- NeoPolitan Pizza and Foods IPO is a fixed price issue of Rs 12 crores.

- This upcoming IPO bidding opens on Sep 30 and closes on Oct 4, 2024.

- NeoPolitan Pizza and Foods SME IPO price is set at Rs 20 per share.

- The minimum investment required is Rs 1,20,000.

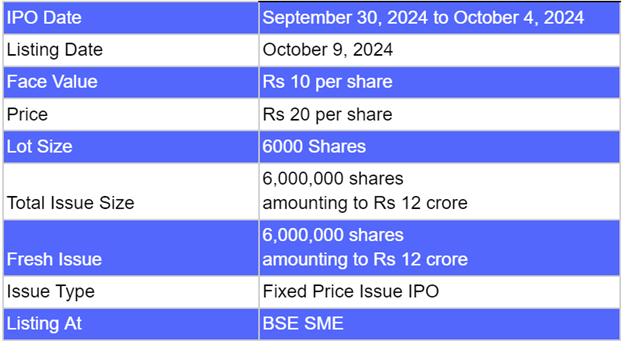

NeoPolitan Pizza and Foods IPO: Synopsis

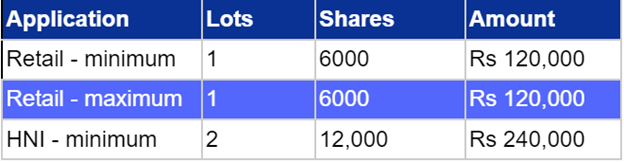

NeoPolitan Pizza and Foods IPO is open for subscription starting Monday, September 30, 2024, and closing on Friday, October 4, 2024. This upcoming IPO price is Rs 20 per share. The minimum lot size set for the retail category is 6000 shares. Meanwhile, the minimum lot size for the HNI category is 2 lots consisting of 12000 shares.

The minimum investment required for retail category investors is Rs 1,20,000 (20 x 6000 shares). However, for the HNI category, the minimum investment amount required is Rs 2,24,000 (20 x 12000 shares). NeoPolitan Pizza and Foods IPO is a book-built issue of Rs 12 crores. This upcoming IPO is an entirely fresh issue of 60 lakh equity shares.

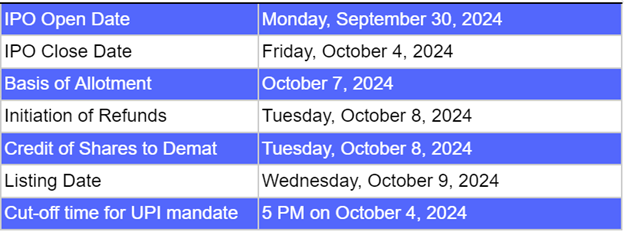

The allotment for this new IPO is expected to be finalised on Monday, October 7, 2024. NeoPolitan Pizza and Foods IPO will be listed on BSE SME on Wednesday, October 9, 2024. Turnaround Corporate Advisors Private Limited is the book-running lead manager, Bigshare Services Private Limited is the registrar, and Mnm Stock Broking is the market maker for this IPO.

Also Read | Subam Papers IPO: Things to Know Before Applying

NeoPolitan Pizza and Foods IPO: About the Company

Neapolitan Pizza and Foods Limited were incorporated in 2011, and engaged in the business of quick service restaurants. The company’s business had two segments - restaurant operations and agricultural commodity trading. NeoPolitan Pizza and Foods owns and operates restaurants and also operates through a franchise model. It specialises in Neapolitan-style pizza made with fresh ingredients and offers a variety of toppings, including gluten-free and vegetarian options.

The company offers a variety of soups, salads, bread, pasta, hand-tossed pizza, and desserts. The concept is family-oriented and kid-friendly. The company also trades agricultural commodities such as wheat, rice, tomatoes, and onions. The aim is to source high-quality products from trusted suppliers and offer them to customers at competitive prices. The company operated 21 restaurants in over 16 cities, spanning 2 states and union territories in India.

NeoPolitan Pizza and Foods IPO: Objectives

The net funds received from this IPO will be used for the expansion of the retail network by launching 16 new QSR. For paying security deposit, brokerage charges of the new restaurant funds will be used. The remaining funds will be used for working capital needs and fulfilling general corporate purposes.

NeoPolitan Pizza and Foods IPO: Other Important Details

Time-Table of NeoPolitan Pizza and Foods IPO

NeoPolitan Pizza and Foods IPO: Financial Metrics (Amt in Rs Lakhs)

NeoPolitan Pizza and Foods posted revenue of Rs 4,401.07 lakhs and net profit of Rs 210.72 lakhs for the period ending on 31 Mar 2024. The company’s revenue increased by 120% and net profit increased by 80% between the FY ending on 31 Mar 2024 and 31 Mar 2023.

Minimum Investment: Lot Size Details

Promoters of NeoPolitan Pizza and Foods Limited and Their Holdings

The promoter of NeoPolitan Pizza and Foods is Mukund Purohit and Arti Mukund Purohit. The promoter shareholdings before the IPO were 72.68%; however, after the IPO, shareholdings will decline to 47.03%.

NeoPolitan Pizza and Foods: Strength of Company

● Neapolitan Pizza And Foods Limited is known for its authentic Neapolitan-style pizza made using traditional techniques and ingredients.

● Diverse menu to cater to different tastes and dietary preferences.

● Strong brand identity through consistent branding across all its outlets and marketing channels.

● The company uses technology in many parts of its operations, like online ordering, tracking deliveries, and getting feedback from customers.

FAQs

1. What are the details of the NeoPolitan Pizza and Foods IPO?

NeoPolitan Pizza and Foods IPO is a book-built issue of Rs 12 crores. This upcoming IPO is an entirely fresh issue of 60 lakh equity shares. The allotment for this new IPO is expected to be finalised on Monday, October 7, 2024.

2. Who are the lead managers for the NeoPolitan Pizza and Foods IPO?

Turnaround Corporate Advisors Private Limited is appointed as the book-running lead manager for the IPO.

3. What is the role of Turnaround Corporate Advisors in this IPO?

Turnaround Corporate Advisors is the registrar for NeoPolitan Pizza and Foods Limited, handling the IPO's administrative aspects.

4. How can I apply for the NeoPolitan Pizza and Foods IPO?

The public subscription of this new IPO will open on September 30, 2024. Click here to initiate the application process.

5. How will the net proceeds from the IPO be utilised?

The net funds received from this IPO will be used for the expansion of the retail network by launching 16 new QSR. For paying security deposit, brokerage charges of the new restaurant funds will be used. The remaining funds will be used for working capital needs and fulfilling general corporate purposes.

6. How can I check the allotment status of the IPO?

Investors who applied can check the allotment status of the NeoPolitan Pizza and Foods Limited IPO by visiting here. For further updates follow Bigul.

Also Read | Paramount Dye Tec IPO: Unlocking the IPO in Detail

.jpg)

.jpg)

.jpg)