medications, bulk drugs, vaccines, contract research & manufacturing, biosimilars, and biologics are some of the major segments of the Indian pharma industry.

Indian pharma companies cater to over 50% of global demand for various vaccines, 40% of generic demand in the US and 25% of all medicine in the UK and hence is rightfully known as the “pharmacy of the world” due to the low cost and high quality of its medicines.

Issues faced by Pharma Companies over the past year

Pharma Index ie. Nifty Pharma has given a negative return of 11.5% in the calendar year 2022 the primary reasons for which are listed below.

- Raw Material dependence on China: China led shortages have caused a spike in prices of API and other chemicals that are imported from China. According to estimates, 70% of India’s API requirement is met through China. The industry is also dependent on China for certain products such as antibiotics, vitamins, hormones, anti-viral, anti-TB, anticonvulsants, analgesics, antipyretics etc. To reduce dependence on China the government proposed to develop three bulk drug parks through grant-in-aid to states with a cap of Rs 1,000 crore per park with 70% financial assistance, but it is expected that it would take at least 3 -4 years before any meaningful drop in imports that can be seen.

- Pricing pressure in American Markets: Indian companies over the past few years have been facing stiff competition from the other generic pharma companies in the biggest market i.e. America leading to pressures on the margins of the Indian Pharma companies.

- Excess stocking in the supply chain.

Pharma Sector Outlook for 2023 post the recent correction.

After witnessing a phase of under performance the pharma sector looks poised for good move as most of the negatives have already been priced in and the valuation of select companies in the pharma pack have become attractive. Investors can focus on the mid-size pharma companies which are not hit by the pricing pressures and other issues that large pharma companies are facing.

In our view the recovery in the non-covid segment would be a key tailwind for this sector which would also help in recovery of the margins of the companies. We expect the 7-9% revenue growth this fiscal.

The situation of resurgence of Covid in China is to be monitored closely.

.jpg)

.jpg)