Reliance General becomes first insurer to accept CBDC in tie-up with YES Bank

Customers who have an active e-rupee wallet with any bank can scan Reliance General Insurance's CBDC QR code to make easy, safe, instant, and green payments27-04-2023

Reliance General becomes first insurer to accept CBDC in tie-up with YES Bank

Customers who have an active e-rupee wallet with any bank can scan Reliance General Insurance's CBDC QR code to make easy, safe, instant, and green payments

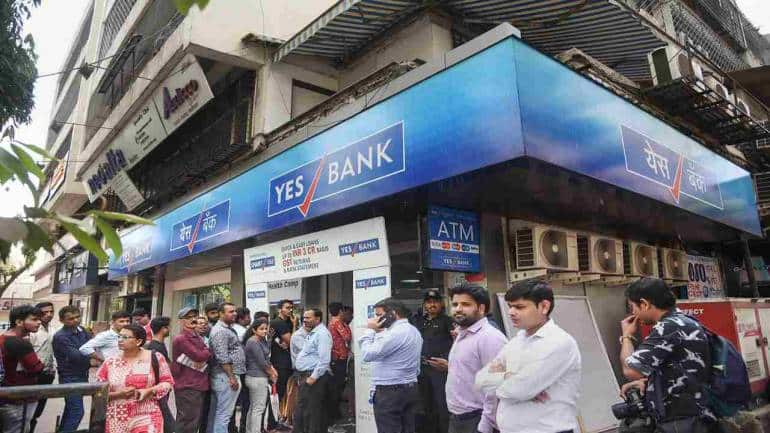

YES Bank eyes MFI acquisition for rural expansion, plans 150 new branches

Several banks have taken the MFI acquisition route as such transactions give them an opportunity to scale up operations in the rural and semi-urban markets

YES BANK LTD. - 532648 - Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

Audio recording of Earnings Call for the audited Financial Results of the Quarter (Q4) and Year ended on March 31, 2023

Yes Bank: Why it remains a no despite expected earnings traction

Business growth of Yes Bank and margin performance will take long to catch up with peers; costs will also remain elevated

Q4FY23 Quarterly Result Announced for YES Bank Ltd.

Yes Bank announced Q4FY23 results: Q4FY23 profits at Rs 202 crore despite accelerated provisioning, three times higher than Q3FY23 profits Q4FY23 NII at Rs 2,105 crore, up 15.7% YoY and 6.8% QoQ. FY23 NII at Rs 7,918 crore up 21.8% YoY Normalised operating profits for FY23 up 22.6% YoY NIM for Q4FY23 at 2.8% up 30 bps on YoY and QoQ. FY23 NIM at 2.6% up 30 bps YoY CASA ratio at 30.8% up 90 bps QoQ; avg. CASA deposits for FY23 are up 26.3% YoY, aided by 30.4% YoY growth on avg. CA deposits Advances growth at 13.2% YoY (excluding ARC transaction and Reverse Repo); retail advances up 38.6% YoY, SME up 22.3% YoY & mid corp. segments up 35.8% YoY New sanctions/disbursement of ~Rs 1 lakh crore in FY23 13.4 lakh CASA accounts opened in FY23 vs 11.4 lakh in FY22 GNPA ratio at 2.2% vs 13.9% last year and 2.0% last quarter NNPA ratio at 0.8% vs 4.5% in FY22 and 1.0% last quarter Resolution momentum continues to be strong with total recoveries & upgrades for FY23 at Rs 6,120 crore - well ahead of guidance of Rs 5,000 crore Organic accretion in capital during the quarter - CET 1 at 13.3% vs 13.0% in Q3; CRAR at 17.9% and RWA to total assets at 69.1% vs 72.8% in FY22 and 70.9% last quarter Commenting on the results and financial performance, Prashant Kumar, MD & CEO, YES BANK, said, “Over the last three years, the bank has significantly progressed on several strategic objectives such as strengthening of Governance and Compliance Standards, bolstering the balance sheet through granularity, addressing the asset quality concerns, building up a strong liability franchise and expanding the customer base. At the same time,- with a continuous focus on retail, we have continued to expand our footprints with new branches, increased the employee headcount and stepped-up our investments in technology. Our retail franchise has now reached a critical scale and is poised for profitable growth. With the current momentum of accelerated growth, the efficiency gains and operating leverage will naturally drive the bank’s profitability upwards. In addition to this, in order to further accelerate the profitability expansion, the bank will be making strategic interventions in the form of calibrated yield enhancement, higher focus on growth in CA and improvement in cross-sell/fee growth on the expanded customer base. Moreover, significant recoveries and upgrades during the year and particularly Q4 have been utilized for accelerated provisioning to step up PCR and normalize credit costs over the near term.” Result PDF

YES Bank Results Earnings Call for Q4FY23

Conference Call with YES Bank Management and Analysts on Q4FY23 Performance and Outlook. Listen to the full earnings transcript.

YES BANK LTD. - 532648 - Announcement under Regulation 30 (LODR)-Press Release / Media Release (Revised)

Investor Presentation on the Financial Results for the Quarter (Q4) and Year ended March 31, 2023 (Updated)

YES Bank Q4 PAT down 45% to 202 crore as provisions weigh

The higher provisioning is mainly on our loans and security receipts (SRs), MD and CEO Prashant Kumar said

YES BANK LTD. - 532648 - Submission Of Disclosure On Related Party Transactions Pursuant To Regulation 23(9) Of SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015

Submission of disclosure on Related Party Transactions pursuant to Regulation 23(9) of SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015

YES BANK LTD. - 532648 - Disclosure Made In Pursuance Of SEBI Operational Circular No. SEBI/HO/DDHS/P/CIR/2021/613 Dated August 10, 2021 Pertaining To Green Infra Bonds Issued By Securities Exchange Board Of India ('SEBI Circular')

Disclosure made in pursuance of SEBI Operational Circular No. SEBI/HO/DDHS/P/CIR/2021/613 dated August 10, 2021 pertaining to Green Infra Bonds issued by Securities Exchange Board of India ('SEBI Circular')