A Healthy Boost in GST Collection: May 2023 Report

India’s Goods and Services Tax (GST) revenue is the country’s economic condition parameter. It is a matter of great joy that it has marked a healthy year-on-year growth of 12% in May 2023, marking the growth of the Indian economy. The GST collection was vigorous at Rs 1.57 lakh crore, notably increasing from the Rs 1.41 lakh crore that was collected in the same month of the year 2022.

Component-Wise GST Collection: A Closer Look

The revenue mix of this substantial collection comprises Central GST (CGST) at Rs 28,411 crore, State GST (SGST) at Rs 35,828 crore, and Integrated GST (IGST) at Rs 81,363 crore. The IGST amount includes Rs 41,772 crore gathered from imported goods. Furthermore, a cess of Rs 11,489 crore was collected, with Rs 1,057 crore of this coming from the import of goods.

GST Type Amount Collected in Crore

| CGST | ₹ 28,411.00 |

| SGST | ₹ 35,828.00 |

| IGST | ₹ 81,363.00 |

| Cess | ₹ 11,489.00 |

This impressive collection reflects the Indian economy’s steady recovery, further substantiated by GST revenues being consistently above Rs 1.4 lakh crore for 14 consecutive months. Interestingly, this is the fifth time the GST revenue has surpassed the Rs 1.5 lakh crore mark since the introduction of the tax regime.

Revenue Distribution between the Centre and States

In the country’s financial architecture, GST forms a significant part of both Central and State revenues. In May 2023, the government settled Rs 35,369 crore to CGST and Rs 29,769 crore to SGST from IGST collections. Post the regular settlement, the total revenue for the Central government and the States stood at Rs 63,780 crore for CGST and Rs 65,597 crore for the SGST.

Revenue Type Amount in Crore

| CGST | ₹ 63,780.00 |

| SGST | ₹ 65,597.00 |

Strong Growth in Import and Domestic Transactions

On the transactional front, the revenue from imported goods in May 2023 saw year-on-year growth of 12%. Domestic transactions, which include the import of services, also performed well, with a growth of 11% over the same month in the previous year. This growth emphasizes the positive momentum of the economic recovery post the global disruptions caused by the pandemic.

