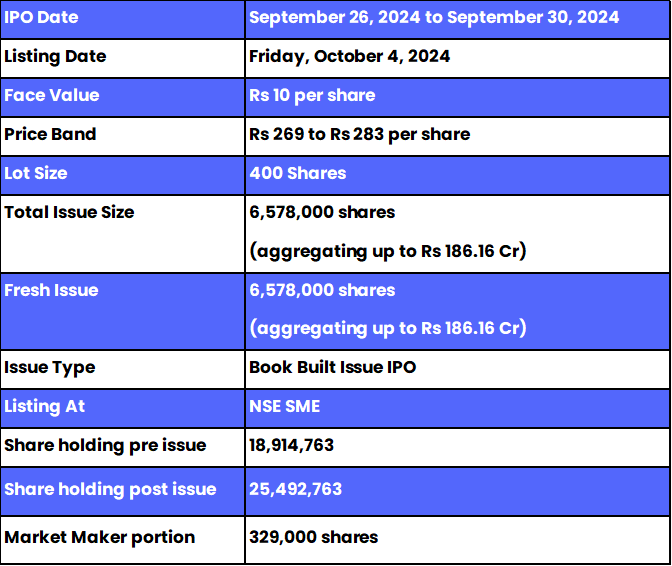

• Sahasra Electronics Solutions IPO is a book-built issue worth up to Rs 186.16 crore.

• Bidding opens on September 26 and closes on September 30, 2024.

• Sahasra Electronics Solutions SME IPO price band is set at Rs 269 – Rs 283 per share.

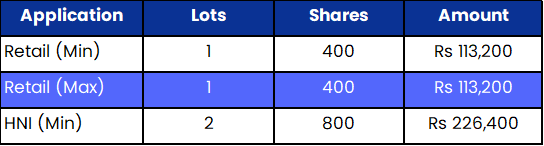

• The minimum amount required for retail investors is Rs 1,13,200.

Sahasra Electronics Solutions IPO: Synopsis

Sahasra Electronics Solutions is open for subscription from Thursday, September 26, 2024, and closes on Monday, September 30, 2024. The price band for this IPO is set at Rs 269 – Rs 283 per share.

Sahasra Electronics Solutions' IPO is offering a fresh issue of 65.78 lakh equity shares worth up to Rs 186.16 crore.

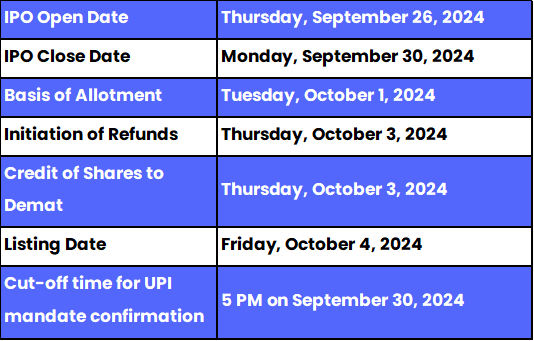

The allotment for this new IPO is expected to be finalised on Tuesday, October 1, 2024. The listing of this IPO will be done on Friday, October 4, 2024, at the NSE SME segment.

The minimum lot size set for the retail category is 1 lot, i.e., 400 shares. For retail investors, the minimum and maximum investment amount required is Rs 113,200. However, for the HNI category, the minimum lot size is 2 lots, i.e., 800 shares amounting to Rs 226,400.

The IPO is managed by Hem Securities Limited, which is the book-running lead manager of this public issue. The company has appointed Bigshare Services Private Limited as the registrar for the issue.

Also Read | Thinking Hats Entertainment IPO: Important Details of IPO

Sahasra Electronics Solutions Limited: About the Company

Sahasra Electronic Solutions Limited was also launched in February 2023. It is an ESDM company located in Noida. The prime product lines include printed circuit board assembly, box build services, and LED lighting solutions. They deliver high-quality electronic components and assemblies to the automotive, medical, IT, and consumer product industries.

