Comparative Analysis: Impact of Forex Reserve Changes on Gold and Crude Oil Imports

1. Introduction

India’s foreign exchange reserves (forex reserves) are crucial for meeting the country’s import needs, especially for essential commodities such as gold and crude oil. The dynamics between forex reserves, gold imports, and crude oil imports are central to understanding the fiscal health and economic stability of the nation. This analysis delves into the relationship between these variables and provides insights into the economic impacts of fluctuating forex reserves.

2. Forex Reserves and Import Coverage

Overview of Forex Reserves (2024)

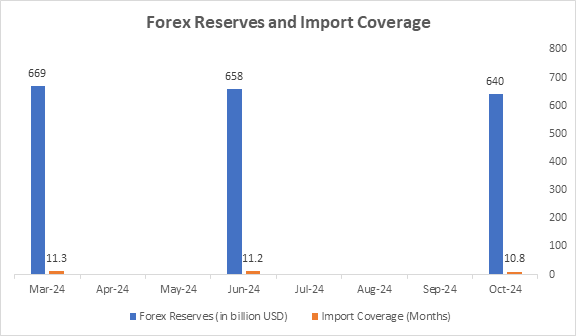

India's forex reserves act as a buffer to meet the import requirements of various goods and services, especially gold and crude oil. The table below highlights the recent trends in India's forex reserves and the months of import coverage they provide:

| Month/Year | Forex Reserves (in billion USD) | Import Coverage (Months) |

|---|---|---|

| March 2024 | 669 | 11.3 |

| June 2024 | 658 | 11.2 |

| October 2024 | 640 | 10.8 |

Insights:

- There is a noticeable decline in forex reserves over the past months, from $669 billion in March 2024 to $640 billion in October 2024.

- The decline in forex reserves reflects a reduction in the country’s ability to cover imports, with the import coverage dropping from 11.3 months to 10.8 months.

- This reduction in reserves increases the pressure on the country’s import capacity, especially for high-value items such as gold and crude oil.

3. Impact on Gold Imports

Gold Import Dynamics (2024)

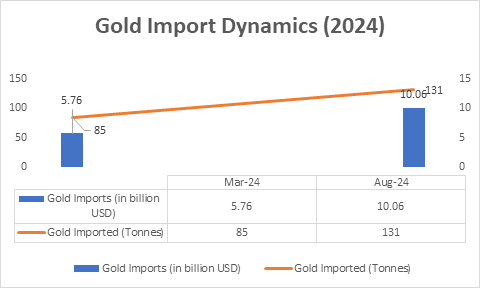

India is one of the largest importers of gold globally, and changes in forex reserves significantly impact its ability to import gold. The data for gold imports in 2024 is as follows:

| Month/Year | Gold Imports (in billion USD) | Gold Imported (Tonnes) |

|---|---|---|

| March 2024 | 5.76 | 85 |

| August 2024 | 10.06 | 131 |

Factors Influencing Gold Imports:

Reduced Import Duties:

The reduction in import duties on gold (from 12.5% to 9%) has increased demand for gold imports in India.Consumer Demand:

Rising consumer demand for both jewelry and investment in gold is another key factor driving up imports.

Forex Reserve Impact:

- A rise in gold imports leads to significant outflows of foreign exchange, further straining the forex reserves. As seen in the data, a substantial increase in the gold import bill occurred between March and August 2024.

- With reduced forex reserves, the country faces challenges in financing this higher gold demand, which may lead to a potential tightening of available foreign exchange.

4. Impact on Crude Oil Imports

Crude Oil Import Trends (2024)

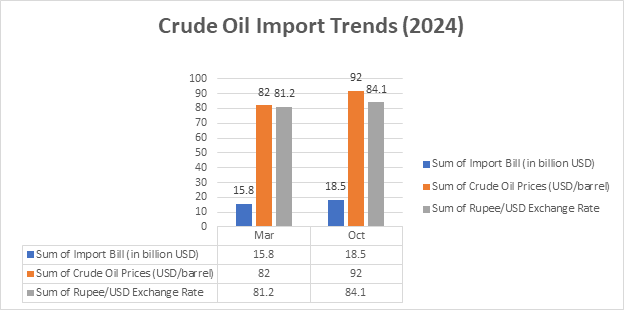

India's crude oil imports are heavily influenced by global oil prices and the exchange rate of the rupee to the dollar. The following table presents the trends for crude oil imports in 2024:

| Month | Crude Oil Prices (USD/barrel) | Import Bill (in billion USD) | Rupee/USD Exchange Rate |

|---|---|---|---|

| March 2024 | 82 | 15.8 | 81.2 |

| October 2024 | 92 | 18.5 | 84.1 |

Key Observations:

Rising Global Oil Prices:

Crude oil prices have risen from $82 per barrel in March 2024 to $92 per barrel in October 2024, leading to an increase in India's import bill.Rupee Depreciation:

The depreciation of the Indian Rupee against the US Dollar from 81.2 in March to 84.1 in October has exacerbated the cost of importing crude oil. This depreciation effectively raises the rupee cost of dollar-denominated oil imports, further straining India’s fiscal resources.

5. Strategic Interdependencies

| Factor | Impact on Gold Imports | Impact on Crude Oil Imports |

|---|---|---|

| Forex Reserve Levels | Higher reserves stabilize import costs by reducing the need to rely on short-term borrowings. | Higher forex reserves support payment obligations for crude oil imports, reducing the impact of price fluctuations. |

| Rupee Depreciation | Depreciation increases the rupee cost of gold imports, as gold is priced in USD. | Depreciation raises the cost of dollar-denominated oil imports, further burdening forex reserves. |

| Geopolitical Risks | Geopolitical risks have minimal direct impact on gold imports. | Geopolitical tensions, such as supply disruptions or sanctions, can heighten crude oil price volatility, impacting the import bill. |

6. Conclusion

The interplay between India’s forex reserves, gold imports, and crude oil imports highlights the vulnerability of the economy to external shocks, such as changes in global commodity prices and currency fluctuations.

Gold Imports:

- The surge in gold imports, driven by reduced duties and rising consumer demand, has put pressure on the country’s forex reserves.

- As the demand for gold increases, so does the outflow of foreign exchange, which could further deplete India’s forex reserves if not managed effectively.

Crude Oil Imports:

- The rise in global oil prices, combined with the depreciation of the rupee, has amplified the fiscal burden of crude oil imports on the country’s forex reserves.

- A higher import bill for crude oil means greater demand for foreign exchange, adding further strain to the declining forex reserves.

Policy Implications:

Gold Reserves Strategy:

Strategic accumulation of gold in the reserves may help hedge against the volatility in global financial markets and safeguard against future supply shocks.Diversification of Energy Sources:

Investing in alternative energy sources and technologies can reduce India’s dependency on crude oil imports, helping to ease the pressure on forex reserves.

References

- Economic Times: Forex Reserves

- Financial Times: Analysis on Gold Imports

- Reuters: Data on Crude Oil Prices and Rupee Depreciation