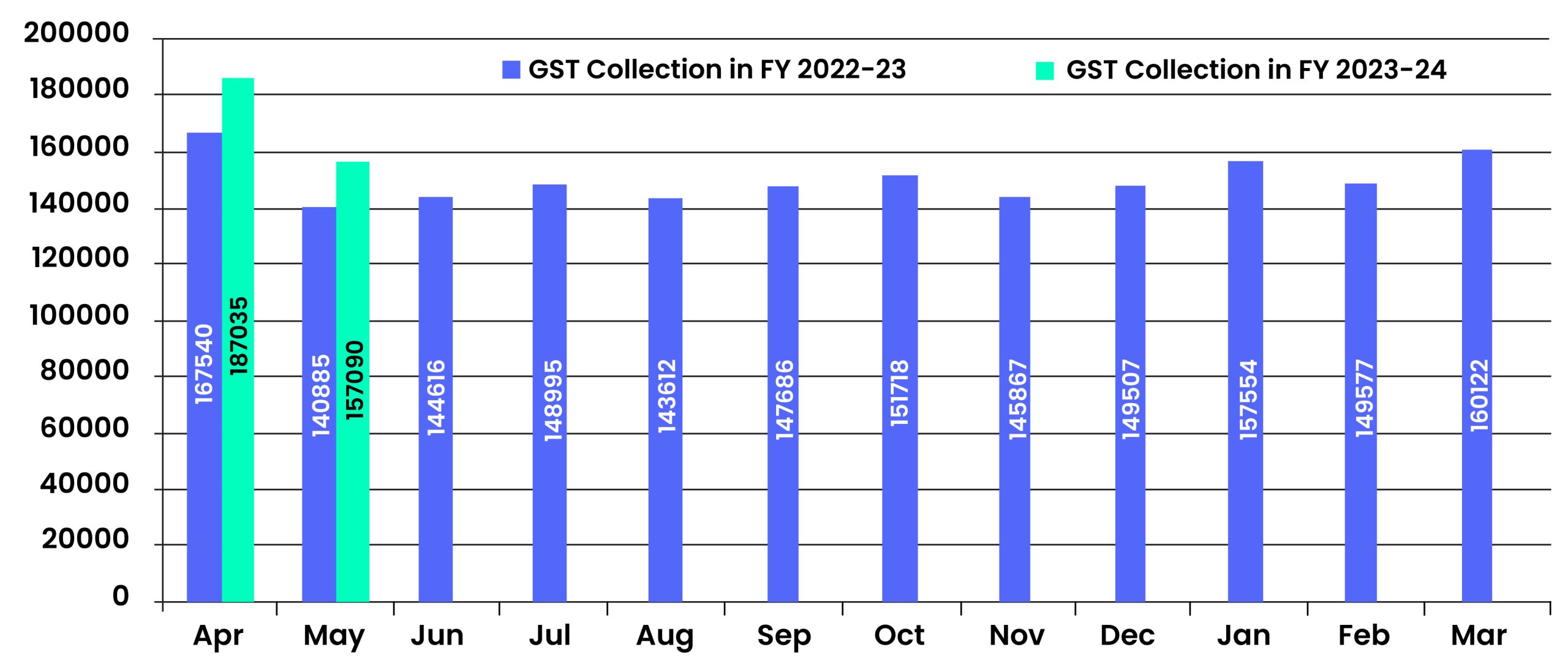

Trends in GST Collection

Growth of GST Revenues in Different States in May’23 (Crore)

| State/UT | May-22 | May-23 | Growth(%) |

| Maharashtra | ₹ 20,313 | ₹ 23,536 | 16% |

| Karnataka | ₹ 9,232 | ₹ 10,317 | 12% |

| Gujarat | ₹ 9,321 | ₹ 9,800 | 5% |

| Tamil Nadu | ₹ 7,910 | ₹ 8,953 | 13% |

| Uttar Pradesh | ₹ 6,670 | ₹ 7,468 | 12% |

| Haryana | ₹ 6,663 | ₹ 7,250 | 9% |

| West Bengal | ₹ 4,896 | ₹ 5,162 | 5% |

| Delhi | ₹ 4,113 | ₹ 5,147 | 25% |

| Telangana | ₹ 3,982 | ₹ 4,507 | 13% |

| Odisha | ₹ 3,956 | ₹ 4,398 | 11% |

| Rajasthan | ₹ 3,789 | ₹ 3,924 | 4% |

| Madhya Pradesh | ₹ 2,746 | ₹ 3,381 | 23% |

| Andhra Pradesh | ₹ 3,047 | ₹ 3,373 | 11% |

| Jharkhand | ₹ 2,468 | ₹ 2,584 | 5% |

| Chattisgarh | ₹ 2,627 | ₹ 2,525 | -4% |

| Kerala | ₹ 2,064 | ₹ 2,297 | 11% |

| Punjab | ₹ 1,833 | ₹ 1,744 | -5% |

| Uttarakhand | ₹ 1,309 | ₹ 1,431 | 9% |

| Bihar | ₹ 1,178 | ₹ 1,366 | 16% |

| Assam | ₹ 1,062 | ₹ 1,217 | 15% |

| Himachal Pradesh | ₹ 741 | ₹ 828 | 12% |

| Goa | ₹ 461 | ₹ 523 | 13% |

| Jammu and Kashmir | ₹ 372 | ₹ 422 | 13% |

| Sikkim | ₹ 279 | ₹ 334 | 20% |

| Dadra and Nagar Haveli and Daman and Diu | ₹ 300 | ₹ 324 | 8% |

| Chandigarh | ₹ 167 | ₹ 259 | 55% |

| Meghalaya | ₹ 174 | ₹ 214 | 23% |

| Puducherry | ₹ 181 | ₹ 202 | 12% |

| Other Territory | ₹ 185 | ₹ 201 | 9% |

| Center Jurisdiction | ₹ 140 | ₹ 187 | 34% |

| Arunachal Pradesh | ₹ 82 | ₹ 120 | 46% |

| Tripura | ₹ 65 | ₹ 75 | 15% |

| Nagaland | ₹ 49 | ₹ 52 | 6% |

| Manipur | ₹ 47 | ₹ 39 | -17% |

| Mizoram | ₹ 25 | ₹ 38 | 52% |

| Andaman and Nicobar Islands | ₹ 24 | ₹ 31 | 29% |

| Ladakh | ₹ 12 | ₹ 26 | 117% |

| Lakshadweep | ₹ 1 | ₹ 2 | 100% |

| Grand Total | ₹ 1,02,485 | ₹ 1,14,261 | 11% |

Final Thoughts

In summary, the 12% growth in GST collections in May 2023 compared to the same month last year underscores India’s strong undercurrent of economic resilience. The GST revenue trends show promising prospects for the country’s fiscal health, reiterating the importance of this tax regime in propelling India’s economic engine.