Sahasra, in FY 2024, exported more than 80% of its products worldwide to producers at destinations such as the United States, United Kingdom, Germany, and Rwanda. Its Noida plant facility is certified as per EN 9100:2018 with a production volume of 1.8 million, thereby ensuring it ensures efficient delivery of services. Its strong edge comes in the form of customer relationships, tax benefits from its special economic zone, and management acumen-all these elements make it a reliable player in the global electronic manufacturing landscape.

Sahasra Electronics Solutions IPO: Objectives

The proceeds of the Fresh Issue following Offer-related expense adjustments would be applied to the following purposes: capital expansion for establishing a new plant and machinery at a new manufacturing facility at Bhiwadi, Rajasthan; venture capital investment in the subsidiary, Sahasra Semiconductors Private Limited for its capital expansion through additional plant and machinery; financing working-capital requirements; and for general corporate purposes.

Sahasra Electronics Solutions IPO: Other Important Details

Time Table of Sahasra Electronics Solutions IPO

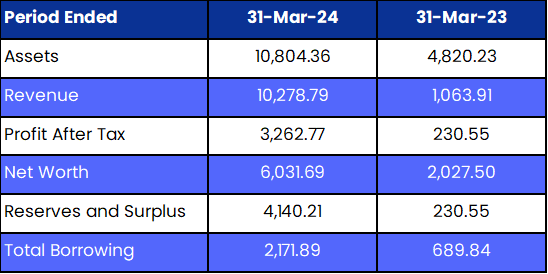

Sahasra Electronics Solutions IPO: Financial Metrics (Amt in Rs Lakhs)

Sahasra Electronics Solutions Limited saw a 866% rise in revenue, while its profit after tax (PAT) massively surged by 1315% between the fiscal years ending March 31, 2024, and March 31, 2023.

Minimum Investment: Lot Size Details

Promoters of Sahasra Electronics Solutions Limited and Their Holdings

The company's promoters are Amrit Lal Manwani, Arunima Manwani and Varun Manwani. They collectively hold 95% of the company's shares. However, post-IPO changes in their shareholding have not been disclosed.

Sahasra Electronics Solutions Limited: Strength of Company

1. The company exports over 80% of its products to global manufacturers in countries like the USA, UK, and Germany.

2. Sahasra Electronics offers a diverse product portfolio, including PCB assemblies, LED lighting solutions, and IT hardware.

3. Sahasra Electronics Solutions Noida’s manufacturing facility is EN 9100:2018 certified, ensuring high-quality production standard

4. The company has reported a 1315% increase in profit after tax for the year FY24 compared to FY23.

FAQs

1. What are the core details available for the Sahasra Electronics Solutions IPO?

Sahasra Electronics Solutions IPO is a book-built public issue of 65.78 lakh equity shares. This upcoming IPO is offering entirely a fresh issue of 65.78 lakh equity shares, worth up to Rs 186.16 crore. The allotment for this new IPO is expected to be finalised on Tuesday, October 1, 2024.

2. How can I apply for the Sahasra Electronics Solutions IPO?

The public subscription of this new IPO opens on September 26 and closes on September 30, 2024. Click here to initiate the application process.

3. Who is the lead manager(s) for the Sahasra Electronics Solutions IPO?

Hem Securities Limited was appointed as the book-running lead manager for the IPO.

4. Who is appointed as the registrar for Sahasra Electronics Solutions IPO?

Bigshare Services Limited has been appointed as the registrar for this public issue.

5. How will the net proceeds from the IPO be utilised?

The proceeds of the Fresh Issue following Offer-related expense adjustments would be applied to the following purposes: capital expansion for establishing a new plant and machinery at a new manufacturing facility at Bhiwadi, Rajasthan; venture capital investment in the subsidiary, Sahasra Semiconductors Private Limited for its capital expansion through additional plant and machinery; financing working-capital requirements; and for general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied for an IPO can check the allotment status of the Sahasra Electronics Solutions IPO by visiting here, for further updates, follow Bigul.

Also Read | Unilex Colours and Chemicals IPO: Know in Detail

.jpg)

.jpg)

1.jpg)

.jpg)